Nissan 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Nissan Annual Report 2008

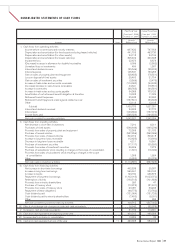

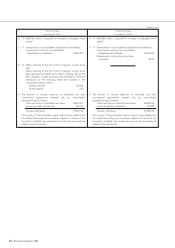

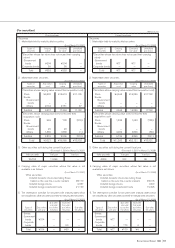

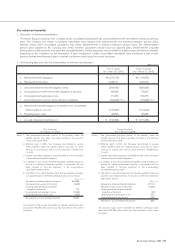

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

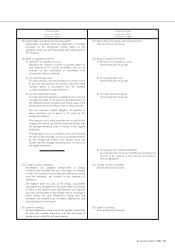

1. *1 Total research and development costs

Research and development costs included

in manufacturing costs and selling, general

and administrative expenses ¥464,839

2. *2 Gain and loss on sales of property, plant and equipment

primarily resulted from the sale of land and buildings in the

amount of ¥30,536 million and ¥1,753 million, respectively.

3. *3 The following loss on impairment of fixed assets was

recorded for the current fiscal year.

Usage Type Location Amount

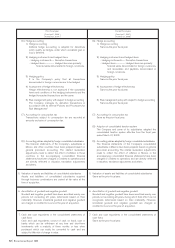

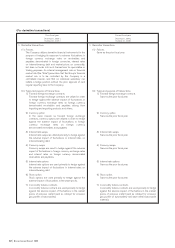

The Group bases its grouping for assessing the impairment loss on

fixed assets on its business segments (automobiles and sales

finance) and geographical segments. However, the Group

determines whether an asset is impaired on an individual asset

basis if the asset is considered idle or if it is to be disposed of.

The Company and some of its domestic consolidated subsidiaries

have recognized an impairment loss on idle assets and assets to be

disposed of due to a significant decline in their market value by

reducing their net book value to the respective recoverable value of

each asset. Such loss amounted to ¥22,673 million has been

recorded as a special loss in the accompanying consolidated

statements of income. This impairment loss consisted of losses of

¥9,298 million on idle assets (land - ¥6,907 million and building and

structures - ¥2,305 million, and machinery and equipment - ¥86

million) and losses of ¥1,078 million on assets to be sold (land -

¥467 million and buildings and structures - ¥611 million), and losses

of ¥12,297 million on assets to be disposed of (land - ¥7,476

million and buildings and structures - ¥4,821 million).

The recoverable value of these assets was measured with their net

sale value, which was estimated based on an appraisal value for the

idle assets and those to be disposed of, or a sales contract for the

assets to be sold.

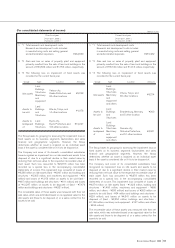

1. *1 Total research and development costs

Research and development costs included

in manufacturing costs and selling, general

and administrative expenses ¥457,482

2. *2 Gain and loss on sales of property, plant and equipment

primarily resulted from the sale of land and buildings in the

amount of ¥78,742 million and ¥1,013 million, respectively.

3. *3 The following loss on impairment of fixed assets was

recorded for the current fiscal year.

Usage Type Location Amount

The Group bases its grouping for assessing the impairment loss on

fixed assets on its business segments (automobiles and sales

finance) and geographical segments. However, the Group

determines whether an asset is impaired on an individual asset

basis if the asset is considered idle or if it is to be disposed of.

The Company and some of its consolidated subsidiaries have

recognized an impairment loss on idle assets and assets to be

disposed of due to a significant decline in their market value by

reducing their net book value to the respective recoverable value of

each asset. Such loss amounted to ¥8,878 million has been

recorded as a special loss in the accompanying consolidated

statements of income. This impairment loss consisted of losses of

¥4,274 million on idle assets (land - ¥1,628 million, building and

structures - ¥1,450 million, machinery and equipment - ¥666

million, and others - ¥530 million) and losses of ¥263 million on

assets to be sold (land - ¥34 million and buildings and structures -

¥229 million), and losses of ¥4,341 million on assets to be

disposed of (land - ¥2,554 million, buildings and structures -

¥1,146 million, machinery and equipment - ¥147 million, and others

- ¥494 million).

The recoverable value of these assets was measured with their net

sale value, which was estimated based on an appraisal value for the

idle assets and those to be disposed of, or a sales contract for the

assets to be sold.

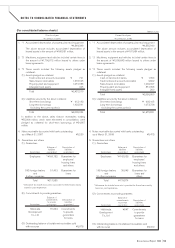

(Millions of yen)

Idle assets

Land

Buildings

Structures

Machinery

and

equipment

Assets to

be sold

Land

Buildings

and

Structures

Assets to

be disposed

of

Land

Buildings

Structures

Yatsuo-city,

Osaka Prefecture, and ¥9,298

93 other locations

Kita-ku, Tokyo, and ¥1,078

14 other locations

Kyoto-city,

Kyoto Prefecture, and ¥12,297

106 other locations

Idle assets

Land

Buildings

Structures

Machinery

and

equipment

and others

Assets to

be sold

Land

Buildings

and

Structures

Assets to

be disposed

of

Land

Buildings

Structures

Machinery

and

equipment

and others

Ota-ku, Tokyo, and ¥4,274

65 other locations

Brandenburg, Germany, ¥263

and 5 other location

Numazu-city,

Shizuoka Prefecture, ¥4,341

and 51 other locations

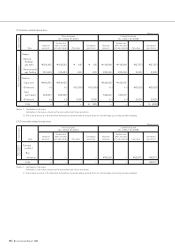

(For consolidated statements of income)