Nissan 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

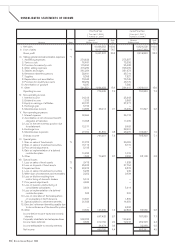

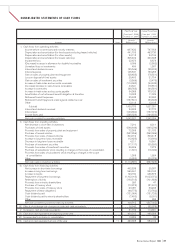

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

45

Nissan Annual Report 2008

Shareholders’ equity

Total

Common stock Capital surplus Retained earnings Treasury stock shareholders’ equity

Balance at March 31, 2006 605,814 804,470 2,116,825 (249,153) 3,277,956

Changes during the period:

Cash dividends paid — — (131,064) — (131,064)

Bonuses to directors and statutory

auditors — — (560) — (560)

Net income for the period — — 460,796 — 460,796

Disposal of treasury stock — — (3,477) 33,134 29,657

Purchases of treasury stock — — — (10,375) (10,375)

Changes due to merger — — 361 — 361

Change in the scope of consolidation — — (3,728) — (3,728)

Change in the scope of equity method — — (763) — (763)

Net changes in items other than those

in shareholders’ equity (Note) ——(35,664) — (35,664)

Total changes during the period — — 285,901 22,759 308,660

Balance as of March 31, 2007 605,814 804,470 2,402,726 (226,394) 3,586,616

Valuation, translation adjustments and others

Balance at March 31, 2006 14,340 — — — — (204,313) (189,973) 3,144 285,893 3,377,020

Changes during the period:

Cash dividends paid — — — — — — — — — (131,064)

Bonuses to directors and statutory

auditors — — — — — — — — — (560)

Net income for the period — — — — — — — — — 460,796

Disposal of treasury stock — — — — — — — — — 29,657

Purchases of treasury stock — — — — — — — — — (10,375)

Changes due to merger — — — — — — — — — 361

Change in the scope of consolidation — — — — — — — — — (3,728)

Change in the scope of equity method — — — — — — — — — (763)

Net changes in items other than

those in shareholders’ equity (Note) (8,514) 1,817 68,923 5,095 (13,826) 95,099 148,594 (433) 43,153 155,650

Total changes during the period (8,514) 1,817 68,923 5,095 (13,826) 95,099 148,594 (433) 43,153 499,974

Balance as of March 31, 2007 5,826 1,817 68,923 5,095 (13,826) (109,214) (41,379) 2,711 329,046 3,876,994

Total

valuation,

translation

adjustments

and others

Translation

adjustments

Unfunded

retirement

benefit

obligation

of foreign sub-

sidiaries

Land revalua-

tion of foreign

subsidiaries

Adjustment

for revaluation

of the

accounts of

the consoli-

dated sub-

sidiaries

based on

general price

level

accounting

Unrealized

gain from

hedging

instruments

Unrealized

holding gain

on securities

Share

subscription

rights

Minority

interests

Total

net assets

(Millions of yen)

(Millions of yen)

Note: As a result of the adoption of the Accounting Standard for Presentation of Net Assets in the Balance Sheet and the Accounting Standard for Statement of

Changes in Net Assets, ¥35,664 million, which had been included in Retained earnings at the end of the fiscal year ended March 31, 2006, has been

reclassified to Valuation, translation adjustments and others.

(Millions of yen)

Adjustments for revaluation of accounts of consolidated subsidiaries based on general price level accounting 49,915

Revaluation of land of foreign subsidiaries 5,134

Unfunded retirement benefit obligation of foreign subsidiaries (19,385)

Total amount reclassified from Retained earnings to Valuation, translation adjustments and others 35,664

Prior fiscal year (from April 1, 2006 to March 31, 2007)