Nissan 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Nissan Annual Report 2008

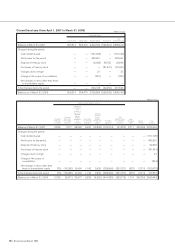

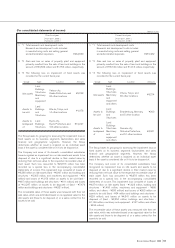

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

(2) Depreciation of property, plant and equipment

Depreciation of property, plant and equipment is calculated

principally by the straight-line method based on the

estimated useful lives and the residual value determined by

the Company.

(3) Basis for significant reserves

1) Allowance for doubtful accounts

Allowance for doubtful accounts is provided based on

past experience for normal receivables and on an

estimate of the collectibility of receivables from

companies in financial difficulty.

2) Accrued warranty costs

Accrued warranty costs are provided to cover the cost of

all services anticipated to be incurred during the entire

warranty period in accordance with the warranty

contracts and based on past experience.

3) Accrued retirement benefits

Accrued retirement benefits or prepaid pension costs are

recorded principally at an amount calculated based on

the retirement benefit obligation and the fair value of the

pension plan assets at the end of the current fiscal year.

The net retirement benefit obligation at transition is

being amortized over a period of 15 years by the

straight-line method.

Prior service cost is being amortized as incurred by the

straight-line method over periods which are shorter than

the average remaining years of service of the eligible

employees.

Actuarial gain or loss is amortized in the year following

the year in which the gain or loss is recognized primarily

by the straight-line method over periods which are

shorter than the average remaining years of service of

the eligible employees

(4) Foreign currency translation

Receivables and payables denominated in foreign

currencies are translated into yen at the rates of exchange

in effect at the balance sheet date, and differences arising

from the translation are included in the statement of

operations.

The balance sheet accounts of the foreign consolidated

subsidiaries are translated into yen at the rates of exchange

in effect at the balance sheet date. Revenue and expense

accounts are translated at the average rate of exchange in

effect during the year. Differences arising from the

translation are presented as translation adjustments and

minority interests in net assets.

(5) Lease accounting

Noncancellable lease transactions that transfer substantially

all risks and rewards associated with the ownership of

assets are accounted for as finance leases.

(2) Depreciation of property, plant and equipment

Same as the prior fiscal year.

(3) Basis for significant reserves

1) Allowance for doubtful accounts

Same as the prior fiscal year.

2) Accrued warranty costs

Same as the prior fiscal year.

3) Accrued retirement benefits

Same as the prior fiscal year.

4) Accrued directors’ retirement benefits

Accrued directors’ retirement benefits are provided at an

amount to be required at the year-end according to

internal regulations.

(4) Foreign currency translation

Same as the prior fiscal year.

(5) Lease accounting

Same as the prior fiscal year.