Nissan 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 Nissan Annual Report 2008

PERFORMANCE

FISCAL 2007 FINANCIAL REVIEW

Nissan reported increases during fiscal 2007 in

revenue, operating profit and net income. In a

challenging year for the entire automotive

industry, our employees performed at high

levels, keeping the company on track despite

facing powerful headwinds.

When comparing the results of fiscal 2007 with

fiscal 2006, please note that we exclude an

additional one-time “fifth quarter” used in the latter.

This fifth quarter was added to harmonize the

calendar-year results of overseas subsidiaries, such

as Europe and Mexico, with fiscal-year results for

Nissan Motor Co., Ltd. The impact of this fifth quarter

in fiscal 2006 was ¥767.6 billion in revenues, ¥21.4

billion in operating profits and ¥11.6 billion in net

income.

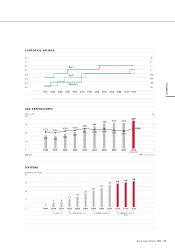

Net sales

For fiscal 2007, Nissan’s consolidated net sales

came to ¥10,824.2 billion, up 11.6 percent from last

year. This positive variance was mainly due to gains

in sales volume. Favorable changes in foreign

exchange rates for currencies such as the euro also

contributed to this improvement.

Operating profit

Our consolidated operating profit increased 4.7

percent to ¥790.8 billion, compared to ¥755.5 billion

in fiscal 2006. As a percentage of net revenue,

operating profit margin came to 7.3 percent.

The variance in consolidated operating profit

between the fiscal 2007 total of ¥790.8 billion and

the unaudited figure of ¥755.2 billion during fiscal

2006—the latter adjusted for the same period as

fiscal 2007 at each subsidiary to avoid the impact of

fiscal year period differences—was the result of the

following factors:

• Purchasing-cost reductions generated a

positive contribution of ¥172.9 billion

• Price, volume and mix had a positive impact of

¥75.0 billion

• A decrease in warranty expenses resulted in a

positive contribution of ¥7.6 billion

• Increased raw material and energy costs had a

negative impact of ¥84.7 billion

• Product enrichment, including regulatory costs,

lowered profits by ¥52.2 billion

• Selling expenses had a ¥38.1 billion negative

impact

• Higher general, administrative and other

expenses had negative impact of ¥18.0 billion

• Foreign exchange rate movements had a

negative effect of ¥16.2 billion. This was

primarily the result of unfavorable movements

by the U.S. dollar, which averaged ¥114.4

compared to ¥117.0 the previous year. The

euro moved to ¥161.6 from ¥146.2.

• Increased manufacturing expenses had a

negative effect of ¥9.2 billion

• Higher R&D expenses created a negative

impact of ¥1.5 billion

Net income

Negative foreign exchange rates were primarily

responsible for pushing our net non-operating

expenses up from last year’s ¥12.9 billion to ¥24.4

billion.

Net extraordinary items contributed a positive

¥1.6 billion, representing a significant improvement

over a negative ¥60.8 billion in fiscal 2006. This

positive variance came from a combination of this

year’s gain on sale of fixed assets—mainly in

Japan—and last year’s one-time losses, which

included headcount reduction programs.

Pre-tax income was ¥768.0 billion, and taxes

totaled ¥262.7 billion, representing an effective

consolidated tax rate of 34.2 percent.

Minority interests, which are profits from fully

consolidated companies that Nissan does not own

outright, such as Calsonic Kansei, Aichi Kikai and

Nissan Shatai, amounted to ¥23.0 billion. Net income

increased 7.4 percent to ¥482.3 billion, versus

¥449.2 billion in fiscal 2006.