Nissan 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Nissan Annual Report 2008

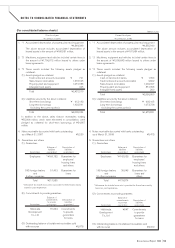

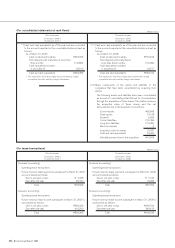

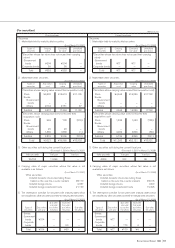

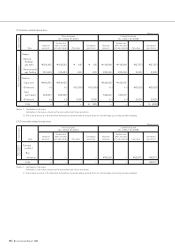

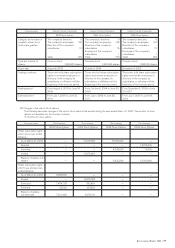

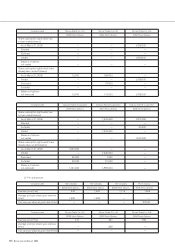

Prior fiscal year Current fiscal year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

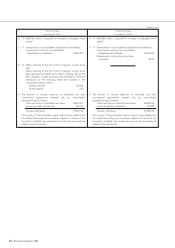

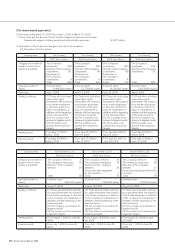

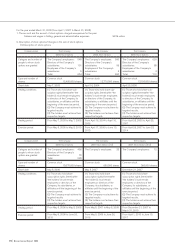

(4) Risk management for derivative transactions

All risk hedge operations of the Group are carried out

pursuant to the Rule which stipulates the Group’s basic

policies for derivative transactions, management policies,

management items, procedures, criteria for the selection of

counterparties, and the reporting system, and so forth. The

Rule prescribes that the Group’s financial market risk is to

be controlled by the Company in a centralized manner, and

that no individual subsidiary is permitted to initiate a hedging

operation without the prior approval of, and regular reporting

back to the Company.

The basic hedge policy is subject to the approval of the

Monthly Hedge Policy Meeting attended by the corporate

officer in charge of the Treasury Department. Execution and

management of all deals are to be conducted pursuant to

the Rule. Derivative transactions are conducted by a special

section of the Finance Department and monitoring of the

balance of all open positions and confirming balances are

the responsibility of the Accounting Section and the Risk

Management Section. Commodity futures contracts are to

be handled by Finance Department under guidelines which

are to be drawn up by the MRMC (Materials Risk

Management Committee). The MRMC is chaired by the

corporate officer in charge of the Purchasing Department

and the CFO and it will meet approximately once every six

months.

The status of derivative transactions is reported on a daily

basis to the corporate officer in charge of Finance

Department and on an annual basis to the Board of

Directors.

Credit risk is monitored quantitatively using RF’s rating

system based principally on the counterparties’ long-term

credit ratings and on their shareholders’ equity. The Finance

Department sets a maximum upper limit on positions with

each of the counterparties for the Group and monitors the

balances of open positions every day.

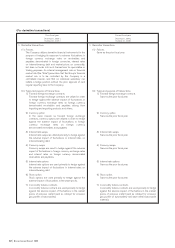

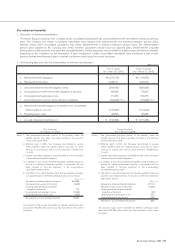

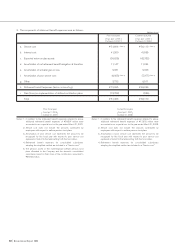

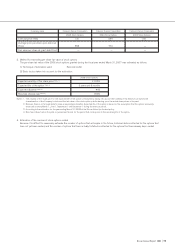

(5) Supplemental explanation on quantitative information

1) The fair value and unrealized gain or loss on derivative

transactions are estimates which are considered

appropriate based on the market at the balance sheet

date and, thus, fair value is not necessarily indicative of

the actual amounts which may be realized or settled in

the future.

2) The notional amounts of the swaps are not a direct

measure of the Company’s risk exposure in connection

with its swap transactions.

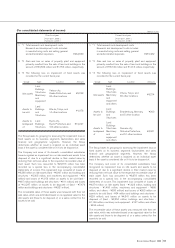

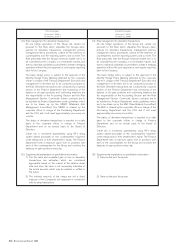

(4) Risk management for derivative transactions

All risk hedge operations of the Group are carried out

pursuant to the Rule which stipulates the Group’s basic

policies for derivative transactions, management policies,

management items, procedures, criteria for the selection of

counterparties, and the reporting system, and so forth. The

Rule prescribes that the Group’s financial market risk is to

be controlled by the Company in a centralized manner, and

that no individual subsidiary is permitted to initiate a hedging

operation without the prior approval of, and regular reporting

back to the Company.

The basic hedge policy is subject to the approval of the

Monthly Hedge Policy Meeting attended by the corporate

officer in charge of the Treasury Department. Execution and

management of all deals are to be conducted pursuant to

the Rule. Derivative transactions are conducted by a special

section of the Finance Department and monitoring of the

balance of all open positions and confirming balances are

the responsibility of the Accounting Section and the Risk

Management Section. Commodity futures contracts are to

be handled by Finance Department under guidelines which

are to be drawn up by the RMC (Raw Material Committee).

The RMC is chaired by the corporate officer in charge of the

Purchasing Department and the CFO and it will meet

approximately once every six months.

The status of derivative transactions is reported on a daily

basis to the corporate officer in charge of Finance

Department and on an annual basis to the Board of

Directors.

Credit risk is monitored quantitatively using RF’s rating

system based principally on the counterparties’ long-term

credit ratings and on their shareholders’ equity. The Finance

Department sets a maximum upper limit on positions with

each of the counterparties for the Group and monitors the

balances of open positions every day.

(5) Supplemental explanation on quantitative information

1) Same as the prior fiscal year.

2) Same as the prior fiscal year.