Nissan 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

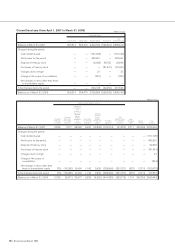

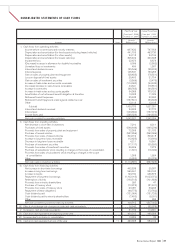

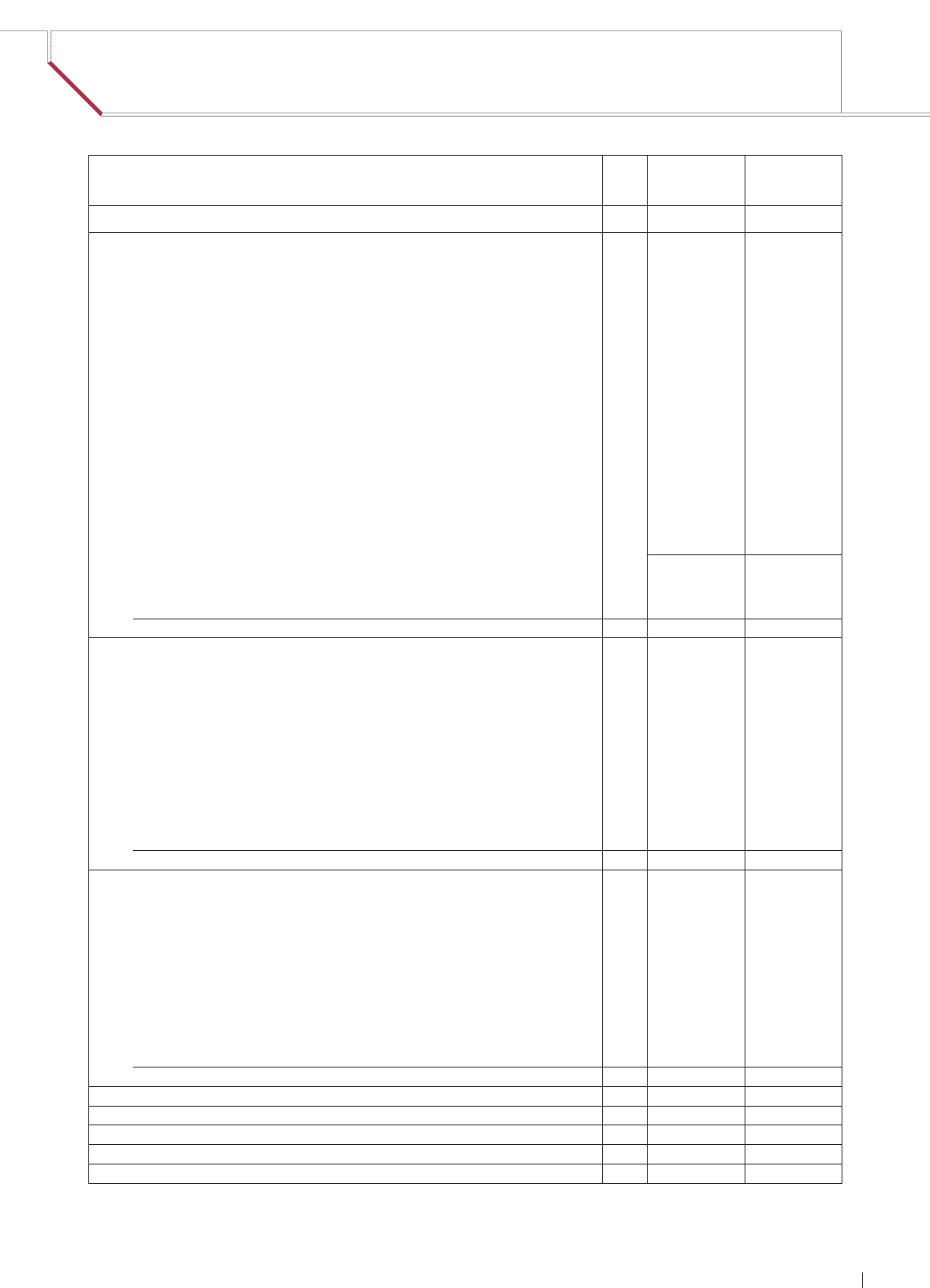

CONSOLIDATED STATEMENTS OF CASH FLOWS

47

Nissan Annual Report 2008

Prior Fiscal Year Current Fiscal

Year

From April 1, 2006 From April 1, 2007

[

To March 31, 2007

][

To March 31, 2008

]

Amounts Amounts

Accounts Notes (Millions of yen) (Millions of yen)

I. Cash flows from operating activities

Income before income taxes and minority interests 697,432 767,958

Depreciation and amortization (for fixed assets excluding leased vehicles) 441,703 463,730

Depreciation and amortization (for other assets) 24,118 24,744

Depreciation and amortization (for leased vehicles) 305,402 340,698

Impairment loss 22,673 8,878

(Decrease) increase in allowance for doubtful receivables 9,996 (2,552)

Unrealized loss on investments 459 1,597

Interest and dividend income (25,546) (28,205)

Interest expense 145,547 159,285

Gain on sales of property, plant and equipment (28,485) (78,551)

Loss on disposal of fixed assets 25,403 21,754

Gain on sales of investment securities (3,566) (3,475)

Increase in trade notes and accounts receivable (114,960) (44,245)

(Increase) decrease in sales finance receivables 44,341 (78,851)

Increase in inventories (88,765) (40,581)

Increase in trade notes and accounts payable 54,368 103,123

Amortization of net retirement benefit obligation at transition 10,928 11,009

Retirement benefit expenses 55,438 52,260

Retirement benefit payments made against related accrual (157,821) (53,303)

Other 12,118 12,108

Subtotal 1,430,783 1,637,381

Interest and dividends received 24,622 27,770

Interest paid (143,650) (157,974)

Income taxes paid (268,928) (164,893)

Net cash provided by operating activities 1,042,827 1,342,284

II. Cash flows from investing activities

Net decrease in short-term investments 7,210 6,311

Purchases of fixed assets (546,848) (469,236)

Proceeds from sales of property, plant and equipment 72,308 131,183

Purchase of leased vehicles (957,356) (862,066)

Proceeds from sales of leased vehicles 304,912 393,418

Increase in long-term loans receivable (12,625) (13,900)

Decrease in long-term loans receivable 4,211 10,561

Purchase of investment securities (17,117) (35,820)

Proceeds from sales of investment securities 36,486 7,272

Purchase of subsidiaries’ stock resulting in changes in the scope of consolidation *2 (1,391) (16,032)

Proceeds from sales of subsidiaries’ stock resulting in changes in the scope

of consolidation 1,308 1,664

Other (5,685) (20,978)

Net cash used in investing activities (1,114,587) (867,623)

III. Cash flows from financing activities

Net increase in short-term borrowings 492,538 25,397

Increase in long-term borrowings 969,461 834,160

Increase in bonds 123,730 236,875

Repayment of long-term borrowings (1,102,015) (1,023,072)

Redemption of bonds (190,515) (101,888)

Proceeds from minority shareholders 260 47

Purchase of treasury stock (10,375) (81,341)

Proceeds from sales of treasury stock 29,087 33,203

Repayment of lease obligations (66,775) (72,762)

Cash dividends paid (131,064) (151,725)

Cash dividends paid to minority shareholders (7,453) (6,291)

Other 33 395

Net cash provided by (used in) financing activities 106,912 (307,002)

IV. Effects of exchange rate changes on cash and cash equivalents 16,640 (52,978)

V. Increase in cash and cash equivalents 51,792 114,681

VI. Cash and cash equivalents at beginning of the year 404,212 469,388

VII. Increase due to inclusion in consolidation 13,384 33

VIII. Cash and cash equivalents at end of the year *1 469,388 584,102