Nissan 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 Nissan Annual Report 2008

PERFORMANCE

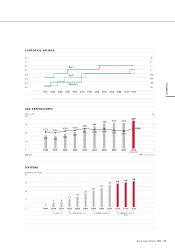

Automotive net cash change

Cash generated by automotive operations totaled

¥1,110.1 billion. Free cash flow equaled ¥456.7

billion, thanks primarily to improvement in working

capital. Cash used for financing activities totaled

¥333.5 billion, including ¥151.7 billion for dividend

payments.

Nissan had a net cash position of ¥180.3 billion

at the end of fiscal 2007, representing a decrease of

¥74.4 billion compared to the beginning of the fiscal

year. This was the combined result of an increase in

cash used in financing activities and a decrease in

the effect of exchange rate changes of ¥197.6

billion, which were offset by the increase in free cash

flow.

Credit rating

Moody’s upgraded Nissan’s rating from Baa1 to A3

on September 5, 2007. As of May 16, 2006, R&I

was listing Nissan’s long-term credit rating as A,

while S&P upgraded the company’s rating from BBB

to BBB+ on July 20, 2004.

Investment policy

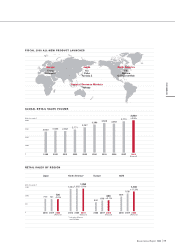

Our capital expenditures totaled ¥428.9 billion, equal

to 4.0 percent of net revenue, including funds used

to launch eleven all-new models during the course of

fiscal 2007. R&D expenditures were ¥457.5 billion.

These funds were used to develop new technologies

and products. Nissan launched ten new technologies

in fiscal 2007. We will continue this trend with ten

new technologies in fiscal 2008, and over fifteen

new technologies in 2009 and the years beyond. Our

strength is the extensive collaborative development

structure Nissan enjoys with Renault’s R&D team

through the Alliance.

Payout policy

At the annual general shareholders meeting that

followed on June 25, 2008, the company proposed

an increase in its annual dividend from ¥34 per

share in 2006 to ¥40 per share in fiscal 2007.

In addition to announcing the new NISSAN GT

2012 midterm plan, Nissan revealed a new dividend

plan on May 13, 2008. Nissan will propose a

dividend of ¥42 per share in fiscal 2008, ¥44 per

share in fiscal 2009, and ¥46 per share in fiscal

2010. The company will propose dividend payouts

for fiscal 2011 and 2012 during fiscal 2010.

Change to free cash flow from return on

invested capital

At the end of fiscal 2007, Nissan’s return on

invested capital (ROIC) was 16.0 percent. The ROIC

average for the NISSAN Value-Up period (fiscal

2005 to 2007) was 17 percent. While that ranks us

at the top level among global automakers, it was

below our commitment of 20 percent. To optimize

profit and investment during NISSAN GT 2012,

Nissan has changed its internal objective from ROIC

to maximizing free cash flow, since the latter covers

a wider range of income statement and balance

sheet items.