Motorola 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

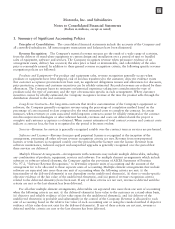

Reclassifications: Certain amounts in prior years’ financial statements and related notes have been

reclassified to conform to the 2008 presentation.

Recent Accounting Pronouncements: The Company adopted Financial Accounting Standards Board

(“FASB”) Statement of Financial Accounting Standard (“SFAS”) No. 157, “Fair Value Measurements”

(“SFAS 157”) on January 1, 2008 for financial assets and liabilities, and non-financial assets and liabilities that are

recognized or disclosed at fair value in the financial statements on a recurring basis. SFAS 157 defines fair value,

establishes a framework for measuring fair value as required by other accounting pronouncements and expands

fair value measurement disclosures. The provisions of SFAS 157 were applied prospectively upon adoption and did

not have a material impact on the Company’s consolidated financial statements. The disclosures required by

SFAS 157 are included in Note 9, “Fair Value Measurements,” to the Company’s consolidated financial statements.

In February 2008, the FASB issued FASB Staff Position 157-2, which delays the effective date of SFAS 157 for

non-financial assets and liabilities, which are not measured at fair value on a recurring basis (at least annually)

until fiscal years beginning after November 15, 2008. The Company is currently assessing the impact of adopting

SFAS 157 for non-financial assets and liabilities on the Company’s consolidated financial statements.

In October 2008, the FASB issued FASB Staff Position (“FSP”) 157-3, which provided guidance to clarify the

application of FAS 157 in a market that is not active. The Company adopted this FSP in the fourth quarter of

2008. The net impact of this FSP was immaterial.

The Company adopted SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities—

Including an Amendment of FASB Statement No. 115” (“SFAS 159”) as of January 1, 2008. SFAS 159 permits

entities to elect to measure many financial instruments and certain other items at fair value. The Company did not

elect the fair value option for any assets or liabilities, which were not previously carried at fair value. Accordingly,

the adoption of SFAS 159 had no impact on the Company’s consolidated financial statements.

The Company adopted EITF 06-4, “Accounting for Deferred Compensation and Postretirement Benefit

Aspects of Endorsement Split-Dollar Life Insurance Arrangements” (“EITF 06-4”) as of January 1, 2008.

EITF 06-4 requires that endorsement split-dollar life insurance arrangements, which provide a benefit to an

employee beyond the postretirement period be recorded in accordance with SFAS No. 106, “Employer’s

Accounting for Postretirement Benefits Other Than Pensions” or APB Opinion No. 12, “Omnibus Opinion—

1967” (“the Statements”) based on the substance of the agreement with the employee. Upon adoption of

EITF 06-4, the Company recognized an increase in Other liabilities of $45 million with the offset reflected as a

cumulative-effect adjustment to January 1, 2008 Retained earnings and Non-owner changes to equity in the

amounts of $4 million and $41 million, respectively, in the Company’s consolidated statement of stockholders’

equity.

In December 2007, the FASB issued SFAS No. 141 (revised 2007) (“SFAS 141R”), a revision of SFAS 141,

“Business Combinations.” SFAS 141R establishes requirements for the recognition and measurement of acquired

assets, liabilities, goodwill and non-controlling interests. SFAS 141R also provides disclosure requirements related

to business combinations. SFAS 141R is effective for fiscal years beginning after December 15, 2008. SFAS 141R

will be applied prospectively to business combinations with an acquisition date on or after the effective date.

In December 2007, the FASB issued SFAS No. 160, “Non-Controlling Interests in Consolidated Financial

Statements an amendment of ARB No. 51” (“SFAS 160”). SFAS 160 establishes new standards for the accounting

for and reporting of non-controlling interests (formerly minority interests) and for the loss of control of partially

owned and consolidated subsidiaries. SFAS 160 does not change the criteria for consolidating a partially owned

entity. SFAS 160 is effective for fiscal years beginning after December 15, 2008. The provisions of SFAS 160 will

be applied prospectively upon adoption except for the presentation and disclosure requirements, which will be

applied retrospectively. The Company does not expect the adoption of SFAS 160 to have a material impact on the

Company’s consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities, an amendment of SFAS No. 133” (“SFAS 161”). SFAS 161 requires enhanced disclosures about an

entity’s derivative and hedging activities and is effective for fiscal years and interim periods beginning after

November 15, 2008. The Company is currently evaluating the additional disclosures required by SFAS 161.

91