Motorola 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to borrow funds under the 5-Year Credit Facility, the Company must be in compliance with various

representations, conditions and covenants contained in the agreement, including a financial covenant relating to

the ratio of total debt to adjusted EBITDA (the “Financial Covenant”). The Company was in compliance with the

terms of the 5-Year Credit Facility at December 31, 2008. If the Company borrows under the 5-Year Credit

Facility, it is required to remain in compliance with the terms of the agreement. Therefore, the amount of

incremental liquidity available from borrowing under the 5-Year Credit Facility is contingent on the Company

maintaining compliance with the Financial Covenant at the end of each quarter.

Events over the past several months, including recent failures and near failures of a number of large financial

service companies, have made the capital markets increasingly volatile. The Company also has access to

uncommitted non-U.S. credit facilities (“uncommitted facilities”), but in light of the state of the financial services

industry and the Company’s current financial condition, the Company does not believe it is prudent to assume the

same level of funding will be available under these facilities going forward as has been available historically.

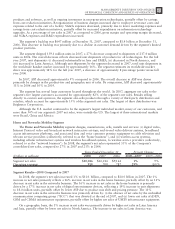

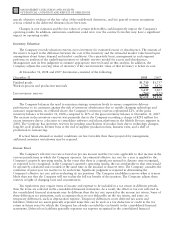

Contractual Obligations and Other Purchase Commitments

Summarized in the table below are the Company’s obligations and commitments to make future payments

under long-term debt obligations (assuming earliest possible exercise of put rights by holders), lease obligations,

purchase obligations and tax obligations as of December 31, 2008.

(in millions) Total 2009 2010 2011 2012 2013 Uncertain

Timeframe Thereafter

Payments Due by Period

(1)

Long-Term Debt Obligations $4,008 $ 3 $536 $609 $410 $11 $ — $2,439

Lease Obligations 770 234 175 129 78 48 — 106

Purchase Obligations 724 597 98 20 5 4 — —

Tax Obligations 914 50 — — — — 864 —

Total Contractual Obligations $6,416 $884 $809 $758 $493 $63 $864 $2,545

(1) Amounts included represent firm, non-cancelable commitments.

Long-Term Debt Obligations: The Company’s long-term debt obligations, including the current portion of

long-term debt, totaled $4.0 billion at December 31, 2008, compared to $4.2 billion at December 31, 2007. A

table of all outstanding long-term debt securities can be found in Note 4, “Debt and Credit Facilities,” to the

Company’s consolidated financial statements.

Lease Obligations: The Company owns most of its major facilities, but does lease certain office, factory and

warehouse space, land, and information technology and other equipment, principally under non-cancelable

operating leases. At December 31, 2008, future minimum lease obligations, net of minimum sublease rentals,

totaled $770 million. Rental expense, net of sublease income, was $181 million in 2008, $231 million in 2007 and

$241 million in 2006.

Purchase Obligations: The Company has entered into agreements for the purchase of inventory, license of

software, promotional activities, and research and development, which are firm commitments and are not

cancelable. At December 31, 2008, the Company’s obligations in connection with these agreements run through

2013, and the total payments expected to be made under these agreements total $724 million during that period.

The Company enters into a number of arrangements for the sourcing of supplies and materials with take-or-

pay obligations. The Company’s obligations with these suppliers run through 2012 and total a minimum purchase

obligation of $127 million during that period. The Company does not anticipate the cancellation of any of these

agreements in the future and estimates that purchases from these suppliers will exceed the minimum obligations

during the agreement periods.

Tax Obligations: The Company has approximately $914 million of unrecognized income tax benefits

relating to multiple tax jurisdictions and tax years. A significant portion of the unrecognized tax benefits, if settled,

would not result in current or future payments as tax carry forwards are available for utilization. The Company

anticipates that it is reasonably possible that $50 million of unrecognized tax benefits could be settled in 2009.

However, it is not possible to estimate the timing of any other potential settlements.

Commitments Under Other Long-Term Agreements: The Company has entered into certain long-term

agreements to purchase software, components, supplies and materials from suppliers. Most of the agreements

58 MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS