Motorola 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

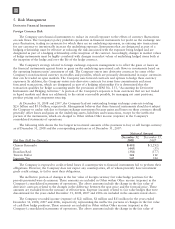

operations, even though the related securities were not considered impaired. Because the Sigma Fund uses

investment-company accounting in its stand-alone financial statements, it marks the investments in the fund to

market and records all unrealized gains or losses in earnings, whether or not the related securities are considered

impaired. The Company has determined that the stand-alone accounting policies of the Sigma Fund should be

retained in its consolidated financial statements. Accordingly, the Company recorded $101 million of accumulated

temporary unrealized losses in Sigma Fund investments in its consolidated statements of operations during the

three months ended December 31, 2008, which represents all of the temporary unrealized gains and losses that

have accumulated in Sigma Fund investments as of December 31, 2008. Portions of the temporary unrealized

losses recognized in the three months ended December 31, 2008 arose in periods prior to the three months ended

December 31, 2008 and should have been reflected in the Company’s consolidated statements of operations in the

periods in which they arose. The Company has determined that the impact of the amounts that arose in prior

periods is not material to the consolidated results of operations of those prior periods.

During the year ended December 31, 2008, the Company recorded total charges related to Sigma Fund

investments, including temporary unrealized losses and impairment charges, of $287 million in its consolidated

statement of operations. During the year ended December 31, 2007, the Company recorded total charges of

$18 million, all of which were impairment charges, in its consolidated statements of operations. There were no

temporary unrealized losses or impairment charges in the Sigma Fund investment portfolio during the year ended

December 31, 2006.

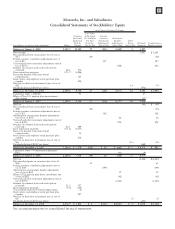

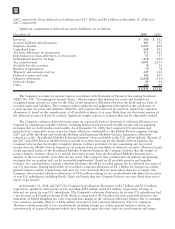

Investments

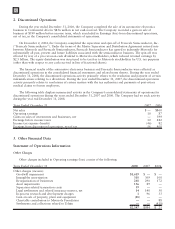

Investments consist of the following:

December 31, 2008

Short-term

Investments Investments

Unrealized

Gains

Unrealized

Losses

Cost

Basis

Recorded Value Less

Certificates of deposit $225 $ — $— $— $225

Available-for-sale securities:

U.S. government and agency obligations — 25 1 — 24

Corporate bonds — 7 — — 7

Asset-backed securities — 1 — — 1

Common stock and equivalents — 128 5 (2) 125

225 161 6 (2) 382

Other securities, at cost — 296 — — 296

Equity method investments — 60 — — 60

$225 $517 $ 6 $(2) $738

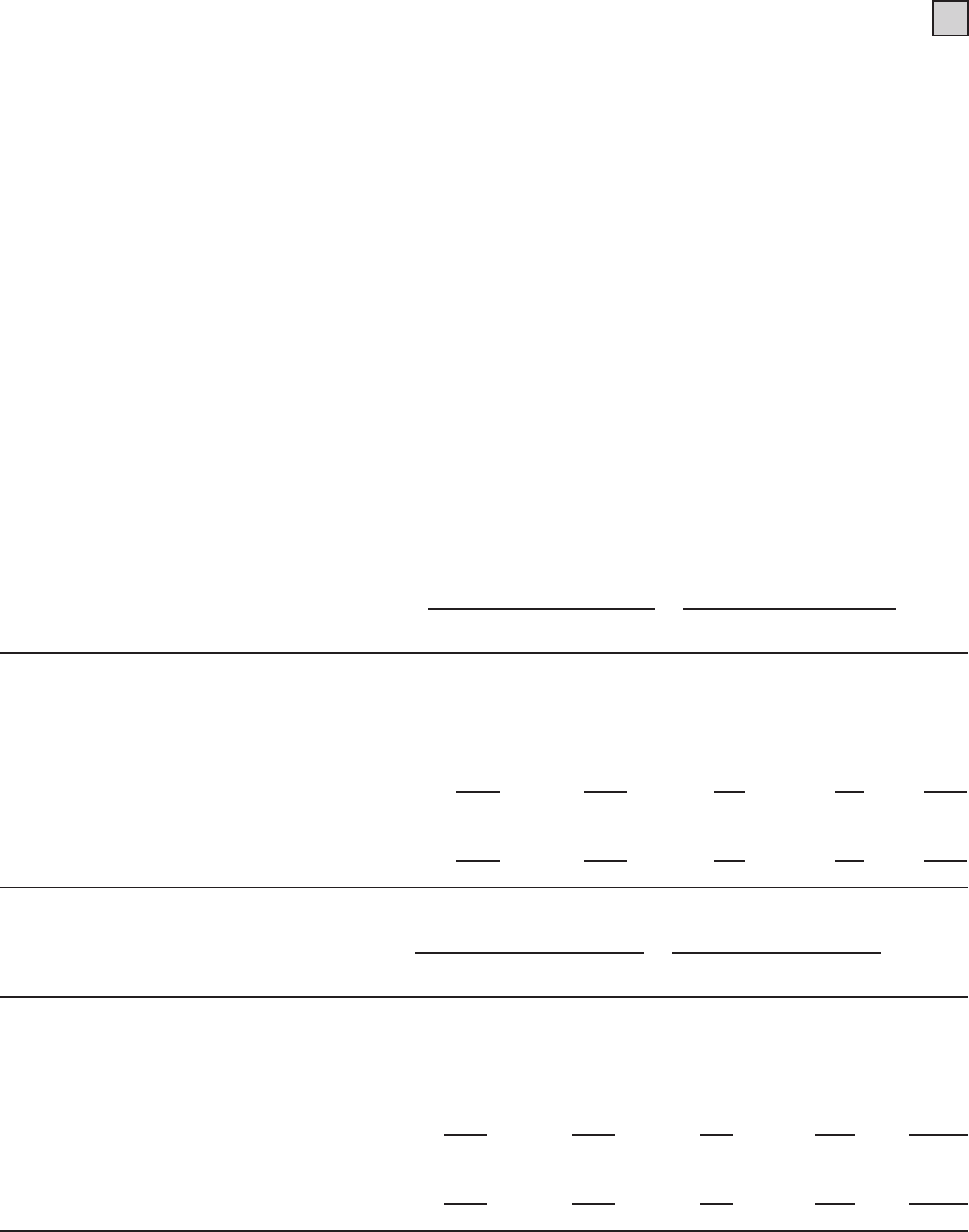

December 31, 2007 Short-term

Investments Investments Unrealized

Gains Unrealized

Losses Cost

Basis

Recorded Value Less

Certificates of deposit $509 $ — $— $ — $ 509

Available-for-sale securities:

U.S. government and agency obligations 19 — — — 19

Corporate bonds 1 — — — 1

Common stock and equivalents — 333 40 (79) 372

Other 83 — — — 83

612 333 40 (79) 984

Other securities, at cost — 414 — — 414

Equity method investments — 90 — — 90

$612 $837 $40 $(79) $1,488

At December 31, 2008, the Company had $225 million in short-term investments (which are highly-liquid

fixed-income investments with an original maturity greater than three months but less than one year), compared to

$612 million of short-term investments at December 31, 2007.

95