Motorola 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

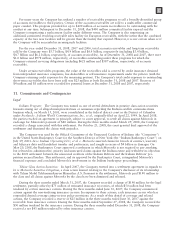

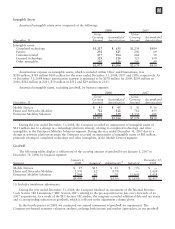

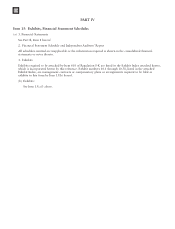

Intangible Assets

Amortized intangible assets were comprised of the following:

December 31

Gross

Carrying

Amount Accumulated

Amortization

Gross

Carrying

Amount Accumulated

Amortization

2008 2007

Intangible assets:

Completed technology $1,127 $ 633 $1,234 $484

Patents 292 125 292 69

Customer-related 277 104 264 58

Licensed technology 129 118 123 109

Other intangibles 150 126 166 99

$1,975 $1,106 $2,079 $819

Amortization expense on intangible assets, which is included within Other and Eliminations, was

$318 million, $369 million $100 million for the years ended December 31, 2008, 2007 and 2006, respectively. As

of December 31, 2008 future amortization expense is estimated to be $278 million for 2009, $256 million in

2010, $242 million in 2011, $50 million in 2012 and $29 million in 2013.

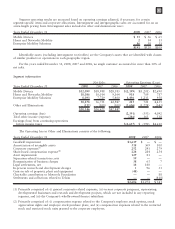

Amortized intangible assets, excluding goodwill, by business segment:

December 31

Gross

Carrying

Amount Accumulated

Amortization

Gross

Carrying

Amount Accumulated

Amortization

2008 2007

Mobile Devices $45 $45 $36 $36

Home and Networks Mobility 722 522 712 455

Enterprise Mobility Solutions 1,208 539 1,331 328

$1,975 $1,106 $2,079 $819

During the year ended December 31, 2008, the Company recorded an impairment of intangible assets of

$121 million due to a change in a technology platform strategy, relating to completed technology and other

intangibles, in the Enterprise Mobility Solutions segment. During the year ended December 31, 2007 due to a

change in software platform strategy, the Company recorded an impairment of intangible assets of $81 million,

primarily relating to completed technology and other intangibles, in the Mobile Devices segment.

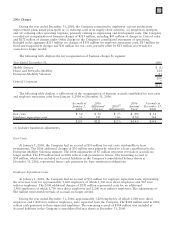

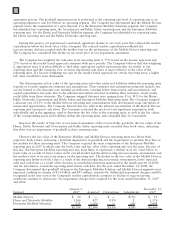

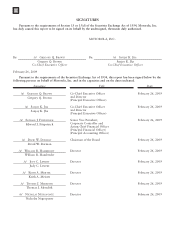

Goodwill

The following tables display a rollforward of the carrying amount of goodwill from January 1, 2007 to

December 31, 2008, by business segment:

Segment January 1,

2008 Acquired Adjustments

(1)

Impaired December 31,

2008

Mobile Devices $ 19 $15 $ 21 $ (55) $ —

Home and Networks Mobility 1,576 12 (179) — 1,409

Enterprise Mobility Solutions 2,904 60 28 (1,564) 1,428

$4,499 $87 $(130) $(1,619) $2,837

(1) Includes translation adjustments.

During the year ended December 31, 2008, the Company finalized its assessment of the Internal Revenue

Code Section 382 Limitations (“IRC Section 382”) relating to the pre-acquisition tax loss carry-forwards of its

2007 acquisitions. As a result of the IRC Section 382 studies, the company recorded additional deferred tax assets

and a corresponding reduction in goodwill, which is reflected in the adjustment column above.

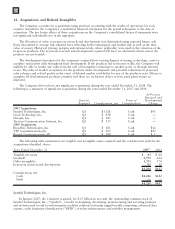

In the fourth quarter of 2008, we conducted our annual assessment of goodwill for impairment. The

Company performed extensive valuation analyses, utilizing both income and market approaches, in our goodwill

129