Motorola 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

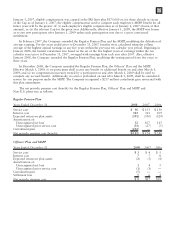

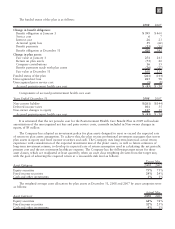

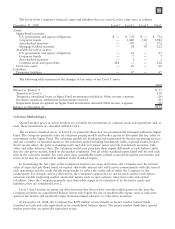

The funded status of the plan is as follows:

2008 2007

Change in benefit obligation:

Benefit obligation at January 1 $ 395 $ 460

Service cost 67

Interest cost 26 23

Actuarial (gain) loss 35 (62)

Benefit payments (33) (33)

Benefit obligation at December 31 429 395

Change in plan assets:

Fair value at January 1 251 243

Return on plan assets (73) 20

Company contributions 16 15

Benefit payments made with plan assets (26) (27)

Fair value at December 31 168 251

Funded status of the plan (261) (144)

Unrecognized net loss 223 98

Unrecognized prior service cost (5) (8)

Accrued postretirement health care cost $ (43) $ (54)

Components of accrued postretirement health care cost:

Years Ended December 31 2008 2007

Non-current liability $(261) $(144)

Deferred income taxes 101 55

Non-owner changes to equity 117 35

Accrued postretirement health care cost $ (43) $ (54)

It is estimated that the net periodic cost for the Postretirement Health Care Benefit Plan in 2009 will include

amortization of the unrecognized net loss and prior service costs, currently included in Non-owner changes in

equity, of $5 million.

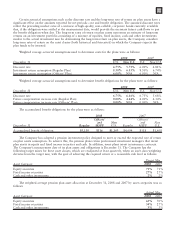

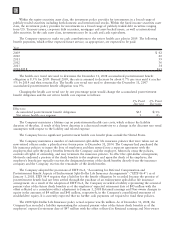

The Company has adopted an investment policy for plan assets designed to meet or exceed the expected rate

of return on plan assets assumption. To achieve this, the plan retains professional investment managers that invest

plan assets in equity and fixed income securities and cash. The Company uses long-term historical actual return

experience with consideration of the expected investment mix of the plans’ assets, as well as future estimates of

long-term investment returns, to develop its expected rate of return assumption used in calculating the net periodic

pension cost and the net retirement healthcare expense. The Company has the following target mixes for these

asset classes, which are readjusted at least quarterly, when an asset class weighting deviates from the target mix,

with the goal of achieving the required return at a reasonable risk level as follows:

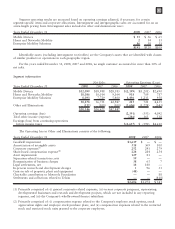

Asset Category 2008 2007

Target Mix

Equity securities 75% 75%

Fixed income securities 24% 24%

Cash and other investments 1% 1%

The weighted-average asset allocation for plan assets at December 31, 2008 and 2007 by asset categories were

as follows:

Asset Category 2008 2007

Actual Mix

Equity securities 64% 74%

Fixed income securities 32% 25%

Cash and other investments 4% 1%

111