Motorola 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

capital losses related to certain investments. The Company believes that the remaining deferred tax assets are more

likely than not to be realizable based on estimates of future taxable income and the implementation of tax

planning strategies.

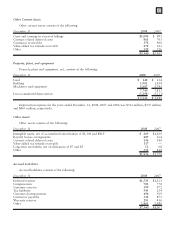

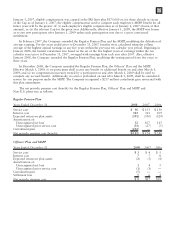

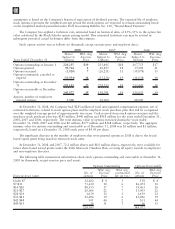

Tax carryforwards at December 31, 2008 are as follows:

Gross

Tax Loss Tax

Effected Expiration

Period

United States:

U.S. tax losses $2,354 $ 824 2017-2028

Foreign tax credits n/a 1,111 2012-2018

General business credits n/a 453 2018-2028

Minimum tax credits n/a 102 Unlimited

State tax losses 3,616 112 2009-2028

State tax credits n/a 56 2009-2024

Non-U.S. Subsidiaries:

China tax losses 143 30 2012-2013

United Kingdom tax losses 223 63 Unlimited

Germany tax losses 316 91 Unlimited

Other subsidiaries tax losses 244 64 Various

Spain tax credits n/a 32 2014-2022

Other subsidiaries tax credits n/a 63 Unlimited

$3,001

The Company adopted FIN 48 on January 1, 2007. The adoption resulted in a $120 million reduction of the

Company’s unrecognized tax benefits and related interest accrual and has been reflected as an increase in the

opening balance of Retained earnings of $27 million and Additional paid-in capital of $93 million as of January 1,

2007. Upon the adoption of FIN 48, the Company also reclassified unrecognized tax benefits of $877 million from

Deferred income tax to Other liabilities in the Company’s consolidated balance sheets.

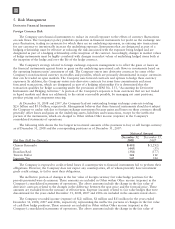

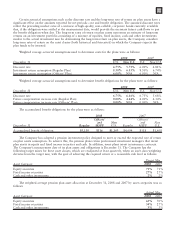

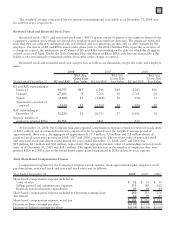

A reconciliation of unrecognized tax benefits, including those attributable to discontinued operations, is as

follows:

2008 2007

Balance at January 1 $1,400 $1,274

Additions based on tax positions related to current year 46 46

Additions for tax positions of prior years 141 197

Reductions for tax positions of prior years (642) (114)

Settlements (31) (3)

Balance at December 31 $ 914 $1,400

Included in the balance of total unrecognized tax benefits at December 31, 2008 and 2007, are potential

benefits of approximately $790 million and $590 million, respectively, net of federal tax benefits that if recognized

would affect the effective tax rate.

During the fourth quarter of 2008, the Company entered into closing agreements with the appellate level of

the Internal Revenue Service (“IRS”) on transfer pricing adjustments for tax years 1996 through 2003 and the IRS

completed its review of the research credit, thereby resolving all significant IRS audit issues for years 1996-2003.

The IRS also completed its field examination of the Company’s 2004 and 2005 tax returns in July 2008, and there

are no significant unagreed issues. As a result of the foregoing and resolution of Non-U.S. audits, the Company

reduced its unrecognized income tax benefits. The Company expects to receive a net tax refund of $126 million,

primarily relating to refund claims that were held pending the resolution of the 1996-2003 tax years.

105