Motorola 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We conduct our business in highly competitive markets, facing both new and established competitors. The

markets for many of our products are characterized by rapidly changing technologies, frequent new product

introductions, changing consumer trends, short product life cycles and evolving industry standards. Market

disruptions caused by new technologies, the entry of new competitors into markets we serve, and frequent

consolidations among our customers and competitors, among other matters, can introduce volatility into our

operating performance and cash flow from operations. As we enter 2009, we face a very challenging global

economic environment and with reduced visibility and slowing demand. Meeting all of these challenges requires

consistent operational planning and execution and investment in technology, resulting in innovative products that

meet the needs of our customers around the world. As we execute on meeting these objectives, we remain focused

taking the necessary action to design and deliver differentiated and innovative products and services that will

advance the way the world connects by simplifying and personalizing communications and enhancing mobility.

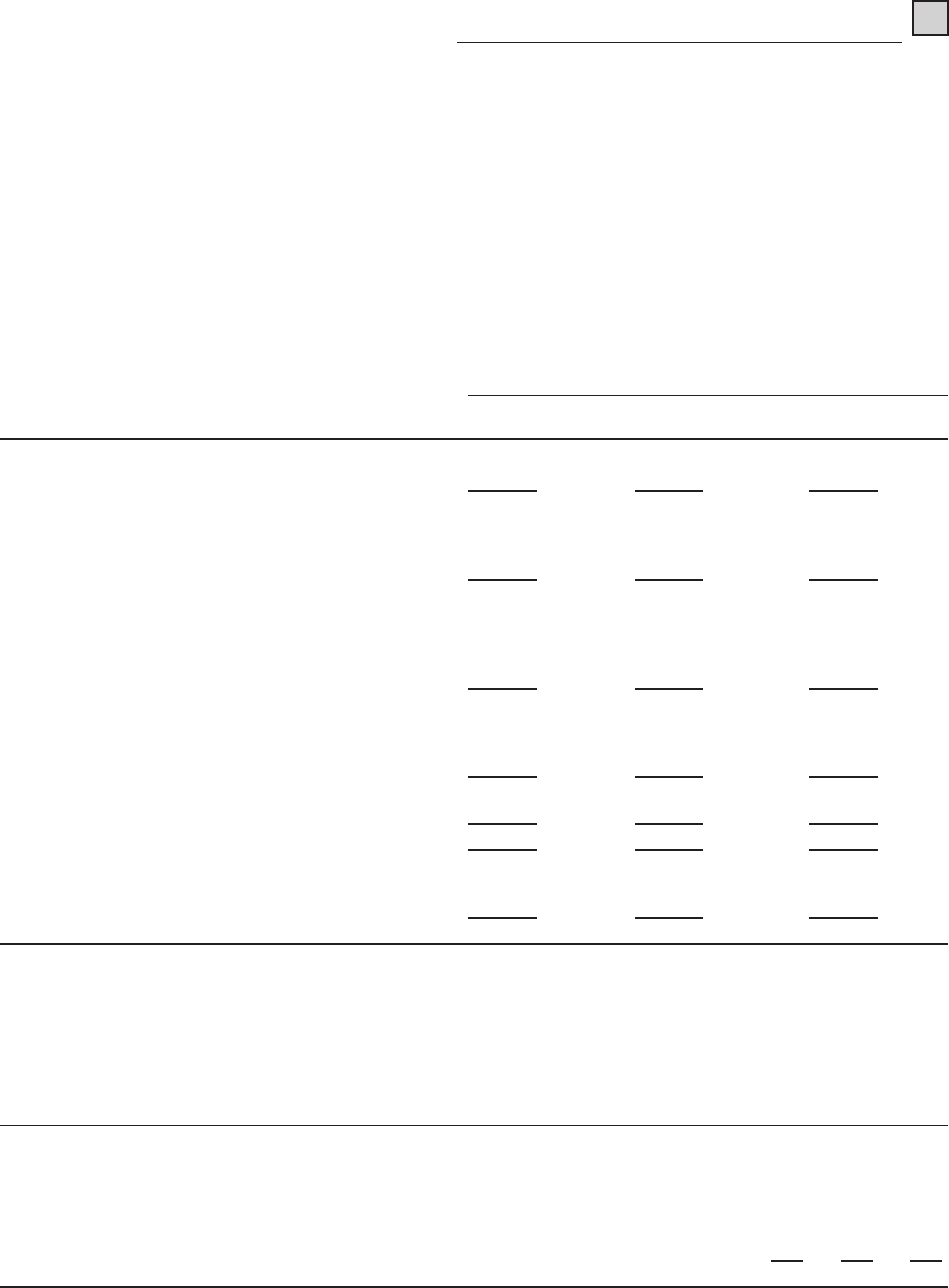

Results of Operations

(Dollars in millions, except per share

amounts) 2008 %of

sales 2007 %of

sales 2006 %of

sales

Years Ended December 31

Net sales $30,146 $36,622 $42,847

Costs of sales 21,751 72.2% 26,670 72.8% 30,120 70.3%

Gross margin 8,395 27.8% 9,952 27.2% 12,727 29.7%

Selling, general and administrative expenses 4,330 14.4% 5,092 13.9% 4,504 10.5%

Research and development expenditures 4,109 13.6% 4,429 12.1% 4,106 9.5%

Other charges 2,347 7.7% 984 2.7% 25 0.1%

Operating earnings (loss) (2,391) (7.9)% (553) (1.5)% 4,092 9.6%

Other income (expense):

Interest income, net 48 0.1% 91 0.2% 326 0.8%

Gains on sales of investments and businesses, net 82 0.3% 50 0.1% 41 0.1%

Other (376) (1.2)% 22 0.1% 151 0.3%

Total other income (expense) (246) (0.8)% 163 0.4% 518 1.2%

Earnings (loss) from continuing operations before

income taxes (2,637) (8.7)% (390) (1.1)% 4,610 10.8%

Income tax expense (benefit) 1,607 5.4% (285) (0.8)% 1,349 3.2%

Earnings (loss) from continuing operations (4,244) (14.1)% (105) (0.3)% 3,261 7.6%

Earnings from discontinued operations, net of tax — 0.0% 56 0.2% 400 0.9%

Net earnings (loss) $ (4,244) (14.1)% $ (49) (0.1)% $ 3,661 8.5%

Earnings (loss) per diluted common share:

Continuing operations $ (1.87) $ (0.05) $ 1.30

Discontinued operations — 0.03 0.16

$ (1.87) $ (0.02) $ 1.46

Geographic market sales measured by the locale of the end customer as a percent of total net sales for 2008,

2007 and 2006 are as follows:

Geographic Market Sales by Locale of End Customer

2008 2007 2006

United States 49% 51% 44%

Latin America 14% 12% 10%

Europe 13% 13% 15%

Asia, excluding China 10% 9% 11%

China 7% 7% 11%

Other Markets 7% 8% 9%

100% 100% 100%

43

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS