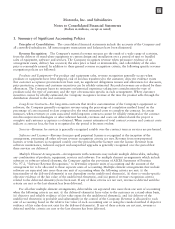

Motorola 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

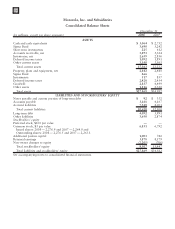

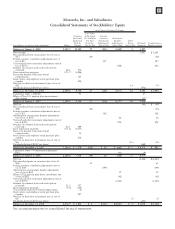

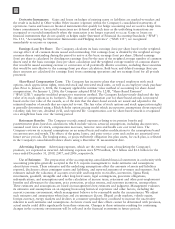

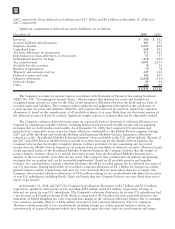

Balance Sheet Information

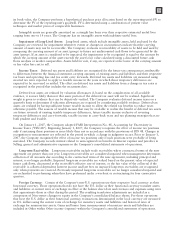

Sigma Fund

Sigma Fund consists of the following:

December 31, 2008 Current Non-current

Temporary

Unrealized

Gains

Temporary

Unrealized

Losses

Recorded Value

Cash $1,108 $ — $— $ —

Certificates of deposit 20 — — —

Securities:

U.S. government and agency obligations 752 — — —

Corporate bonds 1,616 366 25 (88)

Asset-backed securities 113 59 — (24)

Mortgage-backed securities 81 41 — (14)

$3,690 $466 $25 $(126)

December 31, 2007 Recorded Value

Temporary

Unrealized

Gains

Temporary

Unrealized

Losses

Cash $ 16 $— $ —

Certificates of deposit 156 — —

Securities:

Commercial paper 1,282 — —

U.S. government and agency obligations 25 — —

Corporate bonds 3,125 1 (48)

Asset-backed securities 420 — (5)

Mortgage-backed securities 209 — (5)

Other 9——

$5,242 $ 1 $(58)

The fair market value of investments in the Sigma Fund was $4.2 billion and $5.2 billion at December 31,

2008 and 2007, respectively.

The Company considers unrealized losses in the Sigma Fund to be temporary, as these losses have resulted

primarily from the ongoing disruptions in the capital markets. On the securities for which the unrealized losses are

considered temporary (excluding impaired securities), the Company believes it is probable that it will be able to

collect all amounts it is owed according to their contractual terms, which may be at maturity. Temporary

unrealized losses in the Sigma Fund were $101 million and $57 million at December 31, 2008 and 2007,

respectively.

If it becomes probable the Company will not collect amounts it is owed on securities according to their

contractual terms, the Company considers the security to be impaired and adjusts the cost basis of the security

accordingly. For the years ended December 31, 2008 and 2007, impairment charges in the Sigma Fund were

$186 million and $18 million, respectively. The impairment charges were primarily related to investments in

Lehman Brothers Holdings, Inc., Washington Mutual, Inc., and Sigma Finance Corporation, an unrelated special

investment vehicle managed by United Kingdom-based Gordian Knot, Limited.

Securities with a significant temporary unrealized loss and a maturity greater than 12 months and impaired

securities have been classified as non-current in the Company’s consolidated balance sheets. At December 31,

2008, $466 million of the Sigma Fund investments were classified as non-current, and the weighted average

maturity of the Sigma Fund investments classified as non-current (excluding impaired securities) was 16 months.

At December 31, 2007, none of the Sigma Fund investments were classified as non-current.

Prior to the three months ended December 31, 2008, the Company recognized impairment charges from

Sigma Fund investments in its consolidated statements of operations and temporary unrealized losses in Sigma

Fund investments as a component of Non-owner changes to equity in the consolidated statements of stockholders’

equity. During the three months ended December 31, 2008, the Company determined that temporary unrealized

losses in Sigma Fund investments should also be recognized in the Company’s consolidated statements of

94