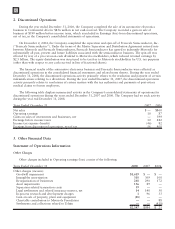

Motorola 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

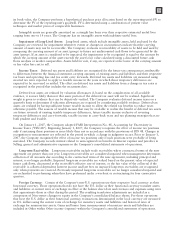

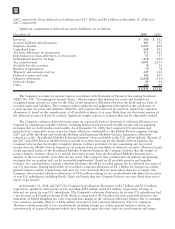

Other Liabilities

Other liabilities consists of the following:

December 31 2008 2007

Defined benefit plans, including split dollar life insurance policies $2,202 $ 562

Deferred revenue 316 393

Unrecognized tax benefits 312 933

Postretirement health care benefit plan 261 144

Royalty license arrangement — 282

Other 559 560

$3,650 $2,874

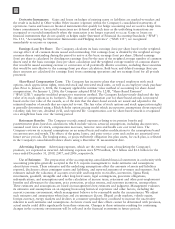

Stockholders’ Equity Information

Share Repurchase Program

Share Repurchase Program: During the year ended December 31, 2008, the Company repurchased

9.0 million of its common shares at an aggregate cost of $138 million, or an average cost of $15.32 per share, all

of which were repurchased during the three months ended March 29, 2008. During the year ended December 31,

2007, the Company repurchased 171.2 million of its common shares at an aggregate cost of $3.0 billion, or an

average cost of $17.74 per share. During the year ended December 31, 2006, the Company repurchased a total of

171.7 million of its common shares at an aggregate cost of $3.8 billion, or an average cost of $22.29 per share.

Since the inception of its share repurchase program in May 2005, the Company has repurchased a total of

394 million common shares for an aggregate cost of $7.9 billion. All repurchased shares have been retired. As of

December 31, 2008, the Company remained authorized to purchase an aggregate amount of up to $3.6 billion of

additional shares under the current stock repurchase program. The timing and amount of future purchases will be

based on market and other conditions.

Payment of Dividends: The Company paid $453 million in cash dividends to holders of its common stock in

2008. In January 2009, the Company paid $114 million in cash dividends that were declared in November 2008.

In February 2009, the Company announced that its Board of Directors voted to suspend the declaration of

quarterly dividends on the Company’s common stock.

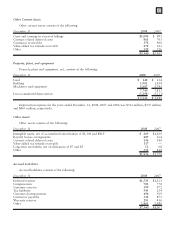

4. Debt and Credit Facilities

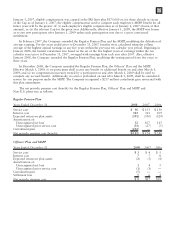

Long-Term Debt

December 31 2008 2007

6.5% notes due 2008 $ — $ 114

5.8% notes due 2008 —84

7.625% notes due 2010 527 527

8.0% notes due 2011 599 599

5.375% senior notes due 2012 400 400

6.0% senior notes due 2017 399 399

6.5% debentures due 2025 397 397

7.5% debentures due 2025 356 398

6.5% debentures due 2028 297 297

6.625% senior notes due 2037 596 596

5.22% debentures due 2097 195 195

Other long-term debt 178 145

3,944 4,151

Adjustment for interest rate swaps

(1)

151 38

Less: current portion (3) (198)

Long-term debt $4,092 $3,991

98