Motorola 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2008, the Company completed the open market purchase of $42 million of the $400 million

aggregate principal amount outstanding of its 7.50% Debentures due in 2025 (the “2025 Debentures”). The

$42 million principal amount of 2025 Debentures was purchased for an aggregate purchase price of approximately

$28 million, including accrued interest. During 2008, the Company recognized a gain of approximately

$14 million related to this open market purchase in Other within Other income (expense) in the consolidated

statements of operations.

In November 2007, the Company issued an aggregate face principal amount of: (i) $400 million of

5.375% Senior Notes due November 15, 2012, (ii) $400 million of 6.00% Senior Notes due November 15, 2017,

and (iii) $600 million of 6.625% Senior Notes due November 15, 2037.

The Company may from time to time seek to retire certain of its outstanding debt through open market cash

purchases, privately-negotiated transactions or otherwise. Such repurchases, if any, will depend on prevailing

market conditions, the Company’s liquidity requirements, contractual restrictions and other factors.

Share Repurchase Program: During 2008, the Company paid an aggregate of $138 million, including

transaction costs, to repurchase 9.0 million shares of the Company’s common stock at an average price of $15.32,

all of which shares were repurchased during the first quarter. During 2007, the Company repurchased

171.2 million of its common shares at an aggregate cost of $3.0 billion, or an average cost of $17.74 per share.

During 2006, the Company repurchased a total of 171.7 million of its common shares at an aggregate cost of

$3.8 billion, or an average cost of $22.29 per share.

Through actions taken in July 2006 and March 2007, the Board of Directors authorized the Company to

repurchase an aggregate amount of up to $7.5 billion of its outstanding shares of common stock over a period

ending in June 2009. The timing and amount of future repurchases will be based on market and other conditions.

As of December 31, 2008, the Company remained authorized to purchase an aggregate amount of up to

$3.6 billion of additional shares under the current stock repurchase program. All repurchased shares have been

retired.

Payment of Dividends: The Company paid $453 million in cash dividends to holders of its common stock in

2008. In January 2009, the Company paid $114 million in cash dividends that were declared in November 2008.

In February 2009, the Company announced that its Board of Directors voted to suspend the declaration of

quarterly dividends on the Company’s common stock. The Company does not currently expect to pay any

additional cash dividends during the remainder of 2009.

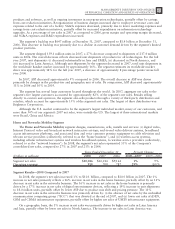

Credit Ratings: Three independent credit rating agencies, Fitch Ratings (“Fitch”), Moody’s Investors Service

(“Moody’s”), and Standard & Poor’s (“S&P”), assign ratings to the Company’s short-term and long-term debt.

The following chart reflects the current ratings assigned to the Company’s senior unsecured non-credit enhanced

long-term debt and the Company’s commercial paper by each of these agencies.

Name of

Rating

Agency Long-Term Debt

Rating Commercial Paper

Rating Date and Recent Actions Taken

Fitch BBB- F-3 February 3, 2009, downgraded long-term debt to BBB- (negative outlook) from

BBB (negative outlook) and downgraded short-term debt to F-3 (negative outlook)

from F2 (negative outlook).

Moody’s Baa3 P-3 February 3, 2009, downgraded long-term debt to Baa3 (negative outlook) from

Baa2 (review for downgrade) and downgraded short-term debt to P-3 (negative

outlook) from P-2 (review for downgrade).

S&P BB+ — December 5, 2008, downgraded long-term debt to BB+ (stable outlook) from

BBB (credit watch negative) and withdrew the rating on commercial paper from A-

2 (credit watch negative).

Since the Company has investment grade ratings from Fitch and Moody’s and a non-investment grade rating

from S&P, it is referred to as a “split rated credit”.

Credit Facilities

At December 31, 2008, the Company maintained a $2.0 billion five-year domestic syndicated revolving credit

facility that matures in December 2011 (as amended, the “5-Year Credit Facility”), which is not utilized. In order

57

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS