Motorola 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

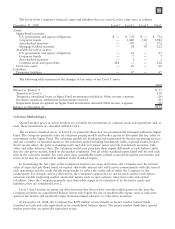

10. Long-term Customer Financing and Sales of Receivables

Long-term Customer Financing

Long-term receivables consist of trade receivables with payment terms greater than twelve months, long-term

loans and lease receivables under sales-type leases. Long-term receivables consist of the following:

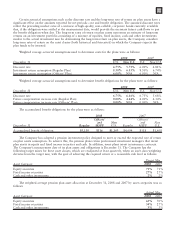

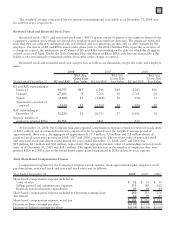

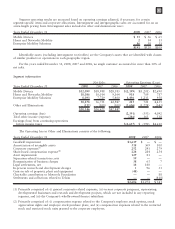

December 31 2008 2007

Long-term receivables $ 169 $123

Less allowance for losses (7) (5)

162 118

Less current portion (110) (50)

Non-current long-term receivables, net $52 $68

The current portion of long-term receivables is included in Accounts receivable and the non-current portion of

long-term receivables is included in Other assets in the Company’s consolidated balance sheets. Interest income

recognized on long-term receivables for the years ended December 31, 2008, 2007 and 2006 was $3 million,

$7 million and $9 million, respectively.

Certain purchasers of the Company’s infrastructure equipment continue to request that suppliers provide long-

term financing, defined as financing with terms greater than one year, in connection with equipment purchases.

These requests may include all or a portion of the purchase price of the equipment. However, the Company’s

obligation to provide long-term financing is often conditioned on the issuance of a letter of credit in favor of the

Company by a reputable bank to support the purchaser’s credit or a pre-existing commitment from a reputable

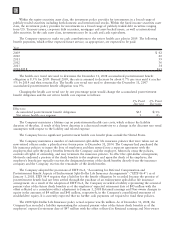

bank to purchase the long-term receivables from the Company. The Company had outstanding commitments to

provide long-term financing to third parties totaling $370 million and $610 million at December 31, 2008 and

2007, respectively. Of these amounts, $266 million and $454 million were supported by letters of credit or by

bank commitments to purchase long-term receivables at December 31, 2008 and 2007, respectively. In response to

the recent tightening in the credit markets, certain customers of the Company have requested financing in

connection with equipment purchases, and these types of requests have increased in volume and scope.

In addition to providing direct financing to certain equipment customers, the Company also assists customers

in obtaining financing directly from banks and other sources to fund equipment purchases. The Company had

committed to provide financial guarantees relating to customer financing totaling $43 million and $42 million at

December 31, 2008 and 2007, respectively (including $23 million at both December 31, 2008 and 2007 relating to

the sale of short-term receivables). Customer financing guarantees outstanding were $6 million and $3 million at

December 31, 2008 and 2007, respectively (including $4 million and $0 million at December 31, 2008 and 2007,

respectively, relating to the sale of short-term receivables).

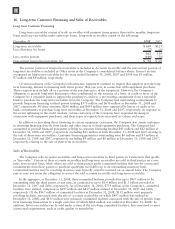

Sales of Receivables

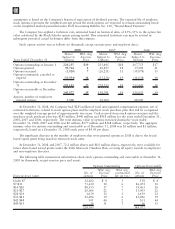

The Company sells accounts receivables and long-term receivables to third parties in transactions that qualify

as “true-sales.” Certain of these accounts receivables and long-term receivables are sold to third parties on a one-

time, non-recourse basis, while others are sold to third parties under committed facilities that involve contractual

commitments from these parties to purchase qualifying receivables up to an outstanding monetary limit.

Committed facilities may be revolving in nature and, typically, must be renewed on an annual basis. The Company

may or may not retain the obligation to service the sold accounts receivable and long-term receivables.

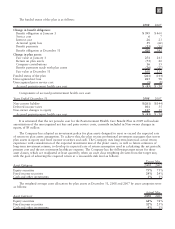

In the aggregate, at December 31, 2008, these committed facilities provided for up to $967 million to be

outstanding with the third parties at any time, as compared to up to $1.4 billion and $1.3 billion provided at

December 31, 2007 and 2006, respectively. As of December 31, 2008, $759 million of the Company’s committed

facilities were utilized, compared to $497 million and $817 million utilized at December 31, 2007 and 2006,

respectively. Of the $967 million of committed facilities at December 31, 2008, $532 million were primarily

revolving facilities associated with the sale of accounts receivables (of which $497 million was utilized at

December 31, 2008) and $435 million were primarily committed facilities associated with the sale of specific long-

term financing transactions to a single customer (of which $262 million was utilized at December 31, 2008). In

addition, before receivables can be sold under certain of the revolving committed facilities, they may need to meet

contractual requirements, such as credit quality or insurability.

118