Motorola 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

patent portfolio and the manufacturing locations; (2) “Home and Networks Mobility Segment,” about the

potential of the portfolio, including WiMAX and LTE, the impact of the separation of set-top security

functionality, 3G and 4G licenses and market development, the Company’s involvement in market development,

including China, sales and utilization, industry decline and growth, industry capital expenditures, the impact of the

segment’s strategy, the impact of acquisitions, the impact from the loss of key customers, competition from new

and existing competitors, consolidation among providers, iDEN trends, the impact of regulatory matters, the

impact from the allocation and regulation of frequencies, the availability of materials and components, energy

supplies and labor, the seasonality of the business, the firmness of the segment’s backlog, the competitiveness of the

patent portfolio and the impact of license agreement royalties; (3) “Enterprise Mobility Solutions segment,” about

industry and demand decline and growth, industry spending, the impact of the segment’s strategy, the impact from

the loss of key customers and reduced spending, the competitive position, competition from system integrators, the

impact of regulatory matters, the impact from the allocation and regulation of frequencies, the availability of

materials and components, energy supplies and labor, the seasonality of the business, the firmness of the segment’s

backlog and the competitiveness of the patent portfolio; (4) “Other Information,” about the impact from the loss

of key customers, the firmness of the aggregate backlog position, the competitiveness through research and

development and utilization of technology; (5) “Properties,” about the consequences of a disruption in

manufacturing; (6) “Legal Proceedings,” about the ultimate disposition of pending legal matters and timing;

(7) “Management’s Discussion and Analysis,” about: (a) the impact of acquisitions, (b) the success of our business

strategy and portfolio, (c) future payments, charges, use of accruals and expected cost-saving benefits associated

with our reorganization of business programs and employee separation costs, (d) the Company’s ability and cost to

repatriate funds, (e) the impact of the timing and level of sales and the geographic location of such sales, (f) future

cash contributions to pension plans or retiree health benefit plans, (g) the Company’s ability to collect on its Sigma

Fund and other investments, (h) outstanding commercial paper balances and purchase obligation payments, (i) the

Company’s ability and cost to access the capital markets, (j) the Company’s ability to borrow under its credit

facilities, (k) the Company’s ability to retire outstanding debt, (l) the Company’s ability and cost to obtain

performance related bonds, (m) adequacy of resources to fund expected working capital and capital expenditure

measurements, (n) expected payments pursuant to commitments under long-term agreements, (o) the outcome of

ongoing and future legal proceedings, (p) the success and impact of the Company turning around the Mobile

Devices business, (q) the impact of recent accounting pronouncements on the Company, (r) the impact of the loss

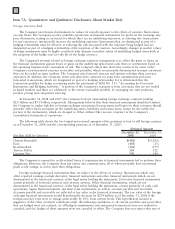

of key customers, and (s) the expected effective tax rate and deductibility of certain items; and (8) “Quantitative

and Qualitative Disclosures about Market Risk,” about: (a) the impact of foreign currency exchange risks,

(b) future hedging activity and expectations of the Company, and (c) the ability of counterparties to financial

instruments to perform their obligations.

Some of the risk factors that affect the Company’s business and financial results are discussed in “Item 1A:

Risk Factors.” We wish to caution the reader that the risk factors discussed in “Item 1A: Risk Factors”, and those

described elsewhere in this report or our other Securities and Exchange Commission filings, could cause our

actual results to differ materially from those stated in the forward-looking statements.

77

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS