Motorola 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14. Acquisitions and Related Intangibles

The Company accounts for acquisitions using purchase accounting with the results of operations for each

acquiree included in the Company’s consolidated financial statements for the period subsequent to the date of

acquisition. The pro forma effects of these acquisitions on the Company’s consolidated financial statements were

not significant individually nor in the aggregate.

The allocation of value to in-process research and development was determined using expected future cash

flows discounted at average risk adjusted rates reflecting both technological and market risk as well as the time

value of money. Historical pricing, margins and expense levels, where applicable, were used in the valuation of the

in-process products. The in-process research and development acquired will have no alternative future uses if the

products are not feasible.

The developmental products for the companies acquired have varying degrees of timing, technology, costs-to-

complete and market risks throughout final development. If the products fail to become viable, the Company will

unlikely be able to realize any value from the sale of incomplete technology to another party or through internal

re-use. The risks of market acceptance for the products under development and potential reductions in projected

sales volumes and related profits in the event of delayed market availability for any of the products exist. Efforts to

complete all developmental products continue and there are no known delays to forecasted plans except as

disclosed.

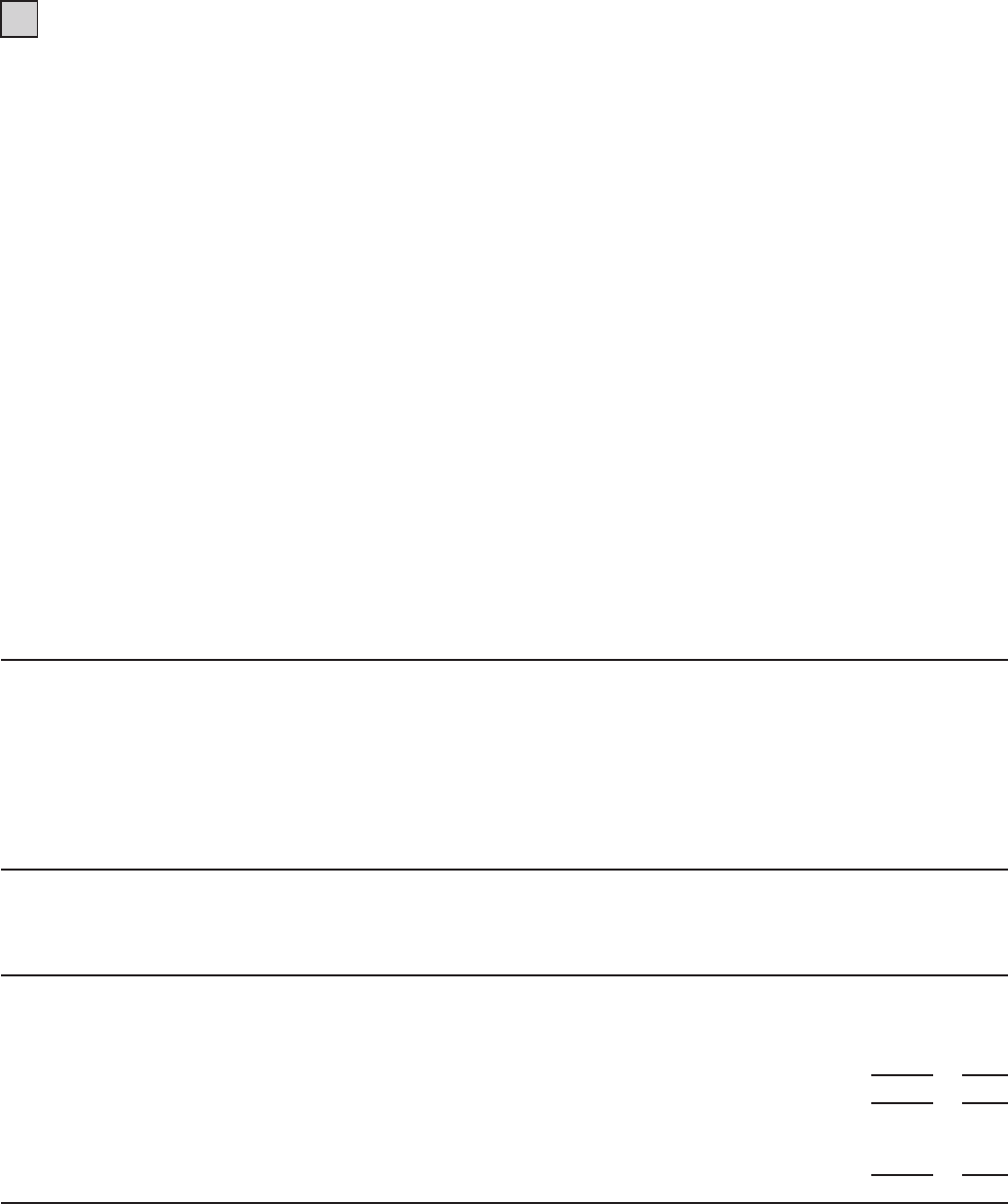

The Company did not have any significant acquisitions during the year ended December 31, 2008. The

following is a summary of significant acquisitions during the years ended December 31, 2007 and 2006:

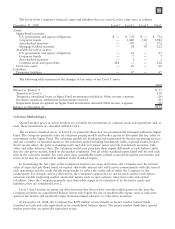

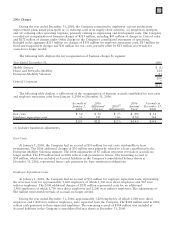

Quarter

Acquired Consideration, net Form of

Consideration

In-Process

Research and

Development

Charge

2007 Acquisitions

Symbol Technologies, Inc. Q1 $3,528 Cash $95

Good Technology, Inc. Q1 $ 438 Cash —

Netopia, Inc. Q1 $ 183 Cash —

Terayon Communication Systems, Inc. Q3 $ 137 Cash —

2006 Acquisitions

Broadbus Technologies, Inc. Q3 $ 181 Cash $12

TTP Communications plc Q3 $ 193 Cash $17

Kreatel Communications AB Q1 $ 108 Cash $ 1

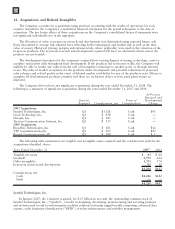

The following table summarizes net tangible and intangible assets acquired and the consideration paid for the

acquisitions identified above:

Years Ended December 31 2007 2006

Tangible net assets $83$20

Goodwill 2,793 262

Other intangibles 1,315 170

In-process research and development 95 30

$4,286 $482

Consideration, net:

Cash $4,286 $482

Stock ——

$4,286 $482

Symbol Technologies, Inc.

In January 2007, the Company acquired, for $3.5 billion in net cash, the outstanding common stock of

Symbol Technologies, Inc. (“Symbol”), a leader in designing, developing, manufacturing and servicing products

and systems used in end-to-end enterprise mobility solutions featuring rugged mobile computing, advanced data

capture, radio frequency identification (“RFID”), wireless infrastructure and mobility management.

126