Motorola 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

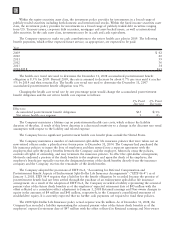

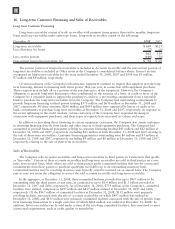

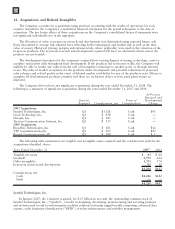

Years Ended December 31 2008 2007 2006 2008 2007 2006 2008 2007 2006

Assets Capital Expenditures Depreciation Expense

Mobile Devices $ 3,559 $ 6,325 $ 9,316 $84 $132 $164 $115 $146 $133

Home and Networks Mobility 7,024 7,451 6,746 147 160 149 135 141 165

Enterprise Mobility Solutions 6,000 8,694 3,268 166 113 190 158 167 92

16,583 22,470 19,330 397 405 503 408 454 390

Other and Eliminations 11,286 12,342 19,263 107 122 146 103 83 73

$27,869 $34,812 $38,593 $504 $527 $649 $511 $537 $463

Assets in Other include primarily cash and cash equivalents, Sigma Fund, deferred income taxes, short-term

investments, property, plant and equipment, investments, and the administrative headquarters of the Company.

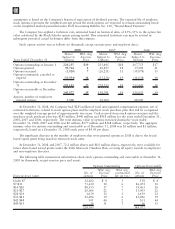

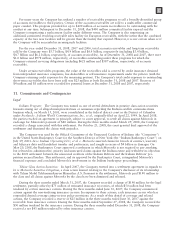

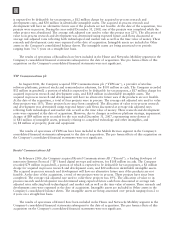

Geographic area information

Years Ended December 31 2008 2007 2006 2008 2007 2006 2008 2007 2006

Net Sales

(1)

Assets Property, Plant, and

Equipment

United States $14,708 $18,548 $18,776 $17,938 $22,385 $24,212 $1,240 $1,252 $1,089

China 2,011 2,632 4,664 3,307 3,926 4,649 294 311 278

Brazil 1,554 1,671 1,269 1,057 1,440 1,219 110 109 107

United Kingdom 936 1,070 1,306 1,314 1,305 1,773 85 121 134

Germany 322 516 874 467 644 1,195 57 75 131

Israel 696 741 659 1,268 1,374 1,195 141 165 156

Singapore 116 128 176 1,875 3,120 3,713 32 40 39

Other nations, net of

eliminations 9,803 11,316 15,123 643 618 637 483 407 333

$30,146 $36,622 $42,847 $27,869 $34,812 $38,593 $2,442 $2,480 $2,267

(1) Net sales by geographic region are measured by the locale of end customer.

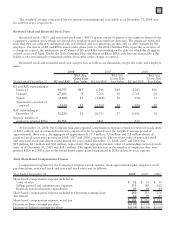

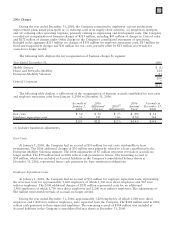

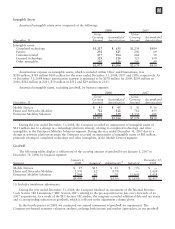

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the “Severance Plan”), which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. The

Company recognizes termination benefits based on formulas per the Severance Plan at the point in time that future

settlement is probable and can be reasonably estimated based on estimates prepared at the time a restructuring

plan is approved by management. Exit costs consist of future minimum lease payments on vacated facilities and

other contractual terminations. At each reporting date, the Company evaluates its accruals for employee separation

and exit costs to ensure the accruals are still appropriate. In certain circumstances, accruals are no longer needed

because of efficiencies in carrying out the plans or because employees previously identified for separation resigned

from the Company and did not receive severance or were redeployed due to circumstances not foreseen when the

original plans were initiated. In these cases, the Company reverses accruals through the consolidated statements of

operations where the original charges were recorded when it is determined they are no longer needed.

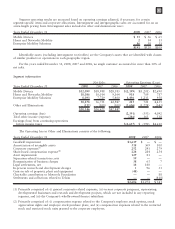

2008 Charges

During the year ended December 31, 2008, the Company committed to implement various productivity

improvement plans aimed at achieving long-term, sustainable profitability by driving efficiencies and reducing

operating costs. All three of the Company’s business segments, as well as corporate functions, are impacted by

these plans, with the majority of the impact in the Mobile Devices segment. The employees affected are located in

all regions. The Company recorded net reorganization of business charges of $334 million, including $86 million

of charges in Costs of sales and $248 million of charges under Other charges in the Company’s consolidated

statements of operations. Included in the aggregate $334 million are charges of $324 million for employee

separation costs, $66 million for exit costs and $9 million for fixed asset impairment charges, partially offset by

$65 million of reversals for accruals no longer needed.

122