Motorola 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

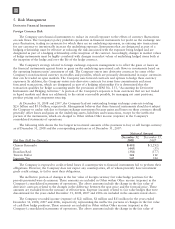

At December 31, 2008, the Company’s available-for-sale equity securities portfolio had an approximate fair

market value of $128 million, which represented a cost basis of $125 million and a net unrealized gain of

$3 million. At December 31, 2007, the Company’s available-for-sale securities portfolio had an approximate fair

market value of $333 million, which represented a cost basis of $372 million and a net unrealized loss of

$39 million.

During the years ended December 31, 2008, 2007 and 2006, the Company recorded investment impairment

charges of $365 million, $44 million and $27 million, respectively, representing other-than-temporary declines in

the value of the Company’s available-for-sale investment portfolio. Investment impairment charges are included in

Other within Other income (expense) in the Company’s consolidated statements of operations.

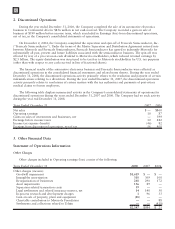

Gains on sales of investments and businesses, consists of the following:

Years Ended December 31 2008 2007 2006

Gains on sales of investments, net $82 $17 $41

Gains on sales of businesses, net —33 —

$82 $50 $41

During the year ended December 31, 2008, the $82 million of net gains primarily relates to sales of a number

of the Company’s equity investments, of which $29 million of gain was attributed to a single investment. During

the year ended December 31, 2007, the $50 million of net gains was primarily related to a $34 million gain on the

sale of the Company’s embedded communication computing business. During the year ended December 31, 2006,

the $41 million of net gains was primarily related to a $141 million gain on the sale of the Company’s remaining

shares in Telus Corporation, partially offset by a $126 million loss on the sale of the Company’s remaining shares

in Sprint Nextel Corporation (“Sprint Nextel”).

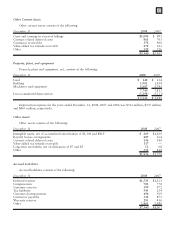

Accounts Receivable

Accounts receivable, net, consists of the following:

December 31 2008 2007

Accounts receivable $3,675 $5,508

Less allowance for doubtful accounts (182) (184)

$3,493 $5,324

Inventories

Inventories, net, consist of the following:

December 31 2008 2007

Finished goods $1,710 $1,737

Work-in-process and production materials 1,709 1,470

3,419 3,207

Less inventory reserves (760) (371)

$2,659 $2,836

During the year ended December 31, 2008, the Company recorded a charge of $291 million for excess

inventory due to a decision to consolidate software and silicon platforms in the Mobile Devices segment.

96