Motorola 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

cash requirements of the Mobile Devices reporting unit, and market participants’ perceptions of the likely

restructuring costs, including severance and exit costs, that might be incurred if the Company’s strategy is not

successful. The results of the Company’s impairment analysis result in an implied control premium commensurate

with historical transactions observed in our industry.

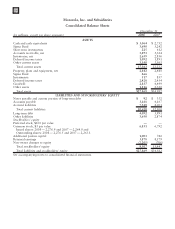

After reflecting the impairment charges, goodwill at the Mobile Devices and Enterprise Mobility reporting

units represented $1.0 billion of our $27.9 billion of total assets as of December 31, 2008. The Company has no

intangible assets with indefinite useful lives.

Long-lived Assets: Long-lived assets include property, plant and equipment, intangible asset, long-term

prepaid assets and other non-current assets. The Company reviews long-lived assets held for use for impairment

whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Events

which may indicate long-lived assets may not be recoverable include, but are not limited to, a significant decrease

in the market price of long-lived assets, a significant adverse change in the manner in which the Company utilizes

a long-lived asset, a significant adverse change in the business climate, a recent history of operating or cash flow

losses, or a current expectation that it is more likely than not likely that a long-lived asset will be sold or disposed

of in the future. For impairment testing purposes, the Company groups our long-lived assets at the lowest level for

which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities (the

asset group).

If the Company determines that a long-lived asset or asset group may not be recoverable, it compares the sum

of the expected undiscounted future cash flows that the asset or asset group is expected to generate to the asset or

asset group’s carrying value. If the sum of the undiscounted future cash flows exceed the carrying amount of the

asset or asset group, the asset or asset group is not considered impaired. However, if the sum of the undiscounted

future cash flows are less than the carrying amount of the assets or asset group, a loss is recognized for the

difference between the fair value of the asset or asset group and the carrying value of the asset or asset group. The

fair value of the asset or asset group is generally determined by discounting the expected future cash flows using a

discount rate that is commensurate with the risk associated with the amount and timing of the expected future

cash flows.

During 2008, the Company tested two asset groups for impairment. The first asset group was tested for

impairment when it was determined that there was a more likely than not likely expectation that assets associated

with a technology platform of the Enterprise Mobility segment would be disposed of or sold. This determination

was made because the technology platform was no longer considered strategic to the Company. The Company

determined that the expected future cash flows, which incorporated this change in the strategic direction of the

platform, did not support its carrying amount. As a result, the assets, consisting primarily of intangible assets, were

written down to their fair values. The Company recorded an impairment charge of $121 million during 2008 to

reduce the carrying amount of the asset group to its fair value.

During the fourth quarter of 2008, due to the continued operating losses of the Mobile Devices segment, the

Company tested the long-lived assets of the Mobile Devices segment for impairment. The long-lived assets of the

Mobile Devices segment consisted primarily of property, plant and equipment and long-term pre-paid licenses. The

asset group also included elements of working capital including inventory and accounts receivable. The Company

considered future cash flows expected to be generated by the business and weighted them according to

management’s view of their probability-weighted outcomes. The sum of these probability-weighted undiscounted

future cash flows indicated that the asset group was recoverable. As a result, no impairment of long-lived assets

was recorded at the Mobile Devices segment. A significant assumption in the expected future cash flow forecast

was that it is more likely than not that management will be successful in its plans to turn around the Mobile

Devices business. The plan to turn around Mobile Devices includes a successful execution of the segment’s

software platform strategy and the Company’s ability to execute its cost savings initiatives.

Expectations of future cash flows could change if the Company determines it will not be successful in

executing its plans to turn around the Mobile Devices business. Impairment charges of the long-lived assets of

Mobile Devices could be required in future periods if the Company’s expectations of future cash flows changes.

Recent Accounting Pronouncements

The Company adopted Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting

Standard (“SFAS”) No. 157, “Fair Value Measurements” (“SFAS 157”) on January 1, 2008 for financial assets and

liabilities, and non-financial assets and liabilities that are recognized or disclosed at fair value in the financial

75

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS