Motorola 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

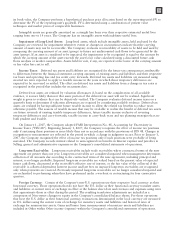

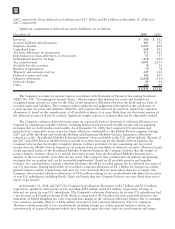

(1) At December 31, 2008, the balance primarily represents the unamortized gain associated with the termination

of all interest rate swaps designated as fair value hedges. For detailed discussion please see Note 5, “Risk

Management.” At December 31, 2007, the balance represents the fair value of the interest rate swaps.

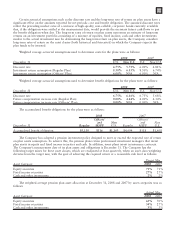

Other Short-Term Debt

December 31 2008 2007

Notes to banks $89 $134

Add: current portion of long-term debt 3198

Notes payable and current portion of long-term debt $92 $332

Weighted average interest rates on short-term borrowings throughout the year

Commercial paper

(1)

— 5.3%

Other short-term debt 4.2% 4.6%

(1) At December 31, 2008, the Company did not have any commercial paper outstanding.

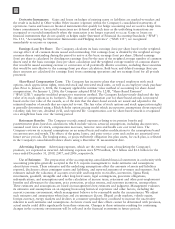

In December 2008, the Company completed the open market purchase of $42 million of the $400 million

aggregate principal amount outstanding of its 7.50% Debentures due 2025 (the “2025 Debentures”). The

$42 million principal amount of 2025 Debentures was purchased for an aggregate purchase price of approximately

$28 million, including accrued interest as of the redemption date. During the year ended December 31, 2008, the

Company recognized a gain of approximately $14 million related to this open market purchase in Other within

Other income (expense) in the consolidated statements of operations.

In October 2008, the Company repaid, at maturity, the entire $84 million aggregate principal amount

outstanding of its 5.80% Notes due October 15, 2008. In March 2008, the Company repaid at maturity, the entire

$114 million aggregate principal amount outstanding of its 6.50% Notes due March 1, 2008.

In November 2007, the Company repaid, at maturity, the entire $1.2 billion aggregate principal amount

outstanding of its 4.608% Notes due November 16, 2007. In November 2007, the Company issued an aggregate

face principal amount of: (i) $400 million of 5.375% Senior Notes due November 15, 2012, (ii) $400 million of

6.00% Senior Notes due November 15, 2017, and (iii) $600 million of 6.625% Senior Notes due November 15,

2037. In January 2007, the Company repaid, at maturity, the entire $118 million aggregate principal amount

outstanding of its 7.6% Notes due January 1, 2007.

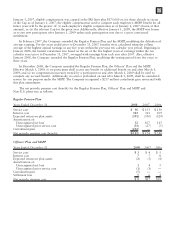

Aggregate requirements for long-term debt maturities during the next five years are as follows: 2009—

$3 million; 2010—$536 million; 2011—$609 million; 2012—$410 million; and 2013—$11 million.

In December 2006, the Company entered into a five-year domestic syndicated revolving credit facility (“5-Year

Credit Facility”) for $2.0 billion. At December 31, 2008 and 2007, the Company had no outstanding borrowings

under the 5-Year Credit Facility. At December 31, 2008, the commitment fee assessed against the daily average

amounts unused was 10.0 basis points. Important terms of the 5-Year Credit Facility include a covenant relating to

the ratio of total debt to adjusted EBITDA. The Company was in compliance with the terms of the 5-Year Credit

Facility at December 31, 2008.

Events over the past several months, including recent failures and near failures of a number of large financial

service companies, have made the capital markets increasingly volatile. The Company also has access to

uncommitted non-U.S. credit facilities (“uncommitted facilities”), but in light of the state of the financial services

industry and the Company’s current financial condition, the Company does not believe it is prudent to assume the

same level of funding will be available under those facilities going forward as has been available historically.

The Company’s current corporate credit ratings are “BBB⫺” with a negative outlook by Fitch Ratings

(“Fitch”), “Baa3” with a negative outlook by Moody’s Investors Service (“Moody’s”), and “BB+” with a stable

outlook by Standard & Poor’s (“S&P”).

99