Microsoft 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

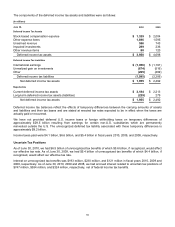

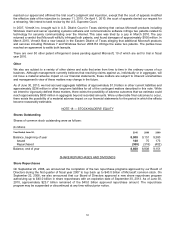

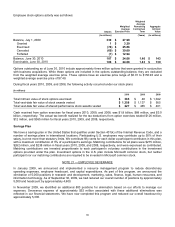

Employee stock options activity was as follows:

Shares

Weighted

Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(In millions)

(Years) (In millions)

Balance, July 1, 2009 330 $ 27.99

Granted 1 $ 3.20

Exercised (74) $ 25.86

Canceled (69) $ 39.00

Forfeited (1) $ 12.94

Balance, June 30, 2010 187 $ 24.68

1.46 $ 143

Exercisable, June 30, 2010 186 $ 24.68

1.43 $ 130

Options outstanding as of June 30, 2010 include approximately three million options that were granted in conjunction

with business acquisitions. While these options are included in the options outstanding balance, they are excluded

from the weighted average exercise price. These options have an exercise price range of $0.01 to $150.93 and a

weighted average exercise price of $7.49.

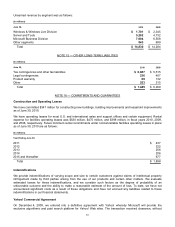

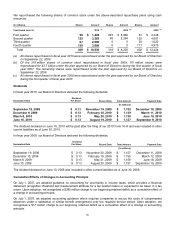

During fiscal years 2010, 2009, and 2008, the following activity occurred under our stock plans:

(In millions)

2010

2009 2008

Total intrinsic value of stock options exercised $365

$ 48 $ 1,042

Total vest-date fair value of stock awards vested $ 1,358

$ 1,137 $ 955

Total vest-date fair value of shared performance stock awards vested $227

$ 485 $ 401

Cash received from option exercises for fiscal years 2010, 2009, and 2008, was $1.8 billion, $88 million, and $3.0

billion, respectively. The actual tax benefit realized for the tax deductions from option exercises totaled $126 million,

$12 million, and $365 million for fiscal years 2010, 2009, and 2008, respectively.

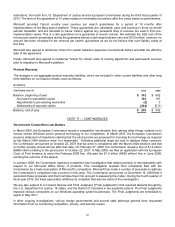

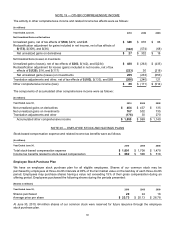

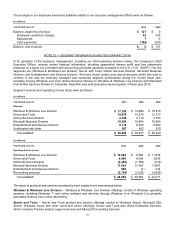

Savings Plan

We have a savings plan in the United States that qualifies under Section 401(k) of the Internal Revenue Code, and a

number of savings plans in international locations. Participating U.S. employees may contribute up to 50% of their

salary, but not more than statutory limits. We contribute fifty cents for each dollar a participant contributes in this plan,

with a maximum contribution of 3% of a participant’s earnings. Matching contributions for all plans were $275 million,

$262 million, and $238 million in fiscal years 2010, 2009, and 2008, respectively, and were expensed as contributed.

Matching contributions are invested proportionate to each participant’s voluntary contributions in the investment

options provided under the plan. Investment options in the U.S. plan include Microsoft common stock, but neither

participant nor our matching contributions are required to be invested in Microsoft common stock.

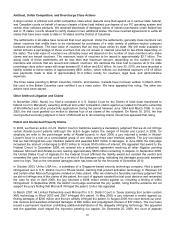

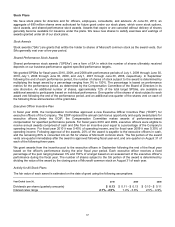

NOTE 21 — EMPLOYEE SEVERANCE

In January 2009, we announced and implemented a resource management program to reduce discretionary

operating expenses, employee headcount, and capital expenditures. As part of this program, we announced the

elimination of 5,000 positions in research and development, marketing, sales, finance, legal, human resources, and

information technology. As of September 30, 2009, we had reduced our overall number of positions by approximately

5,000 and headcount by approximately 4,600.

In November 2009, we identified an additional 800 positions for elimination based on our efforts to manage our

expenses. Severance expense of approximately $52 million associated with these additional eliminations was

reflected in our financial statements. We have now completed this program and reduced our overall headcount by

approximately 5,300.