Microsoft 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

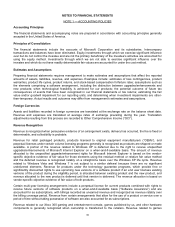

Income Taxes

The objectives of accounting for income taxes are to recognize the amount of taxes payable or refundable for the

current year and deferred tax liabilities and assets for the future tax consequences of events that have been

recognized in an entity’s financial statements or tax returns. We recognize the tax benefit from an uncertain tax

position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities,

based on the technical merits of the position. The tax benefits recognized in the financial statements from such a

position should be measured based on the largest benefit that has a greater than 50% likelihood of being realized

upon ultimate settlement. Accounting literature also provides guidance on derecognition of income tax assets and

liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties

associated with tax positions, and income tax disclosures. Judgment is required in assessing the future tax

consequences of events that have been recognized in our financial statements or tax returns. Variations in the actual

outcome of these future tax consequences could materially impact our financial statements.

Stock-Based Compensation

Stock-based compensation cost is measured at the grant date based on the fair value of the award and is recognized

as expense over the requisite service period. Determining the fair value of stock-based awards at the grant date

requires judgment, including estimating expected dividends. In addition, judgment is also required in estimating the

amount of stock-based awards that are expected to be forfeited. If actual results differ significantly from these

estimates, stock-based compensation expense and our results of operations could be impacted.

Product Warranties

We provide for the estimated costs of hardware and software warranties at the time the related revenue is

recognized. For hardware warranty, we estimate the costs based on historical and projected product failure rates,

historical and projected repair costs, and knowledge of specific product failures (if any). The specific hardware

warranty terms and conditions vary depending upon the product sold and country in which we do business, but

generally include parts and labor over a period generally ranging from 90 days to three years. For software warranty,

we estimate the costs to provide bug fixes, such as security patches, over the life of the software. We regularly

reevaluate our estimates to assess the adequacy of the recorded warranty liabilities and adjust the amounts as

necessary.