Microsoft 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

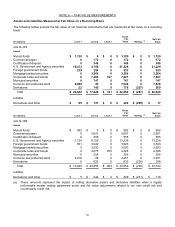

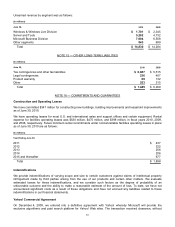

NOTE 13 — INCOME TAXES

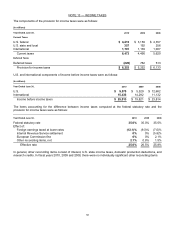

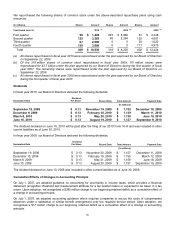

The components of the provision for income taxes were as follows:

(In millions)

Y

ear Ended June 30, 2010

2009 2008

Current Taxes

U.S. federal $ 4,415

$ 3,159 $ 4,357

U.S. state and local 357

192 256

International 1,701

1,139 1,007

Current taxes 6,473

4,490 5,620

Deferred Taxes

Deferred taxes (220 )

762 513

Provision for income taxes $6,253

$ 5,252 $ 6,133

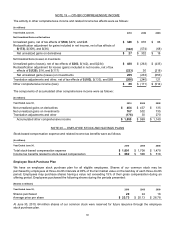

U.S. and international components of income before income taxes were as follows:

(In millions)

Y

ear Ended June 30, 2010

2009 2008

U.S. $9,575

$ 5,529 $ 12,682

International 15,438

14,292 11,132

Income before income taxes $ 25,013

$ 19,821 $ 23,814

The items accounting for the difference between income taxes computed at the federal statutory rate and the

provision for income taxes were as follows:

Y

ear Ended June 30, 2010

2009 2008

Federal statutory rate 35.0%

35.0% 35.0%

Effect of:

Foreign earnings taxed at lower rates (12.1)%

(9.3)% (7.0)%

Internal Revenue Service settlement 0%

0% (5.8)%

European Commission fine 0%

0% 2.1%

Other reconciling items, net 2.1%

0.8% 1.5%

Effective rate 25.0%

26.5% 25.8%

In general, other reconciling items consist of interest, U.S. state income taxes, domestic production deductions, and

research credits. In fiscal years 2010, 2009 and 2008, there were no individually significant other reconciling items.