Microsoft 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

values of the common and preferred stocks that we held that were required to be measured at fair value on a non-

recurring basis were $0 and $164 million, respectively.

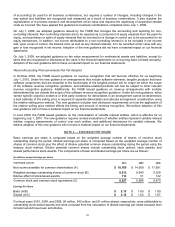

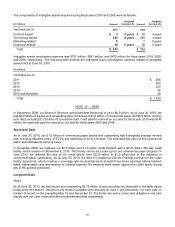

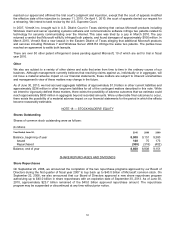

NOTE 7 — INVENTORIES

The components of inventories were as follows:

(In millions)

June 30, 2010 2009

Raw materials $ 172 $ 170

Work in process 16 45

Finished goods 552 502

Total $ 740 $ 717

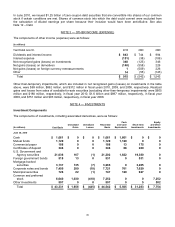

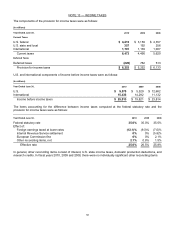

NOTE 8 — PROPERTY AND EQUIPMENT

The components of property and equipment were as follows:

(In millions)

June 30, 2010 2009

Land $ 526 $ 526

Buildings and improvements 6,087 5,886

Leasehold improvements 2,100 1,938

Computer equipment and software 5,673 4,989

Furniture and equipment 1,873 1,743

Total, at cost 16,259 15,082

Accumulated depreciation (8,629) (7,547)

Total, net $ 7,630 $ 7,535

During fiscal years 2010, 2009, and 2008, depreciation expense was $1.8 billion, $1.7 billion, and $1.4 billion,

respectively.

NOTE 9 — BUSINESS COMBINATIONS

During fiscal year 2010, we acquired five entities for total consideration of $267 million, substantially all of which was

paid in cash. During this period, we also sold three entities for total consideration of $600 million, including Razorfish

in the second quarter of fiscal year 2010. These entities have been included in or removed from our consolidated

results of operations since their acquisition or sale dates, respectively. Pro forma results of operations have not been

presented because the effects of these business combinations, individually and in the aggregate, were not material

to our consolidated results of operations.