Microsoft 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

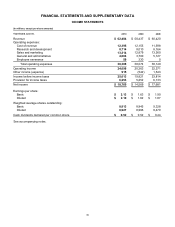

45

In June 2010, we issued $1.25 billion of zero-coupon debt securities that are convertible into shares of our common

stock if certain conditions are met. Shares of common stock into which the debt could convert were excluded from

the calculation of diluted earnings per share because their inclusion would have been anti-dilutive. See also

Note 12 – Debt.

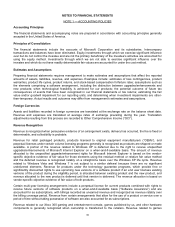

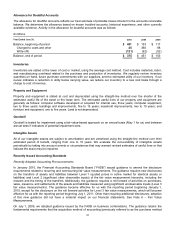

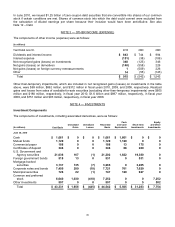

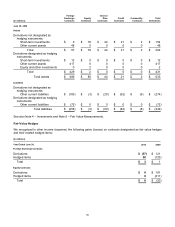

NOTE 3 — OTHER INCOME (EXPENSE)

The components of other income (expense) were as follows:

(In millions)

Y

ear Ended June 30, 2010

2009 2008

Dividends and interest income $ 843

$ 744 $ 994

Interest expense (151 )

(38) (106)

Net recognized gains (losses) on investments 348

(125) 346

Net gains (losses) on derivatives (140 )

(558) 226

Net gains (losses) on foreign currency remeasurements 1

(509) 226

Other 14

(56) (143)

Total $915

$ (542) $ 1,543

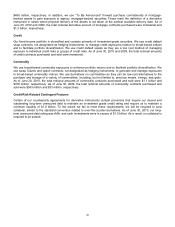

Other-than-temporary impairments, which are included in net recognized gains (losses) on investments in the table

above, were $69 million, $862 million, and $312 million in fiscal years 2010, 2009, and 2008, respectively. Realized

gains and losses from sales of available-for-sale securities (excluding other-than-temporary impairments) were $605

million and $188 million, respectively, in fiscal year 2010, $1.6 billion and $897 million, respectively, in fiscal year

2009, and $751 million and $93 million, respectively, in fiscal year 2008.

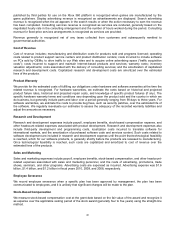

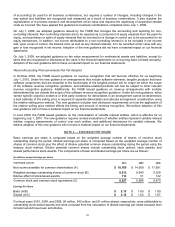

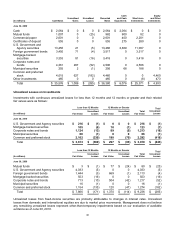

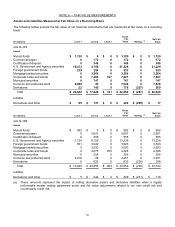

NOTE 4 — INVESTMENTS

Investment Components

The components of investments, including associated derivatives, were as follows:

(In millions) Cost Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Cash

and Cash

Equivalents

Short-term

Investments

Equity

and Other

Investments

June 30, 2010

Cash $ 1,661

$ 0 $ 0 $ 1,661 $ 1,661

$ 0 $ 0

Mutual funds 1,120

0 0 1,120 1,120

0 0

Commercial paper 188

0 0 188 13

175 0

Certificates of deposit 348

0 0 348 68

280 0

U.S. Government and

Agency securities 21,036

167 (1) 21,202 1,822

19,380 0

Foreign government bonds 518

13 0 531 0

531 0

Mortgage-backed

securities 3,137

135 (7) 3,265 0

3,265 0

Corporate notes and bonds

7,450

289 (18) 7,721 701

7,020 0

Municipal securities 726

22 (1) 747 120

627 0

Common and preferred

stock 6,640

1,030 (418) 7,252 0

0 7,252

Other investments 507

0 0 507 0

5 502

Total $ 43,331

$ 1,656 $ (445) $ 44,542 $ 5,505

$ 31,283 $ 7,754