Microsoft 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

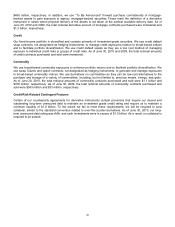

$456 million, respectively. In addition, we use “To Be Announced” forward purchase commitments of mortgage-

backed assets to gain exposure to agency mortgage-backed securities. These meet the definition of a derivative

instrument in cases where physical delivery of the assets is not taken at the earliest available delivery date. As of

June 30, 2010 and 2009, the total notional derivative amount of mortgage contracts purchased were immaterial and

$1.3 billion, respectively.

Credit

Our fixed-income portfolio is diversified and consists primarily of investment-grade securities. We use credit default

swap contracts, not designated as hedging instruments, to manage credit exposures relative to broad-based indices

and to facilitate portfolio diversification. We use credit default swaps as they are a low cost method of managing

exposure to individual credit risks or groups of credit risks. As of June 30, 2010 and 2009, the total notional amounts

of credit contracts purchased and sold were immaterial.

Commodity

We use broad-based commodity exposures to enhance portfolio returns and to facilitate portfolio diversification. We

use swap, futures and option contracts, not designated as hedging instruments, to generate and manage exposures

to broad-based commodity indices. We use derivatives on commodities as they can be low-cost alternatives to the

purchase and storage of a variety of commodities, including, but not limited to, precious metals, energy, and grain.

As of June 30, 2010, the total notional amounts of commodity contracts purchased and sold were $1.1 billion and

$376 million, respectively. As of June 30, 2009, the total notional amounts of commodity contracts purchased and

sold were $543 million and $33 million, respectively.

Credit-Risk-Related Contingent Features

Certain of our counterparty agreements for derivative instruments contain provisions that require our issued and

outstanding long-term unsecured debt to maintain an investment grade credit rating and require us to maintain a

minimum liquidity of $1.0 billion. To the extent we fail to meet these requirements, we will be required to post

collateral, similar to the standard convention related to over-the-counter derivatives. As of June 30, 2010, our long-

term unsecured debt rating was AAA, and cash investments were in excess of $1.0 billion. As a result, no collateral is

required to be posted.