Microsoft 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

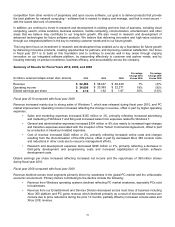

17

The above declines were partially offset by increased server and server application revenue, reflecting recognition of

deferred revenue from previously signed agreements and continued adoption of the Windows Server Platform and

applications through SQL Server, Enterprise CAL Suites, and System Center products. Foreign currency exchange

rates had a favorable impact of $486 million on revenue.

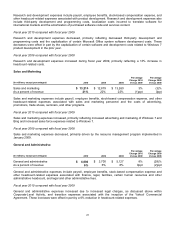

Operating income decreased primarily reflecting decreased revenue. Operating expenses were flat with decreased

general and administrative and sales and marketing expenses offset by increased headcount-related expenses, cost

of revenue, and employee severance charges.

• General and administrative expenses decreased $1.4 billion or 28%, primarily due to decreased costs for

legal settlements and contingencies. We incurred $283 million of legal charges during the twelve months

ended June 30, 2009 as compared to $1.8 billion during the twelve months ended June 30, 2008. The

prior year costs were primarily related to the European Commission fine of $1.4 billion (€899 million).

• Sales and marketing expenses decreased $381 million or 3%, primarily driven by the resource

management program. As part of that program, we reduced marketing and advertising expenses.

• Headcount-related expenses, excluding $330 million of employee severance charges, increased 7%,

driven by a 2% increase in headcount during the past 12 months and an increase in salaries and benefits

for existing headcount.

• Cost of revenue increased $557 million or 5%, primarily reflecting increased online costs, including online

traffic acquisition, data center and equipment, and headcount-related costs, partially offset by decreased

Xbox 360 platform costs.

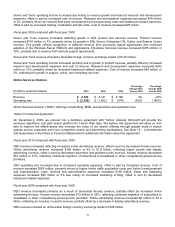

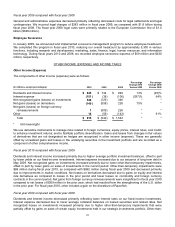

In January 2009, we announced and implemented a resource management program to reduce discretionary

operating expenses, employee headcount, and capital expenditures. As part of this program, we announced the

elimination of up to 5,000 positions in research and development, marketing, sales, finance, legal, human resources,

and information technology by June 30, 2010. During fiscal year 2009, we recorded employee severance charges of

$330 million for the expected reduction in employee headcount.

Diluted earnings per share declined primarily reflecting decreased net income, partially offset by share repurchases

during the prior 12 months. We repurchased 318 million shares during fiscal year 2009.

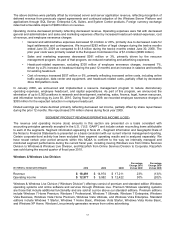

SEGMENT PRODUCT REVENUE/OPERATING INCOME (LOSS)

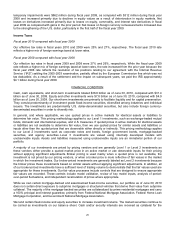

The revenue and operating income (loss) amounts in this section are presented on a basis consistent with

accounting principles generally accepted in the U.S. (“U.S. GAAP”) and include certain reconciling items attributable

to each of the segments. Segment information appearing in Note 22 – Segment Information and Geographic Data of

the Notes to Financial Statements is presented on a basis consistent with our current internal management reporting.

Certain corporate-level activity has been excluded from segment operating results and is analyzed separately. We

have recast certain prior period amounts within this MD&A to conform to the way we internally managed and

monitored segment performance during the current fiscal year, including moving Windows Live from Online Services

Division to Windows & Windows Live Division, and Razorfish from Online Services Division to Corporate. Razorfish

was sold during the second quarter of fiscal year 2010.

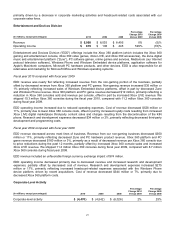

Windows & Windows Live Division

(In millions, except percentages) 2010 2009 2008

Percentage

Change 2010

Versus 2009

Percentage

Change 2009

Versus 2008

Revenue $ 18,491 $ 14,974 $ 17,211

23% (13)%

Operating income $12,977 $ 9,982 $ 12,422 30% (20)%

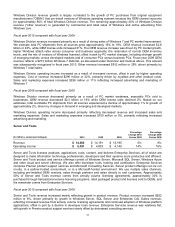

Windows & Windows Live Division (“Windows Division”) offerings consist of premium and standard edition Windows

operating systems and online software and services through Windows Live. Premium Windows operating systems

are those that include additional functionality and are sold at a price above our standard editions. Premium editions

include Windows 7 Home Premium, Windows 7 Professional, Windows 7 Ultimate, Windows 7 Enterprise, Windows

Vista Business, Windows Vista Home Premium, Windows Vista Ultimate, and Windows Vista Enterprise. Standard

editions include Windows 7 Starter, Windows 7 Home Basic, Windows Vista Starter, Windows Vista Home Basic,

and Windows XP Home. Windows Live primarily generates revenue from online advertising.