Microsoft 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

Employee Stock Purchase Plan

Shares of our common stock may be purchased by employees at three-month intervals at 90% of the fair market

value of the stock on the last day of each three-month period. Compensation expense for the employee stock

purchase plan is measured as the discount the employee is entitled to upon purchase and is recognized in the period

of purchase.

Income Taxes

Income tax expense includes U.S. and international income taxes, the provision for U.S. taxes on undistributed

earnings of international subsidiaries not deemed to be permanently invested and interest and penalties on uncertain

tax positions. Certain income and expenses are not reported in tax returns and financial statements in the same year.

The tax effect of such temporary differences is reported as deferred income taxes.

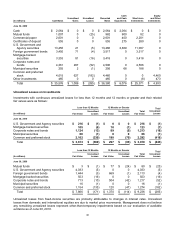

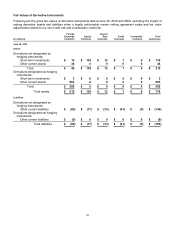

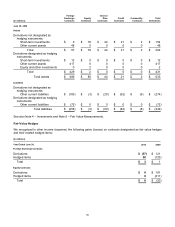

Fair Value Measurements

We account for certain assets and liabilities at fair value. The hierarchy below lists three levels of fair value based on

the extent to which inputs used in measuring fair value are observable in the market. We categorize each of our fair

value measurements in one of these three levels based on the lowest level input that is significant to the fair value

measurement in its entirety. These levels are:

• Level 1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active

markets. Our Level 1 non-derivative investments primarily include U.S. treasuries, domestic and

international equities, and actively traded mutual funds. Our Level 1 derivative assets and liabilities

include those actively traded on exchanges.

• Level 2 – inputs are based upon quoted prices for similar instruments in active markets, quoted prices for

identical or similar instruments in markets that are not active, and model-based valuation techniques (e.g.

the Black-Scholes model) for which all significant inputs are observable in the market or can be

corroborated by observable market data for substantially the full term of the assets or liabilities. Where

applicable, these models project future cash flows and discount the future amounts to a present value

using market-based observable inputs including interest rate curves, foreign exchange rates, and forward

and spot prices for currencies and commodities. Our Level 2 non-derivative investments consist primarily

of corporate notes and bonds, mortgage-backed securities, agency securities, certificates of deposit, and

commercial paper. Our Level 2 derivative assets and liabilities primarily include certain over-the-counter

option and swap contracts.

• Level 3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions

that market participants would use in pricing the asset or liability. The fair values are therefore determined

using model-based techniques, including option pricing models and discounted cash flow models. Our

Level 3 non-derivative assets primarily comprise investments in certain corporate bonds. We value these

corporate bonds using internally developed valuation models, inputs to which include interest rate curves,

credit spreads, stock prices, and volatilities. Unobservable inputs used in these models are significant to

the fair values of the investments. Our Level 3 derivative assets and liabilities primarily comprise

derivatives for foreign equities. In certain cases, market-based observable inputs are not available and we

use management judgment to develop assumptions to determine fair value for these derivatives.

We measure certain assets, including our cost and equity method investments, at fair value on a nonrecurring basis

when they are deemed to be other-than-temporarily impaired. The fair values of these investments are determined

based on valuation techniques using the best information available, and may include quoted market prices, market

comparables, and discounted cash flow projections.

Our current financial liabilities, including our short-term debt, have fair values that approximate their carrying values.

Our long-term financial liabilities consist of long-term debt which is recorded on the balance sheet at issuance price

less unamortized discount.

Financial Instruments

We consider all highly liquid interest-earning investments with a maturity of three months or less at the date of

purchase to be cash equivalents. The fair values of these investments approximate their carrying values. In general,

investments with original maturities of greater than three months and remaining maturities of less than one year are

classified as short-term investments. Investments with maturities beyond one year may be classified as short-term