Microsoft 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

(d) These amounts represent purchase commitments, including all open purchase orders and all contracts that are

take-or-pay contracts that are not presented as construction commitments above.

(e) We have excluded long-term tax contingencies and other tax liabilities of $7.1 billion and other long-term

contingent liabilities of $236 million (related to the antitrust and unfair competition class action lawsuits) from

the amounts presented, as the amounts that will be settled in cash are not known and the timing of any

payments is uncertain. We have also excluded unearned revenue of $1.2 billion and non-cash items of $240

million.

Other Planned Uses of Capital

We will continue to invest in sales, marketing, product support infrastructure, and existing and advanced areas of

technology. Additions to property and equipment will continue, including new facilities, data centers, and computer

systems for research and development, sales and marketing, support, and administrative staff. We have operating

leases for most U.S. and international sales and support offices and certain equipment. We have not engaged in any

related party transactions or arrangements with unconsolidated entities or other persons that are reasonably likely to

materially affect liquidity or the availability of capital resources.

We believe existing cash, cash equivalents and short-term investments, together with funds generated from

operations, should be sufficient to meet operating requirements, regular quarterly dividends, debt repayment

schedules, and share repurchases. Our philosophy regarding the maintenance of a balance sheet with a large

component of cash and cash equivalents, short-term investments, and equity and other investments, reflects our

views on potential future capital requirements relating to research and development, creation and expansion of sales

distribution channels, investments and acquisitions, share dilution management, legal risks, and challenges to our

business model. We regularly assess our investment management approach in view of our current and potential

future needs.

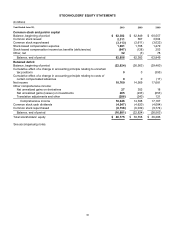

As a result of the special dividend paid in the second quarter of fiscal year 2005 and shares repurchased, our

retained deficit, including accumulated other comprehensive income, was $16.7 billion at June 30, 2010. Our

retained deficit is not expected to affect our future ability to operate, pay dividends, or repay our debt given our

continuing profitability and strong cash and financial position.

RECENT LEGISLATION

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act

of 2010 were signed into law in the United States. This legislation expands health care coverage to many uninsured

individuals and expands coverage to those already insured. The changes required by this legislation will largely be

funded through tax increases to both insurers and the insured. We do not expect any near term impact on our

financial results as a result of the legislation. One provision that will impact certain companies significantly is the

elimination of the tax deductibility of the Medicare Part D subsidy. This provision does not affect us because we do

not provide retiree health benefits.

RECENTLY ISSUED ACCOUNTING STANDARDS

Recently Adopted Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board (“FASB”) issued guidance to amend the disclosure

requirements related to recurring and nonrecurring fair value measurements. The guidance requires new disclosures

on the transfers of assets and liabilities between Level 1 (quoted prices in active market for identical assets or

liabilities) and Level 2 (significant other observable inputs) of the fair value measurement hierarchy, including the

reasons and the timing of the transfers. Additionally, the guidance requires a roll forward of activities on purchases,

sales, issuance, and settlements of the assets and liabilities measured using significant unobservable inputs (Level 3

fair value measurements). The guidance became effective for us with the reporting period beginning January 1,

2010, except for the disclosure on the roll forward activities for Level 3 fair value measurements, which will become

effective for us with the reporting period beginning July 1, 2011. Other than requiring additional disclosures, adoption

of this new guidance did not have a material impact on our financial statements.

On July 1, 2009, we adopted guidance issued by the FASB on business combinations. The guidance retains the

fundamental requirements that the acquisition method of accounting (previously referred to as the purchase method

of accounting) be used for all business combinations, but requires a number of changes, including changes in the

way assets and liabilities are recognized and measured as a result of business combinations. It also requires the