Microsoft 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

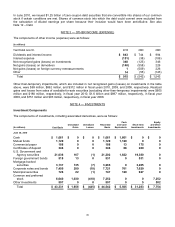

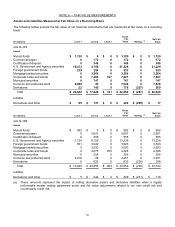

based on their highly liquid nature and because such marketable securities represent the investment of cash that is

available for current operations. All cash equivalents and short-term investments are classified as available-for-sale

and realized gains and losses are recorded using the specific identification method. Changes in market value,

excluding other-than-temporary impairments, are reflected in OCI.

Equity and other investments classified as long-term include both debt and equity instruments. Debt and publicly-

traded equity securities are classified as available-for-sale and realized gains and losses are recorded using the

specific identification method. Changes in market value, excluding other-than-temporary impairments, are reflected in

OCI. Common and preferred stock and other investments that are restricted for more than one year or are not

publicly traded are recorded at cost or using the equity method.

We lend certain fixed-income and equity securities to increase investment returns. The loaned securities continue to

be carried as investments on our balance sheet. Cash and/or security interests are received as collateral for the loan

securities with the amount determined based upon the underlying security lent and the creditworthiness of the

borrower. Cash received is recorded as an asset with a corresponding liability.

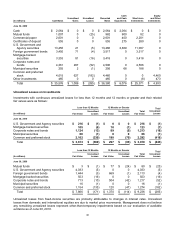

Investments are considered to be impaired when a decline in fair value is judged to be other-than-temporary. Fair

value is calculated based on publicly available market information or other estimates determined by management.

We employ a systematic methodology on a quarterly basis that considers available quantitative and qualitative

evidence in evaluating potential impairment of our investments. If the cost of an investment exceeds its fair value, we

evaluate, among other factors, general market conditions, credit quality of debt instrument issuers, the duration and

extent to which the fair value is less than cost, and for equity securities, our intent and ability to hold, or plans to sell,

the investment. For fixed income securities, we also evaluate whether we have plans to sell the security or it is more

likely than not that we will be required to sell the security before recovery. We also consider specific adverse

conditions related to the financial health of and business outlook for the investee, including industry and sector

performance, changes in technology, and operational and financing cash flow factors. Once a decline in fair value is

determined to be other-than-temporary, an impairment charge is recorded to other income (expense) and a new cost

basis in the investment is established.

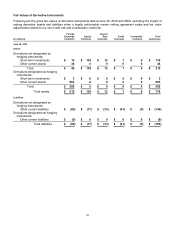

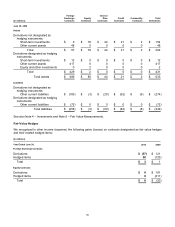

Derivative instruments are recognized as either assets or liabilities and are measured at fair value. The accounting

for changes in the fair value of a derivative depends on the intended use of the derivative and the resulting

designation.

For a derivative instrument designated as a fair-value hedge, the gain (loss) is recognized in earnings in the period of

change together with the offsetting loss or gain on the hedged item attributed to the risk being hedged. For options

designated as fair-value hedges, changes in the time value are excluded from the assessment of hedge

effectiveness and are recognized in earnings.

For derivative instruments designated as cash-flow hedges, the effective portion of the derivative’s gain (loss) is

initially reported as a component of OCI and is subsequently recognized in earnings when the hedged exposure is

recognized in earnings. For options designated as cash-flow hedges, changes in the time value are excluded from

the assessment of hedge effectiveness and are recognized in earnings. Gains (losses) on derivatives representing

either hedge components excluded from the assessment of effectiveness or hedge ineffectiveness are recognized in

earnings.

For derivative instruments that are not designated as hedges, gains (losses) from changes in fair values are primarily

recognized in other income (expense). Other than those derivatives entered into for investment purposes, such as

commodity contracts, the gains (losses) are generally economically offset by unrealized gains (losses) in the

underlying available-for-sale securities, which are recorded as a component of OCI until the securities are sold or

other-than-temporarily impaired, at which time the amounts are moved from OCI into other income (expense).