Microsoft 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

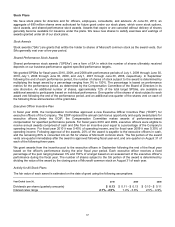

During fiscal year 2010, the following activity occurred under our existing plans:

Shares

Weighted

Average

Grant-Date

Fair Value

(In millions)

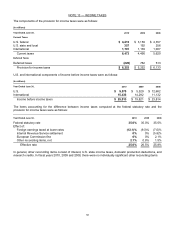

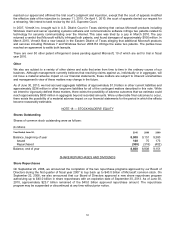

Stock Awards

Nonvested balance, beginning of year 191 $ 25.69

Granted 100 $ 23.43

Vested (52) $ 25.50

Forfeited (16) $ 25.19

Nonvested balance, end of year 223 $ 24.76

Shared Performance Stock Awards

Nonvested balance, beginning of year 28 $ 26.79

Granted 12 $ 24.57

Vested (7) $ 26.65

Forfeited (3) $ 25.74

Nonvested balance, end of year 30 $ 25.32

As of June 30, 2010, there was $4.2 billion and $482 million of total unrecognized compensation costs related to SAs

and SPSAs, respectively. These costs are expected to be recognized over a weighted average period of 3.4 years

and 2.4 years, respectively.

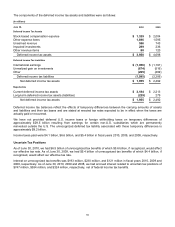

During fiscal year 2009 and 2008, the following activity occurred under our stock plans:

(In millions, except fair values) 2009 2008

Stock Awards

Awards granted 91 71

Weighted average grant-date fair value $ 24.95 $ 27.83

Shared Performance Stock Awards

Awards granted 10 19

Weighted average grant-date fair value $ 25.93 $ 27.82

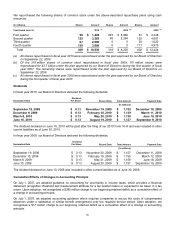

Stock Options

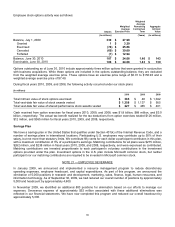

In fiscal year 2004, we began granting employees and non-employee directors SAs rather than non-qualified and

incentive stock options as part of our equity compensation plans. Since then, stock options issued to employees

have been issued primarily in conjunction with business acquisitions. Options granted between 1995 and 2001

generally vest over four and one-half years and expire seven years from the date of grant, while certain options vest

either over four and one-half years or over seven and one-half years and expire 10 years from the date of grant.

Options granted after 2001 vest over four and one-half years and expire 10 years from the date of grant. We granted

one million, one million, and 10 million stock options in conjunction with business acquisitions during fiscal years

2010, 2009, and 2008, respectively.