Microsoft 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

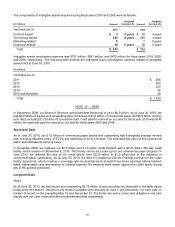

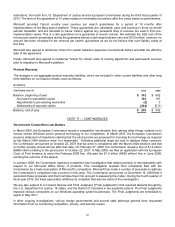

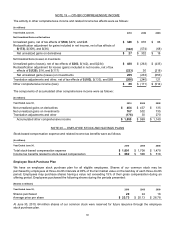

NOTE 19 — OTHER COMPREHENSIVE INCOME

The activity in other comprehensive income and related income tax effects were as follows:

(In millions)

Y

ear Ended June 30, 2010

2009 2008

Net Unrealized Gains on Derivatives

Unrealized gains, net of tax effects of $188, $472, and $46 $ 349

$ 876 $ 86

Reclassification adjustment for gains included in net income, net of tax effects of

$(173), $(309), and $(36) (322 )

(574) (68)

Net unrealized gains on derivatives $ 27

$ 302 $18

Net Unrealized Gains (Losses) on Investments

Unrealized gains (losses), net of tax effects of $263, $(142), and $(234) $ 488

$ (263) $ (435)

Reclassification adjustment for losses (gains) included in net income, net of tax

effects of $(120), $16, and $(117) (223 )

30 (218)

Net unrealized gains (losses) on investments 265

(233) (653)

Translation adjustments and other, net of tax effects of $(103), $(133), and $69 (206 )

(240) 121

Other comprehensive income (loss) $ 86

$ (171) $ (514)

The components of accumulated other comprehensive income were as follows:

(In millions)

Y

ear Ended June 30, 2010

2009 2008

Net unrealized gains on derivatives $464

$ 437 $ 135

Net unrealized gains on investments 767

502 735

Translation adjustments and other (176 )

30 270

Accumulated other comprehensive income $ 1,055

$ 969 $ 1,140

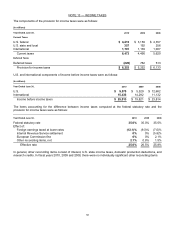

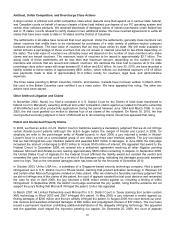

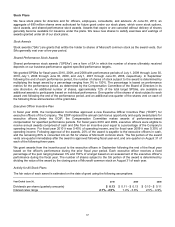

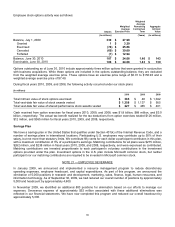

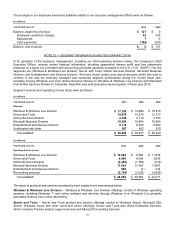

NOTE 20 — EMPLOYEE STOCK AND SAVINGS PLANS

Stock-based compensation expense and related income tax benefits were as follows:

(In millions)

Y

ear Ended June 30, 2010

2009 2008

Total stock-based compensation expense $ 1,891

$ 1,708 $ 1,479

Income tax benefits related to stock-based compensation $662

$ 598 $ 518

Employee Stock Purchase Plan

We have an employee stock purchase plan for all eligible employees. Shares of our common stock may be

purchased by employees at three-month intervals at 90% of the fair market value on the last day of each three-month

period. Employees may purchase shares having a value not exceeding 15% of their gross compensation during an

offering period. Employees purchased the following shares during the periods presented:

(Shares in millions)

Y

ear Ended June 30, 2010

2009 2008

Shares purchased 20

24 18

Average price per share $ 23.73

$ 20.13 $ 26.78

At June 30, 2010, 64 million shares of our common stock were reserved for future issuance through the employee

stock purchase plan.