Microsoft 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

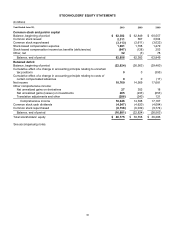

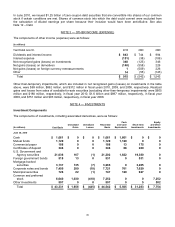

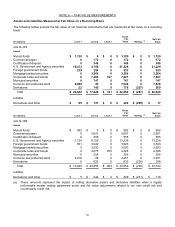

46

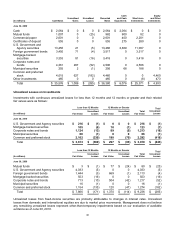

(In millions) Cost Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Cash

and Cash

Equivalents

Short-term

Investments

Equity

and Other

Investments

June 30, 2009

Cash $ 2,064 $ 0 $0 $ 2,064 $ 2,064 $ 0 $0

Mutual funds 1,007

0 (25) 982 900

82 0

Commercial paper 2,601

0 0 2,601 400

2,201 0

Certificates of deposit 555

0 0 555 275

280 0

U.S. Government and

Agency securities 13,450

21 (5) 13,466 2,369

11,097 0

Foreign government bonds 3,450

71 (4) 3,517 0

3,517 0

Mortgage-backed

securities 3,353

81 (16) 3,418 0

3,418 0

Corporate notes and

bonds 4,361

287 (52) 4,596 0

4,596 0

Municipal securities 255

2 (1) 256 68

188 0

Common and preferred

stock 4,015

627 (182) 4,460 0

0 4,460

Other investments 465

0 0 465 0

(8) 473

Total $ 35,576

$ 1,089 $ (285) $ 36,380 $ 6,076

$ 25,371 $ 4,933

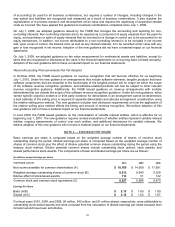

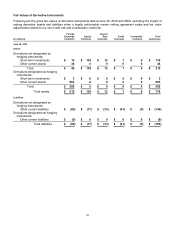

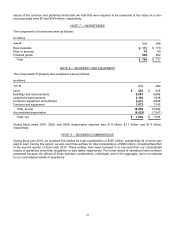

Unrealized Losses on Investments

Investments with continuous unrealized losses for less than 12 months and 12 months or greater and their related

fair values were as follows:

Less than 12 Months 12 Months or Greater

Total

Unrealized

Losses

(In millions) Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

Total

Fair Value

June 30, 2010

U.S. Government and Agency securities $216 $ (1) $ 0 $ 0

$ 216 $ (1)

Mortgage-backed securities 105 (6) 18 (1 )

123 (7)

Corporate notes and bonds 1,124 (13) 89 (5 )

1,213 (18)

Municipal securities 66 (1) 0 0

66 (1)

Common and preferred stock 2,102 (339) 190 (79 )

2,292 (418)

Total $ 3,613 $ (360) $ 297 $ (85 )

$ 3,910 $ (445)

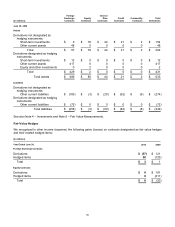

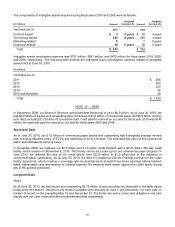

Less than 12 Months 12 Months or Greater

Total

Unrealized

Losses

(In millions) Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

Total

Fair Value

June 30, 2009

Mutual funds $3 $(1)$77 $(24 ) $ 80 $(25)

U.S. Government and Agency securities 4,033 (5) 0 0

4,033 (5)

Foreign government bonds 1,444 (3) 669 (1 )

2,113 (4)

Mortgage-backed securities 503 (16) 0 0

503 (16)

Corporate notes and bonds 713 (10) 504 (42 )

1,217 (52)

Municipal securities 16 (1) 0 0

16 (1)

Common and preferred stock 1,154 (135) 120 (47 )

1,274 (182)

Total $ 7,866 $ (171) $ 1,370 $ (114 )

$ 9,236 $ (285)

Unrealized losses from fixed-income securities are primarily attributable to changes in interest rates. Unrealized

losses from domestic and international equities are due to market price movements. Management does not believe

any remaining unrealized losses represent other-than-temporary impairments based on our evaluation of available

evidence as of June 30, 2010.