Konica Minolta 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

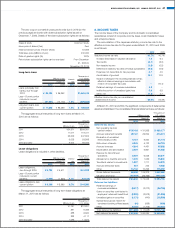

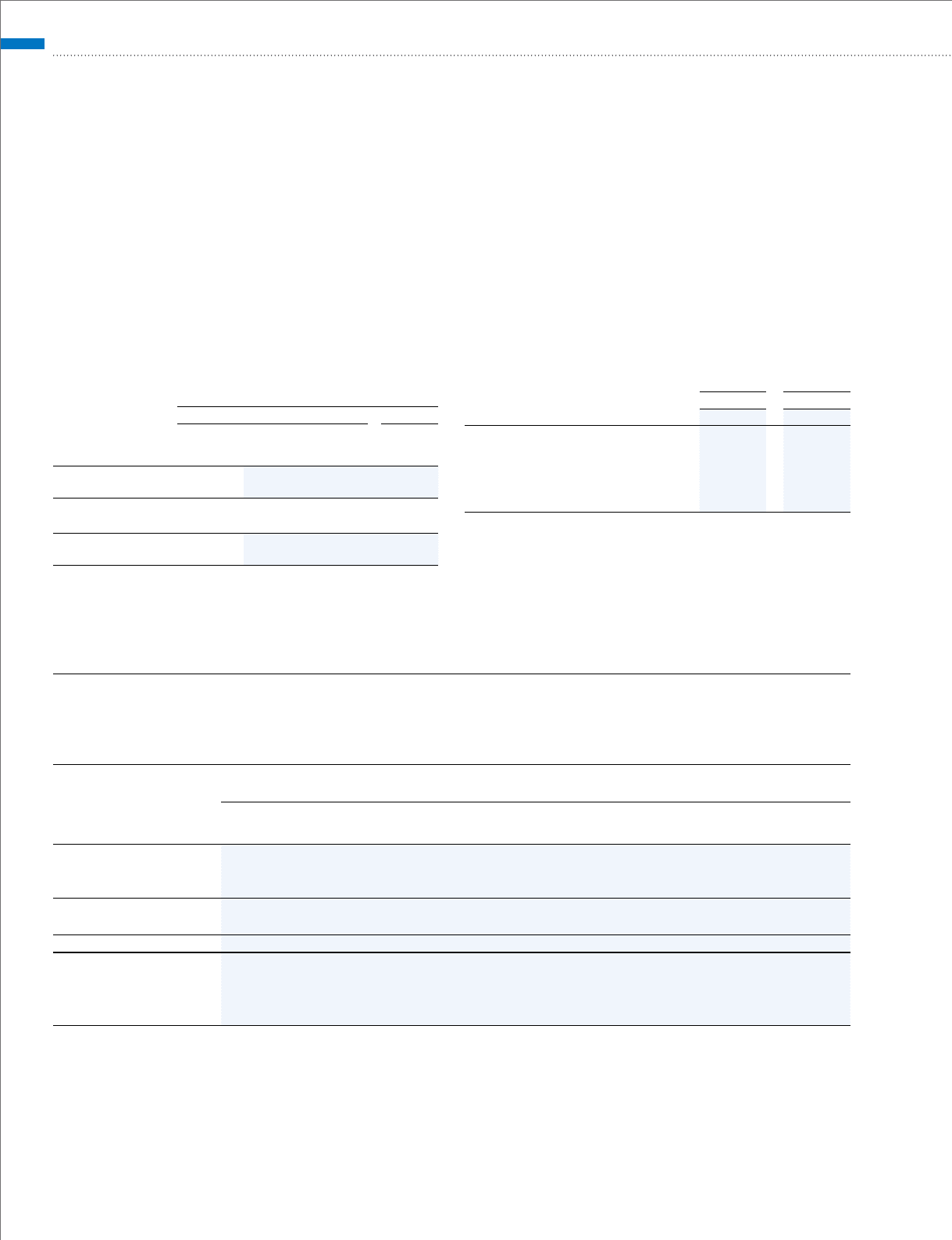

25. INVESTMENT AND RENTAL PROPERTY

Additional Information

Effective from the year ended March 31, 2010, the Companies adopted

ASBJ Statement No. 20, “Accounting Standards for Disclosures about

Fair Value of Investment and Rental Property”, issued by the ASBJ on

November 28, 2008 and ASBJ Guidance No. 23, “Guidance on

Accounting Standards for Disclosures about Fair Value of Investment

and Rental Property”, issued by the ASBJ on November 28, 2008.

Conditions and Fair Value of Investment and Rental Property

The Companies have office buildings for rent and idle assets, etc., in

Japan and overseas.

The book value on the consolidated balance sheet, the changes and

the fair value as of March 31, 2010 are as follows:

Millions of yen

Book Value Fair Value

as of March

31, 2009

Increase

(Decrease)

—net

as of March

31, 2010

as of March

31, 2010

Investment and

rental property ¥3,973 ¥ (117) ¥3,855 ¥4,800

Thousands of U.S. dollars

Investment and

rental property $42,702 $(1,258) $41,434 $51,591

Notes:1. Book value is calculated by subtracting accumulated depreciation and

accumulated impairment losses from acquisition cost.

2. Fair value as of March 31, 2010 is recorded as follows:

(1) Fair value of a majority of domestic properties has been calculated by the

Companies in accordance with the method similar to the Real-estate

Appraisal Standards. When there is no significant change in fair value, the

properties are valued using the most recent appraisal report.

Fair value of other properties has been calculated based on a certain

appraisal or criteria which appear to best reflect the fair value of the property.

(2) Fair value of overseas properties has been primarily calculated by local

real-estate appraisers.

Income and Expenses of Investment and Rental Property

The income and expenses as of March 31, 2010 are as follows.

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2010

Income of investment and rental property ¥208 $2,236

Expenses of investment and rental property 257 2,762

Difference (48) (516)

Other income (expenses) of investment

and rental property – –

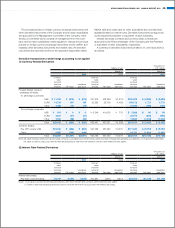

26. SEGMENT INFORMATION

(1) Business Segment Information

Business segment information of the Companies for the years ended March 31, 2010 and 2009 is presented as follows:

Business segment Related business segment products

Business Technologies: MFPs, printers and others

Optics: Optical devices, electronics materials and others

Medical and Graphic Imaging: Medical products, graphic imaging products and others

Sensing: Industrial-use and medical-use measuring instruments and others

Other: Other products not categorized in the above segments

Millions of yen

2010:

Business

Technologies Optics

Medical and

Graphic

Imaging Sensing Other Total

Eliminations

and Corporate Consolidated

Net sales

External ¥540,809 ¥136,745 ¥104,350 ¥6,921 ¥15,639 ¥804,465 ¥ – ¥804,465

Intersegment 3,681 924 1,569 970 46,493 53,640 (53,640) –

Total 544,490 137,670 105,920 7,892 62,132 858,105 (53,640) 804,465

Operating expenses 505,526 123,279 104,450 7,899 58,350 799,507 (39,030) 760,477

Operating income (loss) ¥ 38,963 ¥ 14,390 ¥ 1,469 ¥ (6) ¥ 3,781 ¥ 58,598 ¥ (14,610) ¥ 43,988

Assets ¥402,012 ¥139,051 ¥ 76,668 ¥7,474 ¥55,679 ¥680,886 ¥184,910 ¥865,797

Depreciation 30,973 18,799 4,214 281 2,185 56,453 4,720 61,174

Impairment losses 168 1,050 1,338 – 3 2,561 – 2,561

Capital expenditure 18,190 13,599 1,782 165 1,485 35,223 1,710 36,933

Notes: 1. Operating expenses that are included in Eliminations and Corporate that can not be properly allocated are primarily R&D expenses incurred by the Company and expenses

associated with head office functions. Such expenses amounted to ¥29,396 million for the year ended March 31, 2010.

2. Included within the Eliminations and Corporate figure of assets are ¥232,694 million of corporate assets, which primarily include the holding company’s surplus of operating

funds (cash and short-term investment securities) and long-term investment funds (investment securities) as well as other assets held by the holding company.

48 KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010