Konica Minolta 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP OVERVIEW

The Konica Minolta Group (the Group) consists of the Company,

Konica Minolta Holdings, Inc., 96 consolidated subsidiaries, 18

non-consolidated subsidiaries, and 7 affiliated companies. The

Group’s core business operations are Business Technologies,

Optics, Medical and Graphic Imaging, and Sensing, all of which the

Group operates on a global basis.

BUSINESS ENVIRONMENT

The domestic and global economic environment during the fiscal

year ended March 31, 2010 (FY March 2010) saw weakness in the

global economy grow more pronounced as fallout from the credit

crunch triggered by the financial crisis that struck in the fall of 2008

adversely impacted the real economy. This development, in turn,

spurred a troubling cycle of lackluster consumer spending, produc-

tion cutbacks, and worsening employment prospects. A reprieve

from this relentless picture would eventually come from successful

policies and economic stimulus measures employed by treasuries

and governments worldwide in a bid to restore financial stability.

But although signs of an economic recovery gradually emerged

from the second half of the year, the recovery remained weak as

controlled capital investment in the corporate sector and limited

credit availability persisted. The yen, moreover, settled at a high

level of appreciation in the currency markets. This trend had a

severe impact on the Konica Minolta Group with a high percentage

of sales outside of Japan, and became one of the factors that put

substantial pressure on business earnings for the year.

MANAGEMENT POLICY <09-10>

The Group recognized that the radical changes in the aforemen-

tioned market environment represented more than a temporary

economic slowdown. Instead, these changes appear to be the turn-

ing point of a massive and global socioeconomic transformation.

Seizing the moment as an opportunity to enhance its value, the

Group sought to achieve more vigorous growth with the formulation

of MANAGEMENT POLICY <09-10>. The key policies comprising

this two-year management plan spanning FY March 2010 to FY

March 2011 are (1) Execute structural reforms, (2) Achieve strong

growth, and (3) Reform the corporate culture. During the fiscal year

under review, the initial year of the plan’s enactment, the Group

pursued bold reforms designed to achieve a robust corporate struc-

ture; one capable of generating free cash flow irrespective of the

outlook for sales growth in a harsh business climate.

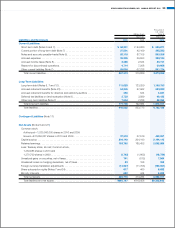

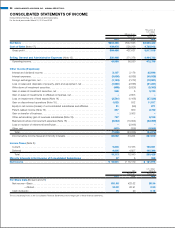

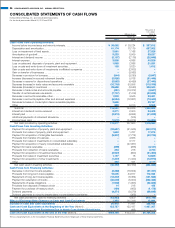

OPERATING RESULTS

NET SALES

In the fiscal year ended March 31, 2010, net sales decreased

¥143.3 billion, or 15.1% year on year, to ¥804.4 billion. Sales for

the Group’s mainstay products, multi-functional peripherals (MFPs)

for the office, were weaker compared to the previous fiscal year,

and sales were also adversely impacted when converted to yen by

the currency’s appreciation. These and other negative factors were

partially offset by firm sales of TAC films (protective films for the

polarizing plates of LCD panels) and glass hard disk substrates,

tracking a recovery in market prices for LCD televisions and PCs.

OPERATING INCOME

Operating income declined ¥12.2 billion, or 21.8% year on year, to

¥43.9 billion. The operating income ratio was down 0.4 of a per-

centage point to 5.5%. This outcome stemmed mainly from

reduced profits accompanying lower sales and currency exchange

rate effects. These factors outweighed benefits seen in the Business

Technologies business from efforts to streamline bases and person-

nel structures at overseas sales divisions, as well as moves in the

Optics business to optimize the domestic and overseas production

frameworks. Steps were also taken to reduce fixed costs, pare

down operating expenses, and trim R&D costs.

4

162.2

5

164.1

6

167.1

7

168.2

8

159.5

9

149.7

10

125.2

11

121.2

12

127.0

1

115.0

2

123.7

3

130.9

4

130.4

5

134.8

6

135.2

7

134.9

8

133.3

9

131.3

10

132.6

11

129.6

12

132.5

1

125.2

2

121.0

3

126.3

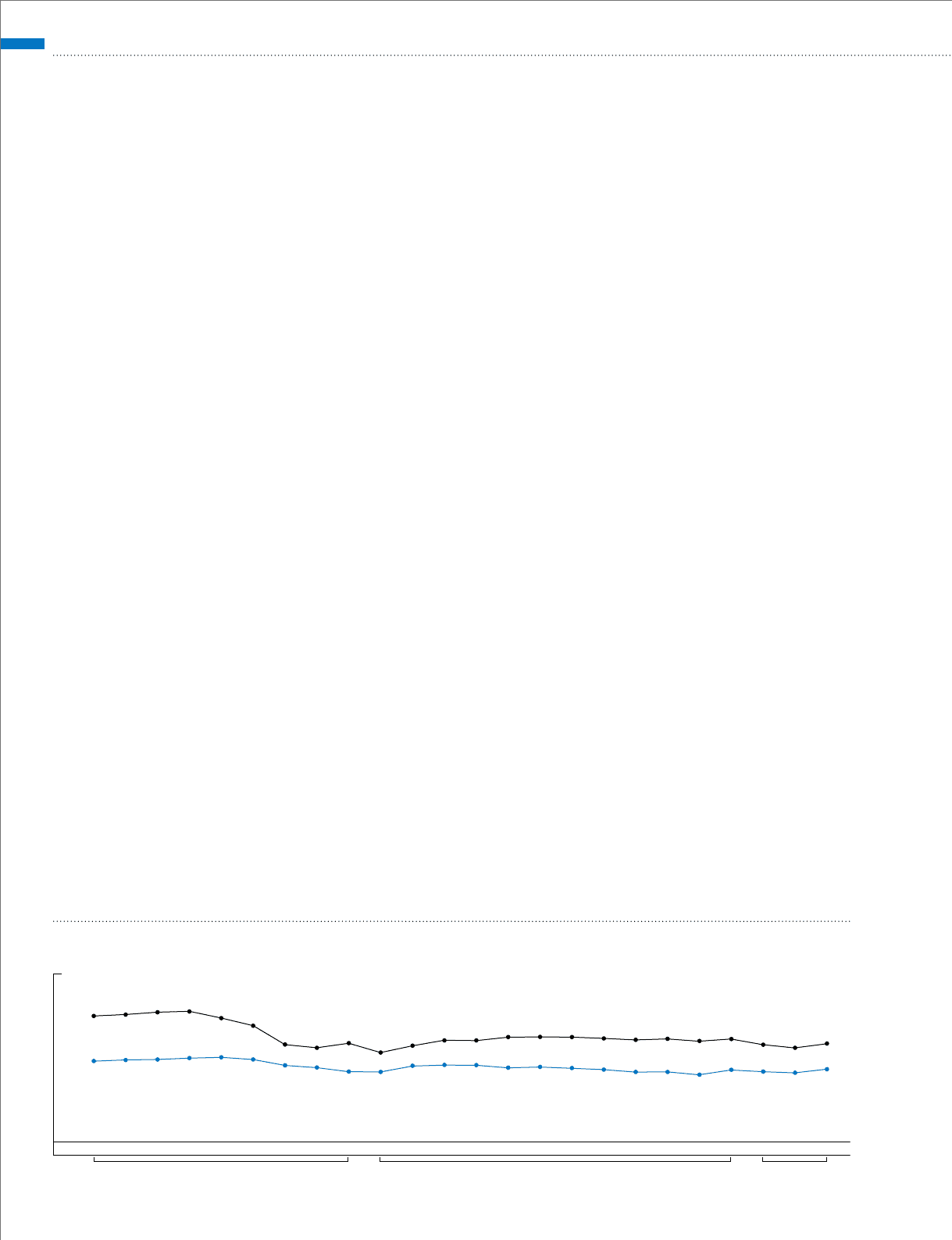

103.9 105.5 106.1 107.8 108.8 106.0 98.4 95.5 90.3 90.0 97.6 98.8 98.6 95.3 96.3 94.7 93.0 89.8 90.1 86.3 92.5 90.3 88.8 93.5

2008 2009 2010

YEN/USD AND YEN/EURO EXCHANGE RATES*

(Yen)

n

Yen/EURO

n

Yen/USD

* Exchange rates as of the end of each month.

FINANCIAL REVIEW

28 KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010