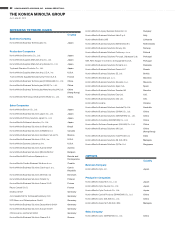

Konica Minolta 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

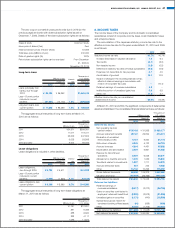

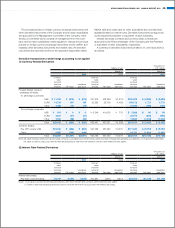

(2) Fixed assets have been written down to the recoverable amount

and the correlating impairment losses have been recognized due to

worsening market conditions for plates in the Medical and Graphic

business, restructuring of microlens manufacturing facilities in the

Optics business, etc. In addition, the decline in real estate value and

the poor performance and profitability of rental and idle assets have

contributed to the write down.

(3) Details of impairment of fixed assets

Amount

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Buildings and structures ¥1,040 ¥ – $11,178

Machinery and equipment 817 648 8,781

Land 407 –4,374

Others 296 520 3,181

(4) Measuring recoverable amount

The recoverable amount of a cash-generating unit is the fair value

less costs to sell. The fair value is supported by an appraisal report

for land and buildings and structures, or a management estimate for

rental business-use assets.

15. DISCONTINUED OPERATIONS

The amounts included in the statements of income for discontinued

operations for the years ended March 31, 2010 and 2009 represent:

Amount

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Reversal of excess reserve made

for discontinued operations

in the previous fiscal year ¥1,327 ¥1,412 $ 14,263

Loss on discontinued operations

in the fiscal year under review (301) (480) (3,235)

Gain on discontinued operations ¥1,025 ¥ 932 $ 11,017

16. PATENT-RELATED INCOME

Patent-related income consists of patent royalties related to the Photo

Imaging business.

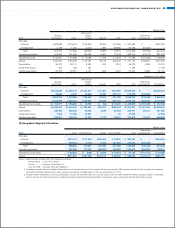

17. COST OF SALES

The Companies have recognized valuation losses associated with

the write down of inventory of ¥2,081 million ($22,357 thousand) and

¥6,302 million for the years ended March 31, 2010 and 2009, respec-

tively, due to decline of profitability. Those losses are included within the

cost of sales.

18. BUSINESS STRUCTURE IMPROVEMENT

EXPENSES

The business structure improvement expenses consist mainly of retire-

ment allowances, etc., associated with staff allocation/optimization in the

Business Technologies business, with expenses on business reorganiza-

tion in the Medical and Graphic Imaging business, and with expenses on

the reorganization of manufacturing facilities in the Optics business.

19. EXTRAORDINARY GAINS OF OVERSEAS

SUBSIDIARIES

Extraordinary gains of overseas subsidiaries represent the reduction

in refund obligation, etc., in accordance with U.S. state laws for the

U.S. subsidiary.

20. PENSION LIABILITIES ADJUSTMENT OF

OVERSEAS SUBSIDIARIES

The pension liabilities adjustment of overseas subsidiaries results from

the accounting treatment of retirement benefits that affect certain

consolidated subsidiaries in the United States.

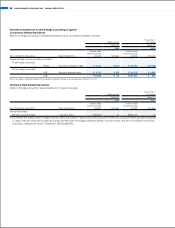

21. LEASE TRANSACTIONS

Proforma information on the Company and its domestic consolidated

subsidiaries’ finance lease transactions (except for those which are

deemed to transfer the ownership of the leased assets to the lessee)

and operating lease transactions is as follows:

As Lessee

1) Finance Leases (not involving transfer of ownership commencing

on or before March 31, 2008)

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Purchase cost:

Buildings and structures ¥ 7,418 ¥ 7,459 $ 79,729

Machinery and equipment 2,180 2,268 23,431

Tools and furniture 2,755 4,622 29,611

Rental business-use assets 408 1,227 4,385

Intangible fixed assets 53 63 570

12,816 15,641 137,747

Less: Accumulated depreciation (10,691) (11,853) (114,908)

Loss on impairment of

leased assets (11) (200) (118)

Net book value ¥ 2,113 ¥ 3,587 $ 22,711

The scheduled maturities of future lease rental payments on such

lease contracts at March 31, 2010 and 2009 are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Due within one year ¥ 801 ¥1,650 $ 8,609

Due over one year 1,323 2,136 14,220

Total ¥2,125 ¥3,787 $22,840

Lease rental expenses and depreciation equivalents under the

finance leases which are accounted for in the same manner as operat-

ing leases for the years ended March 31, 2010 and 2009 are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Lease rental expenses for the period ¥1,467 ¥2,393 $15,767

Depreciation equivalents 1,277 2,373 13,725

Depreciation equivalents are calculated based on the straight-line

method over the lease terms of the leased assets.

Accumulated loss on impairment of leased assets as of March 31,

2010 and 2009 are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Reserve for loss ¥11 ¥200 $118

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 43