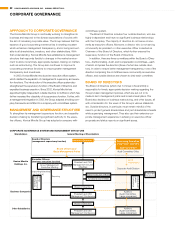

Konica Minolta 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OPTICS

OVERVIEW OF RESULTS FOR FY MARCH 2010

The global economy began moving toward a recovery, with

increased production in the digital appliance industry and others. In

this environment, the Optics business saw increased unit sales of

glass hard disk substrates and TAC films, lifting overall revenues for

the business. At the same time, unit sales of image input/output

components remained sluggish, and optical pickup lenses were

affected by a drop in unit prices due to a shift to using plastic

lenses for Blu-ray Discs. As a result, sales were down 21.1% com-

pared to the previous period, at ¥136.7 billion, but operating

income rose 14.8% to ¥14.3 billion, thanks in part to a recovery in

sales of key products and the effects of ongoing cost structure

improvement since the end of the previous fiscal year.

STATUS BY SEGMENT

DISPLAY MATERIALS

Orders for TAC films recovered due to rising demand for large-screen

LCD televisions, spurred by measures in various countries to stimu-

late demand for home appliances, and revenue improved in the first

half. Sales remained steady for VA-TAC film, and thin-film, both

products in which we have an established advantage.

MEMORY

Unit sales of optical pickup lenses for Blu-ray format fell below initial

projections as the high-volume IT-related market was slow to

recover, but unit sales for use in audio-visual applications continued

their steady recovery. Overall, unit sales of optical pickup lenses,

including those for use in CDs and DVDs, exceeded results for the

previous period.

In glass hard disk substrates, we focused on expanding sales

of products for high-density recording, including 250GB and

320GB disks. Recovery in demand, centered around notebook

computers and external memory devices, brought a significant

increase in unit sales beginning around the third quarter. To accom-

modate future growth in demand, we have begun construction of

additional production lines at our Malaysia plant, aiming to start

operation in October 2010.

IMAGE INPUT/OUTPUT COMPONENTS

As we worked to concentrate our product domains with a focus on

profitability, overall demand remained sluggish for the high-end

segments we specialize in due to the global economic downturn,

and unit sales remained weak.

STRATEGY GOING FORWARD

In the digital home appliance segment, key upcoming market

trends include the introduction of 3D LCD televisions, the full-

fledged adoption of the Blu-ray format and increasingly high-

density hard disks. These trends will bring increased demand for

TAC film, optical pickup lenses for Blu-ray format, and glass

substrates for hard disks, and should thus provide a boost for our

mainstay business.

We will also continue to promote our genre-top strategy,

maintaining strong growth in each segment while utilizing our

technological strengths in optics to move into new fields, such as

lighting, automotive, energy, and life care, expanding the reach of

our business and enabling us to continue to grow.

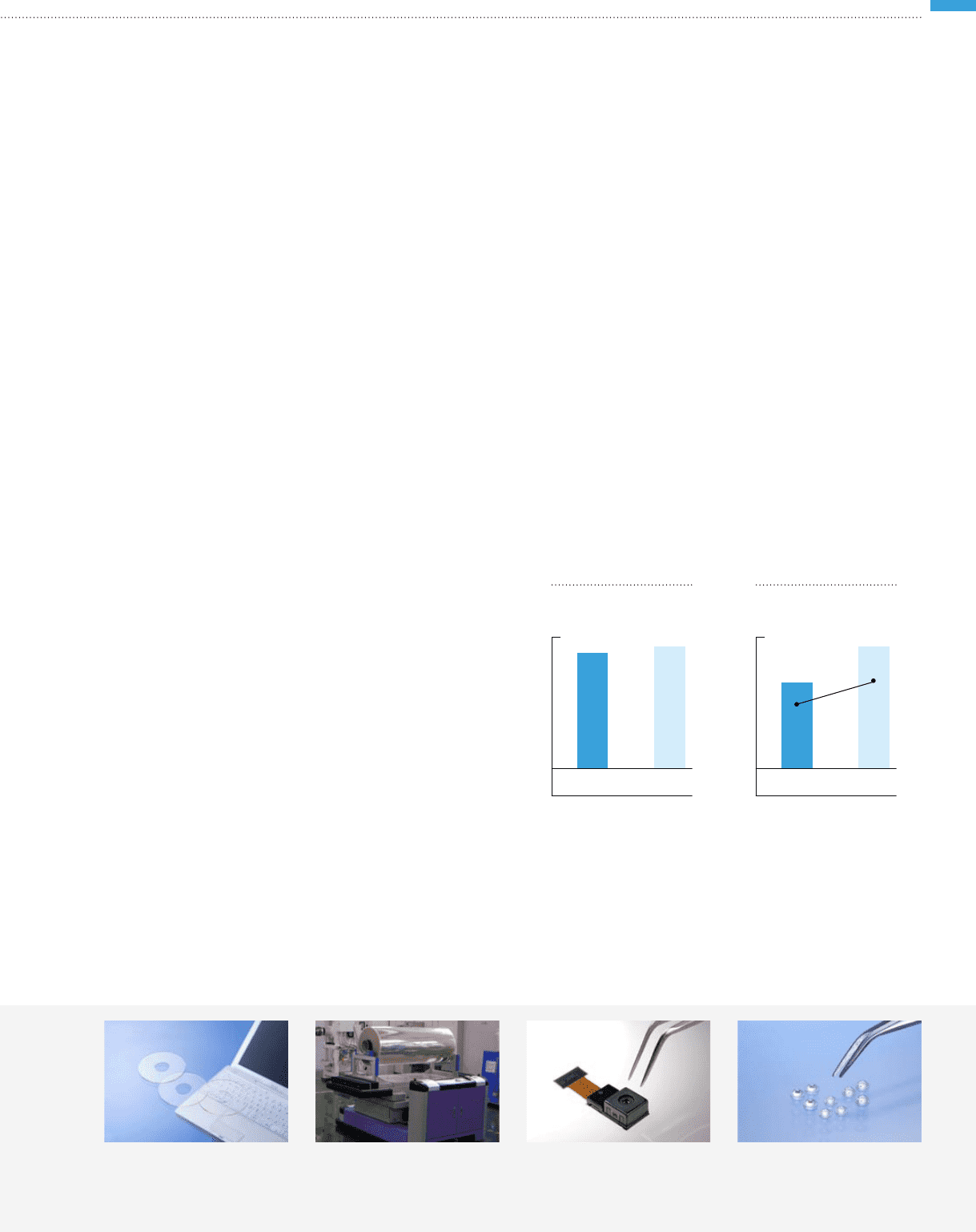

Glass hard disk substrates TAC film Optical pickup lenses for Blu-ray formatLens unit for camera-equipped

mobile phones

136.7 144.0

2011

Forecast*

2010

Result

NET SALES

(Billions of yen)

* Forecast: Announced

May 13, 2010

14.3

20.5

10.5

14.2

2011

Forecast*

2010

Result

OPERATING INCOME AND

OPERATING INCOME RATIO

(Billions of yen, %)

nn Operating Income

n

Operating Income Ratio

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 19