Konica Minolta 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

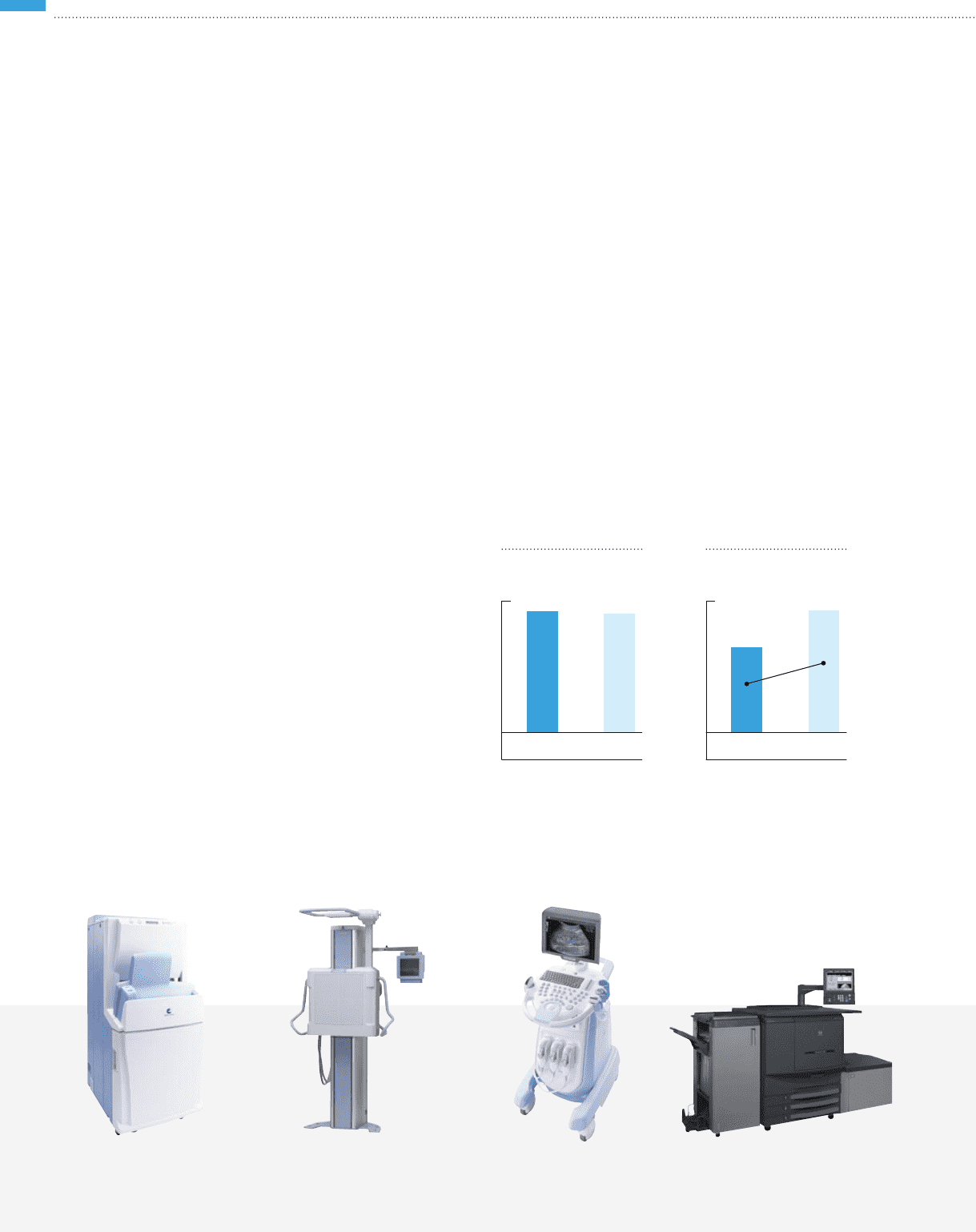

MEDICAL AND GRAPHIC IMAGING

OVERVIEW OF RESULTS FOR FY MARCH 2010

While we worked to expand sales of digital devices and focus on

strengthening our solutions business, the healthcare and graphic

imaging segments were unable to make up for the accelerating drop

in sales of film products, and with the additional effects of a high yen,

sales were down 17.1% versus the previous period, to ¥104.3 billion.

Despite thorough measures to reduce fixed costs, operating income

also fell by 52.3% compared to the previous period, to ¥1.4 billion.

STATUS BY SEGMENT

HEALTHCARE

In the key digital X-ray diagnostic imaging field, we began sales

of our new REGIUS MODEL 210, and, along with digital radiogra-

phy system and diagnostic imaging workstations, worked to

expand sales to hospitals and clinics worldwide. Unit sales of

these and other digital diagnostic systems maintained levels

similar to those in the previous period. We also worked to expand

our reach in the healthcare segment, introducing two new prod-

ucts outside the X-ray diagnostic imaging sector, the I-PACS EX

ceed network workstation, and the SONIMAGE 513, a color

ultrasound diagnostic system.

GRAPHIC IMAGING

We worked to expand sales of the Pagemaster Pro 6500N on-

demand printing system and other digital systems. While the printing

industry continues to see a freeze on capital investment due to the

prolonged economic downturn, our efforts to expand sales kept

digital equipment sales on par with the previous period.

STRATEGY GOING FORWARD

With demand for film-related products in the medical and healthcare

segment expected to continuously decline, we plan to expand into

new business domains by promoting sales of digital diagnostic imag-

ing systems, and by aggressively expanding our infomity service,

which combines remote maintenance, management support, and

network services. In emerging markets, for the present we will focus

our efforts on China and India, working to expand sales of digital

systems tailored to the needs of those markets.

In the graphic imaging segment, we will utilize our accumulated

knowledge of customer needs and workflows in commercial print-

ing to further enhance our competitiveness and expand our busi-

ness in the field of production printing, which is being positioned as

a growth segment for the Group*.

* We have decided to carve out the graphic imaging business managed by Konica

Minolta Medical & Graphics, Inc. and place it under the management of Konica Minolta

Business Technologies, Inc.

1.4

2.0

1.4

2.0

2011

Forecast*

2010

Result

OPERATING INCOME AND

OPERATING INCOME RATIO

(Billions of yen, %)

nn Operating Income

n

Operating Income Ratio

104.3 102.0

2011

Forecast*

2010

Result

NET SALES

(Billions of yen)

* Forecast: Announced

May 13, 2010

Digital X-Ray Image Reader

REGIUS MODEL 210

Digital Radiography

PLAUDR C30

On-demand Printing System

Pagemaster Pro 6500N

Color Diagnostic Ultrasound System

SONIMAGE 513

20 KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010