Konica Minolta 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

deemed other than temporary. In these instances, securities are written

down to the fair market value and the resulting losses are charged to

income during the period.

Hedge Accounting

Gains or losses arising from changes in fair market value of derivatives

designated as “hedging instruments” are deferred as an asset or a

liability and charged or credited to income in the same period that the

gains and losses on the hedged items or transactions are recognized.

Derivatives designated as hedging instruments by the Companies are

primarily interest rate swaps and forward foreign currency exchange

contracts. The related hedged items are trade accounts receivable,

trade accounts payable and long-term bank loans.

The Companies have a policy to utilize the above hedging instru-

ments in order to reduce the Companies’ exposure to the risks of

interest rate and exchange rate fluctuations. As such, the Companies’

purchases of the hedging instruments are limited to, at maximum, the

amounts of the hedged items.

The Companies evaluate the effectiveness of their hedging activities by

reference to the accumulated gains or losses on the hedging instruments

and the related hedged items from the commencement of the hedges.

(l) Retirement Benefit Plans

Retirement Benefits for Employees

The Company, domestic consolidated subsidiaries and certain overseas

consolidated subsidiaries have obligations to make defined benefit

retirement payments to their employees and, therefore, provide accrued

retirement benefits based on the estimated amount of projected benefit

obligations and the fair value of plan assets.

For the Company and its domestic consolidated subsidiaries, unrec-

ognized prior service cost is amortized using the straight-line method

over a 10-year period, which is shorter than the average remaining

years of service of the eligible employees. Unrecognized net actuarial

gain or loss is primarily amortized in the following year using the

straight-line method over a 10-year period, which is shorter than the

average remaining years of service of the eligible employees.

Changes in Accounting Standards

Effective from the year ended March 31, 2010, the Company and its

domestic consolidated subsidiaries adopted Accounting Standards

Board of Japan (ASBJ) Statement No. 19, “Partial Amendments to

Accounting Standard for Retirement Benefits (Part 3)”, issued by the

ASBJ on July 31, 2008.

The new accounting standard requires domestic companies to use

the rate of return on long-term government or gilt-edged bonds as of

the end of the fiscal year for calculating the projected benefit obligation

of a defined-benefit plan. Previously, domestic companies were allowed

to use a discount rate determined by taking into consideration fluctua-

tions in the yield of long-term government or gilt-edged bonds over a

certain period.

This adoption had no impact on the consolidated statements of income

and retirement benefit obligations for the year ended March 31, 2010.

Accrued Retirement Benefits for Directors

and Statutory Auditors

Domestic consolidated subsidiaries record a reserve for retirement

benefits for directors and statutory auditors based on the amount

payable accumulated at the end of the period in accordance with their

internal regulations.

(m) Per Share Data

Net income per share of common stock has been computed based on

the weighted-average number of shares outstanding during the year.

Cash dividends per share shown for each year in the accompanying

consolidated statements are dividends declared as applicable to the

respective year.

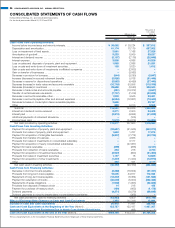

(n) Cash Flows from Operating Activities

“Decrease/increase in consumption taxes receivable/payable” which

were included within “Other” in the “Cash flows from operating activi-

ties” section of the consolidated statements of cash flows in the previ-

ous fiscal year, are now separately disclosed from the year ended

March 31, 2010.

The amount for the year ended March 31, 2009 was ¥952 million.

(o) Practical Solution on Unification of Accounting Policies

Applied to Foreign Subsidiaries for Consolidated Financial

Statements

Effective from the year ended March 31, 2009, the Company applied

the “Practical Solution on Unification of Accounting Policies Applied to

Foreign Subsidiaries for Consolidated Financial Statements” (ASBJ

Practical Issues Task Force (PITF) No. 18, issued by the ASBJ on May

17, 2006).

The Company makes necessary adjustments upon consolidation to

unify accounting standards for foreign subsidiaries in principle.

3. U.S. DOLLAR AMOUNTS

The translation of Japanese yen amounts into U.S. dollars is included

solely for the convenience of the reader, using the prevailing exchange

rate at March 31, 2010, of ¥93.04 to U.S.$1.00. The translations

should not be construed as representations that the Japanese yen

amounts have been, could have been, or could in the future be, con-

verted into U.S. dollars at this or any other exchange rate.

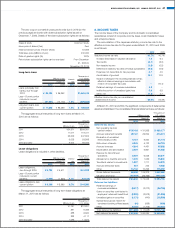

4. CASH AND CASH EQUIVALENTS

Cash and cash equivalents as of March 31, 2010 and 2009, consist of:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Cash on hand and in banks ¥ 85,533 ¥ 85,753 $ 919,314

Time deposits (over 3 months) (387) (26) (4,160)

Short-term investments 79,000 48,000 849,097

Cash and cash equivalents ¥164,146 ¥133,727 $1,764,252

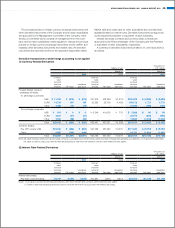

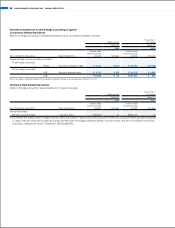

5. FINANCIAL INSTRUMENTS

Additional Information

Effective from the year ended March 31, 2010, the Companies adopted

ASBJ Statement No. 10, “Accounting Standards for Financial Instru-

ments”, issued by the ASBJ on March 10, 2008 and ASBJ Guidance

No. 19, “Implementation Guidance on Disclosures about the Fair Value

of Financial Instruments”, issued by the ASBJ on March 10, 2008.

Conditions of Financial Instruments

The Companies raise short-term working capital mainly with bank

borrowings and invest temporary surplus funds in financial instruments

deemed to have lower risk. The Companies enter into derivative trans-

actions based on the need for these transactions in accordance with its

internal regulations.

In principle, the risk of currency fluctuations relating to receivables

and payables, denominated in foreign currencies, are hedged using the

forward exchange contract. With respect to the interest volatility risk

relating to certain long-term loans payable, the Companies use interest-

rate swap to fix interest expenses.

Investment securities consist mainly of stocks, and the market values

of listed stocks are determined on a quarterly basis.

The Companies control credit risk of customers relating to notes

and accounts receivable-trade through a comprehensive monitoring of

reviewing aging schedules and balances.

38 KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010