Konica Minolta 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANSWER

WE EXCEEDED OUR PLAN WITH RESPECT TO STRUCTURAL REFORM,

AND SAW A RECOVERY IN GROUP OPERATING RESULTS BEGIN TO

EMERGE DURING THE SECOND HALF OF THE YEAR.

FY March 2010 started with an operating environment that offered no real prospects for growth in net sales

or profit. Our highest priority was to work to establish a corporate structure capable of delivering steady free

cash flow despite these daunting conditions. In practical terms, we concentrated on lowering the breakeven

point for profitability. For example, we sought to optimize our domestic and foreign production frameworks,

sales bases and the headcount at our overseas sales divisions, and worked extensively to reduce fixed

costs, mainly by executing structural reforms and paring down operating expenses. In addition, we strove to

streamline our balance sheet by reducing inventories, scaling back capital expenditure, and negotiating more

favorable terms with respect to credit and debt.

As a result, we generated free cash flow of ¥72.9 billion, substantially exceeding our initial target of ¥30.0

billion. Meanwhile, our balance of interest-bearing debt declined ¥33.0 billion year on year to ¥197.3 billion.

Where operating results are concerned, in Business Technologies, we successfully boosted demand by

aggressively unveiling new color MFPs, a move that breathed vigor back into selling conditions from the

second half of FY March 2010. In Optics, we capitalized on a rebound in market demand for LCD televisions

and PCs, leading to firm sales of TAC films and glass hard disk substrates. In this way, Group operating

results are continuing their turn towards eventual recovery.

Realizing robust and sustainable growth requires constant efforts in certain areas. We plan to take firm,

decisive action over the coming year to boldly enact the reforms necessary to make Konica Minolta a stron-

ger company.

QUESTION

HOW DID KONICA MINOLTA PERFORM IN THE FISCAL YEAR ENDED MARCH 2010, AS THE

INITIAL YEAR OF MANAGEMENT POLICY <09-10>?

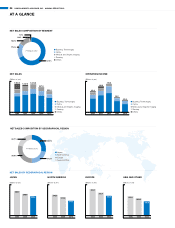

2010.1Q

189.4

2010.2Q

203.9

2010.3Q

195.3

2010.4Q

215.7

2010.1Q

(0.5)

2010.2Q

9.7

2010.3Q

12.0

2010.4Q

22.7

(0.3)

4.8

6.2

10.6

QUARTERLY NET SALES

QUARTERLY OPERATING INCOME

(LOSS) AND OPERATING INCOME RATIO

(Billions of yen) (Billions of yen, %)

n Operating income (loss)

n

Operating income ratio

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 11