Konica Minolta 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

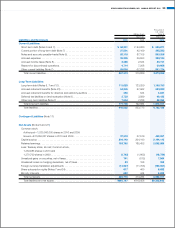

CASH FLOWS FROM INVESTING ACTIVITIES

Net cash used in investing activities was ¥40.4 billion, compared to

¥90.1 billion used in the previous fiscal year. Cash used consisted

largely of ¥33.6 billion for payments for acquisition of property, plant

and equipment, mainly for the purchase of casting molds for new

products in the Business Technologies business and for invest-

ments to augment production capacity in the Optics business.

As a result, free cash flow (the sum of cash flows from operat-

ing activities and investing activities) was a positive ¥72.9 billion,

compared to a positive ¥17.3 billion in the previous fiscal year.

CASH FLOW FROM FINANCING ACTIVITIES

Net cash used in financing activities was ¥43.8 billion, compared to

¥4.9 billion provided by financing activities a year earlier. Along with

a payment of ¥30.0 billion for the redemption of bonds, uses of

cash included dividend payments of ¥9.2 billion and ¥4.4 billion for

repayment of loans and lease obligations.

DIVIDEND POLICY AND DIVIDENDS

FOR FY MARCH 2010 AND 2011

The Company’s basic policy in deciding the distribution of retained

earnings as dividends is to consistently return profits to sharehold-

ers following consideration of a comprehensive range of factors,

including consolidated business results and the promotion of stra-

tegic investment in growth fields. To this end, the Company has set

a dividend payout ratio of 25% or more as a specific medium- to

long-term target in this regard. When deemed appropriate based

on its financial position, share price and other relevant factors, the

Company will also purchase treasury stock as a means of returning

profit to shareholders.

For the fiscal year under review, the Company will pay an

annual dividend of ¥15 per share, consisting of an interim and

full-year dividend of ¥7.5, respectively. The Company opted to pay

this dividend as initially forecast despite the impact of an operating

environment that was far more severe that expected during the first

half of the year.

In light of the challenging operating environment anticipated, in

the fiscal year ending March 31, 2011 the Company expects to pay

an annual dividend of ¥15 per share, consisting of interim and

year-end dividends of ¥7.5 per share.

OUTLOOK

The business environment surrounding the Group is expected to

see the economic recovery gain momentum in Japan and around

the globe. Growth in emerging markets, particularly in Asia, is

expected to remain robust, with a modest upturn also on the hori-

zon for the developed economies of Japan, the United States and

Europe. The Group recognizes, however, that conditions are likely

to remain challenging due to several issues fueling uncertainty,

among them negative factors such as a worsening employment

environment, rising long-term interest rates, and the yen’s strength

in the currency markets. Regarding forecasts for the Company’s

key markets, in the Business Technologies business, although a

full-scale recovery in office and production printing products is likely

to remain elusive for some time, a modest upturn appears likely

during the upcoming term. In the Optics business, demand for LCD

televisions, PCs and other digital appliances is expected to con-

tinue to expand overall.

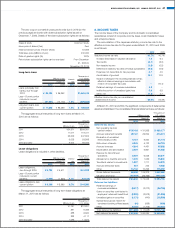

FORECASTS FOR FY MARCH 2011 (ANNOUNCED MAY 13, 2010)

(Billions of yen)

1H FY

March 2011

2H FY

March 2011

Full Year

FY March 2011

Net Sales 400 430 830

Operating Income 21 29 50

Net Income 8 12 20

Free Cash Flow 20

CURRENCY EXCHANGE RATE ASSUMPTIONS

(Yen)

Exchange rate USD 90.00

EUR 120.00

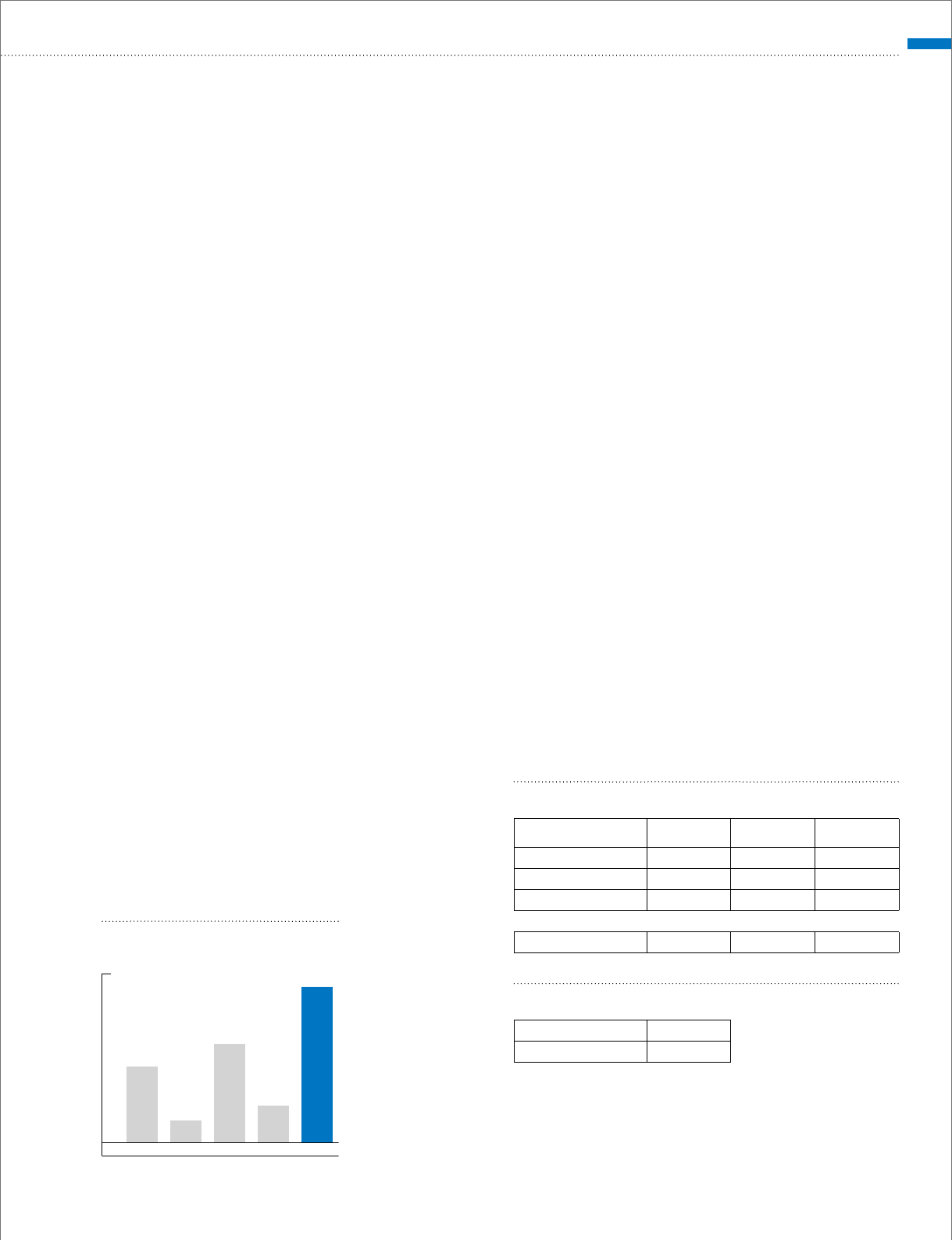

2006

35.7

2007

10.3

2008

46.1

2009

17.3

2010

72.9

FREE CASH FLOWS

(Billions of yen)

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 31