Konica Minolta 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

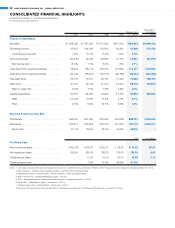

2006

1,068.3

2007

1,027.6

2008

1,071.5

2009

947.8

2010

804.4

2006

(17.1)

21.9

17.5

3.7 4.1

2007 2008 2009 2010

2006

35.7

2007

10.3

2008

46.1

2010

72.9

2009

17.3

2006

83.4

2007

104.0

2008

119.6

2009

56.2

2010

43.9

7.8

10.1 11.2

5.9 5.5

2006

9.0

11.2

12.7

6.2

5.2

2007 2008 2009 2010

2006

0.81

31.1

2007

38.6

0.62

2008

0.54

43.0

2010

0.47

48.5

2009

45.0

0.56

2006

(54.3)

2007

72.5

2008

68.8

2009

15.1

2010

16.9

2006

67.1

2007

72.1

2008

81.3

2009

81.9

2010

68.4

6.3 7.0 7.6

8.6 8.5

NET SALES

ROE

FREE CASH FLOWS

OPERATING INCOME AND

OPERATING INCOME RATIO

ROA

EQUITY RATIO AND D/E RATIO

NET INCOME (LOSS)

R&D COSTS AND R&D-TO-SALES RATIO

(Billions of yen)

(%)

(Billions of yen)

(Billions of yen, %)

(%)

(%) (Times)

(Billions of yen)

(Billions of yen, %)

nn Operating Income

n

Operating Income Ratio

n

Equity Ratio (left)

n

D/E Ratio (right)

Note: D/E ratio = Interest-bearing debts ÷ shareholders’ equity

nn R&D Costs

n

R&D-to-Sales Ratio

PRODUCTION OF FREE CASH FLOW

The Company produced free cash flow of over ¥70.0 billion for the year. This

figure reflected vigorous efforts to streamline the balance sheet by reducing

inventories, controlling capital spending, and improving the terms of accounts

receivable and payable.

STRENGTHENING OUR FINANCIAL POSITION

To establish a robust financial position essential to future growth, the Company

made steady progress in enhancing shareholders’ equity and lowering interest-

bearing debt.

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 03