Konica Minolta 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

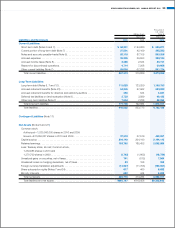

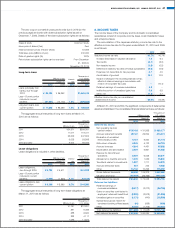

The zero coupon convertible unsecured bonds due in 2016 (on the

previous page) are bonds with share subscription rights issued on

December 7, 2006. Details of the share subscription rights are as follows:

2016 bonds

Class of stock Common Stock

Issue price of shares (Yen) Zero

Initial conversion prices (Yen/per share) ¥2,383

Total issue price (Millions of yen) ¥40,000

Ratio of granted rights (%) 100%

Period share subscription rights can be exercised From December

21, 2006 to

November 22, 2016

Long-term loans

Millions of yen Interest

rate

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010 2010

Loans principally from

banks, due through

2018 ¥ 99,126 ¥ 95,362 $1,065,413

Less—Current portion

included in current

liabilities (27,501) (12,102) 1.4% (295,583)

Long-term loans, less

current portion ¥ 71,625 ¥ 83,259 1.4% $ 769,830

The aggregate annual maturities of long-term loans at March 31,

2010 are as follows:

Amount

Millions of yen

Thousands of

U.S. dollars

2011 ¥24,571 $264,091

2012 11,017 118,411

2013 23,009 247,302

2014 5,023 53,988

2015 and after 8,002 86,006

Lease obligations

Lease obligations is included in other liabilities.

Millions of yen Interest

rate

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010 2010

Lease obligations,

due through 2026 ¥ 5,724 ¥ 5,511 $ 61,522

Less—Current portion

included in current

liabilities (1,594) (1,545) 4.7% (17,132)

Lease obligations, less

current portion ¥ 4,130 ¥ 3,965 4.7% $ 44,390

The aggregate annual maturities of long-term lease obligations at

March 31, 2010 are as follows:

Amount

Millions of yen

Thousands of

U.S. dollars

2011 ¥1,191 $12,801

2012 881 9,469

2013 588 6,320

2014 383 4,117

2015 and after 1,086 11,672

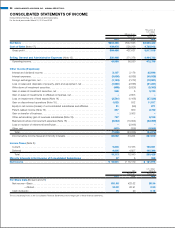

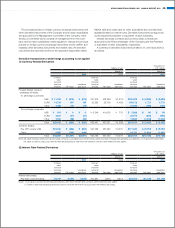

8. INCOME TAXES

The income taxes of the Company and its domestic consolidated

subsidiaries consist of corporate income taxes, local inhabitants’ taxes

and enterprise taxes.

The reconciliation of the Japanese statutory income tax rate to the

effective income tax rate for the years ended March 31, 2010 and 2009

is as follows:

2010 2009

Statutory income tax rate 40.7% 40.7%

Increase (Decrease) in valuation allowance 1.8 6.4

Tax credits (0.7) (5.0)

Non-taxable income (1.0) (0.5)

Difference in statutory tax rates of foreign subsidiaries (8.5) (0.6)

Expenses not deductible for tax purposes 2.7 4.5

Amortization of goodwill 10.1 10.9

Impact of change in the recording standard of tax

effects of retained earnings in accordance with

revision of Corporate Tax Laws –(10.4)

Retained earnings of overseas subsidiaries 3.2 –

Ineffective portion of unrealized (gain) loss 5.9 5.5

Other, net (1.2) 2.7

Effective income tax rate per consolidated

statements of income 53.0% 54.3%

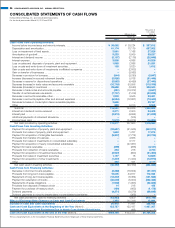

At March 31, 2010 and 2009, the significant components of deferred tax

assets and liabilities in the consolidated financial statements are as follows:

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Deferred tax assets:

Net operating tax loss

carried forward ¥ 36,116 ¥ 31,953 $ 388,177

Accrued retirement benefits 29,147 29,824 313,274

Elimination of unrealized

intercompany profits 4,761 9,064 51,172

Write-down of assets 4,345 5,122 46,700

Accrued bonuses 4,214 4,431 45,292

Depreciation and amortization 3,901 5,661 41,928

Reserve for discontinued

operations 2,407 6,025 25,871

Allowance for doubtful accounts 1,470 1,039 15,800

Tax effects related to investments 1,337 1,717 14,370

Accrued enterprise taxes 461 242 4,955

Other 10,733 10,295 115,359

Gross deferred tax assets 98,898 105,378 1,062,962

Valuation allowance (34,254) (33,335) (368,164)

Total deferred tax assets ¥ 64,644 ¥ 72,043 $ 694,798

Deferred tax liabilities:

Retained earnings of

overseas subsidiaries (3,417) (2,272) (36,726)

Gains on securities contributed to

employees’ retirement benefit trust (2,920) (2,973) (31,384)

Unrealized gains on securities (1,171) (440) (12,586)

Special tax-purpose reserve for

condensed booking of fixed assets (61) (558) (656)

Other (4,127) (1,703) (44,357)

Total deferred tax liabilities ¥(11,699) ¥ (7,948) $ (125,742)

Net deferred tax assets ¥ 52,945 ¥ 64,094 $ 569,056

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 41