Konica Minolta 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The principal policies on foreign currency exchange instruments and

other derivative instruments of the Company and its major subsidiaries

are approved by the Management Committee of the Company. Addi-

tionally, a Committee which consists of management from the Com-

pany and its major subsidiaries meets regularly to discuss the principal

policies on foreign currency exchange instruments and to reaffirm and

reassess other derivative instruments and market risks. All derivative

instruments are reported monthly to the respective responsible officer.

Market risks and credit risks for other subsidiaries are controlled and

assessed based on internal rules. Derivative instruments are approved

by the respective president or equivalent of each subsidiary.

Interest rate swap contracts and currency swap contracts are

approved by the Finance Manager of the Company and the President

or equivalent of other subsidiaries, respectively.

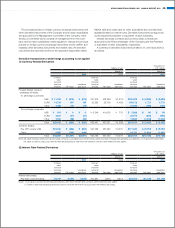

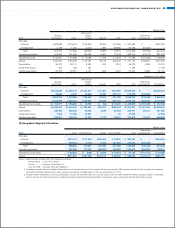

A summary of derivative instruments at March 31, 2010 and 2009 is

as follows:

Derivative transactions to which hedge accounting is not applied

(1) Currency-Related Derivatives

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Contract

value

(notional

principal

amount) Fair value

Unrealized

gain (loss)

Contract

value

(notional

principal

amount) Fair value

Unrealized

gain (loss)

Contract

value

(notional

principal

amount) Fair value

Unrealized

gain (loss)

Forward foreign currency

exchange contracts:

To sell foreign currencies:

US$ ¥ 11,192 ¥ (279) ¥ (279) ¥21,978 ¥23,296 ¥(1,318) $120,292 $ (2,999) $ (2,999)

EURO 11,739 165 165 22,253 23,709 (1,455) 126,172 1,773 1,773

Other 1,362 (74) (74) – – – 14,639 (795) (795)

To buy foreign currencies:

US$ ¥ 551 ¥ 8 ¥ 8 ¥ 9,249 ¥10,025 ¥ 775 $ 5,922 $ 86 $ 86

EURO 3,021 (47) (47) – – – 32,470 (505) (505)

Other 1,549 (96) (96) –––16,649 (1,032) (1,032)

Total ¥29,415 ¥ (324) ¥ (324) ¥53,481 ¥57,031 ¥(1,998) $316,154 $ (3,482) $ (3,482)

Currency Swaps:

Pay JPY, receive US$ ¥15,942 ¥ (852) ¥ (852) ¥40,736 ¥37,460 ¥ 3,275 $171,346 $ (9,157) $ (9,157)

Other 2,955 (149) (149) –––31,761 (1,601) (1,601)

Total ¥18,897 ¥(1,001) ¥(1,001) ¥40,736 ¥37,460 ¥ 3,275 $203,106 $(10,759) $(10,759)

Note: Fair value of foreign currency forward exchange contracts is calculated based on the foreign currency forward exchange rates prevailing as of March 31, 2010 and 2009, respectively.

Fair value of currency swaps is provided by the financial institutions with whom the derivative contracts were entered into and agreed.

(2) Interest Rate-Related Derivatives

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2009 2010

Contract

value

(notional

principal

amount) Fair value

Unrealized

gain (loss)

Contract

value

(notional

principal

amount) Fair value

Unrealized

gain (loss)

Contract

value

(notional

principal

amount) Fair value

Unrealized

gain (loss)

Interest rate swaps:

Pay fixed, receive floating ¥3,747 ¥(106) ¥(106) ¥10,387 ¥(371) ¥(371) $40,273 $(1,139) $(1,139)

Notes: 1. Fair value is provided by the financial institutions with whom the derivative contracts were entered into and agreed.

2. Contract value (notional principal amount) does not indicate the level of risk associated with interest rate swaps.

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 45