Konica Minolta 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

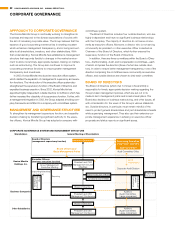

In principle, the Board of Directors meets once a month. Out-

side directors receive advance briefings on agenda items in order

to ensure they understand the items and thereby facilitate more

lively discussion at meetings of the board. In particular, explana-

tions of important management decisions are provided by the

relevant executive officers. In FY March 2010, overall attendance by

outside directors at meetings of the Board of Directors and its three

committees exceeded 90% on average.

Every year, each board member provides an evaluation of the

Board of Directors, which serves as a general review of the compo-

sition and administration of the board and its three committees, as

well as other matters. This evaluation is summarized and discussed

by the outside directors, the chairman, and the president, in an

effort to enhance corporate governance.

COMMITTEE ROLES AND FUNCTIONS

NOMINATING COMMITTEE

The key role of the Nominating Committee (which met five times in

FY March 2010), is the selection of director candidates who will be

presented for approval before the general meeting of shareholders.

When appointing internal and outside directors, the Nominating

Committee selects candidates in accordance with the Group’s

proprietary selection criteria. In selecting candidates for outside

directors, key criteria include independence, and experience in

corporate management. The Nominating Committee also clearly

documented criteria regarding the independence of outside direc-

tors, stipulating, among other conditions, that candidates shall have

no significant business relationships with the Group, or personal

relationships with its executive officers. Further, to address the

concern that long-serving outside directors may eventually become

less independent, Konica Minolta limits their re-nomination to, in

principle, a term of four years.

COMPENSATION COMMITTEE

The Compensation Committee (which met six times in FY March

2010) formulates policies for executive compensation, and deter-

mines the amount of individual compensation for directors and execu-

tive officers. The compensation system is designed to raise motivation

among executive officers to continuously improve business results in

the mid- to long-term, and contributes to enhancing overall Group

value by providing a benchmark for attracting and retaining personnel

willing to ensure the company’s future development.

•Compensationfordirectorsandexecutiveofficers

Compensation for inside directors, who are responsible for super-

vising Group management, comprises base salary, and stock

options for stock-linked compensation to encourage long-term

performance. The compensation of outside directors is base salary

only. The target compensation of executive officer packages is 60%

in base salary, 20% in short-term performance-based cash

bonuses as an incentive, and 20% in stock options for stock-linked

compensation as a long-term incentive. The amount of perfor-

mance-based cash bonuses are determined by business perfor-

mance levels for the fiscal year in question, and by the degree to

which fiscal year performance goals have been met.

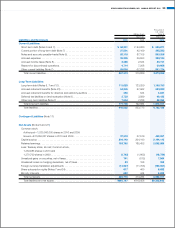

The amount of compensation to directors and executive officers

recorded as expenses for FY March 2010, is as shown below.

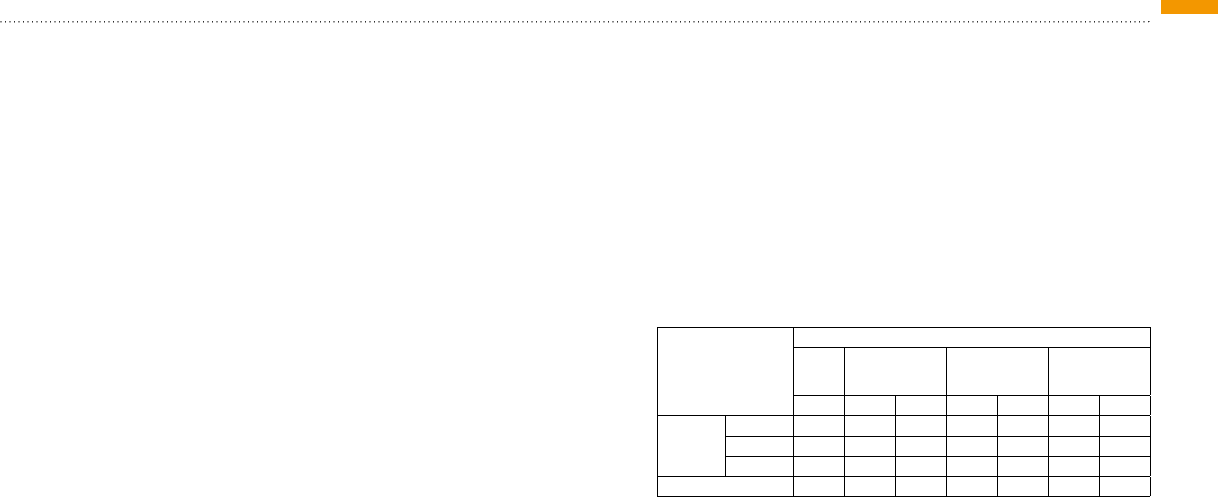

Compensation (millions of yen)

Total Total base salary

Performance-

based

cash bonus

Stock

option-based

compensation

Amount Persons Amount Persons Amount Persons Amount

Directors Outside 41 5 41 – – – –

Inside 152 5 127 – – 5 24

Total 193 10 168 – – 5 24

Executive Officers 809 23 525 23 151 23 132

Note 1: As of March 31, 2010, there are four outside directors, three internal directors

(excluding those who serve concurrently as executive officers), and 22 execu-

tive officers.

Note 2: In addition to the five inside directors shown above, the company has another five

inside directors who concurrently hold executive officer posts, and compensation

to these directors is included in the executive officer compensation noted above.

Note 3: Regarding performance-based cash bonuses, the amounts stated are those

which should be recorded as an expense for FY March 2010.

Note 4: Regarding stock option-based compensation, the amounts stated are those

which should be recorded as an expense, based on an estimation of the fair

value of the new share subscription rights issued to directors (excluding outside

directors) and executive officers as part of their compensation.

Note 5: Compensation figures for executive officers in the table above include base

salaries and performance-based cash bonuses provided to the 14 executive

officers who are primarily responsible for the company’s subsidiaries, and which

are partially paid for by the subsidiaries.

AUDIT COMMITTEE

The Audit Committee (which met 14 times in FY March 2010)

audits executive management decisions to see whether they are

legitimate and proper and monitors and verifies internal control

systems. The committee also reviews the methods used and

results provided by the independent auditors, and decides on

proposals for the selection, dismissal, and/or non-reelection of the

independent auditors, as well as approving their compensation.

The Audit Committee works with the independent auditors and the

Corporate Audit Division, which acts as an internal audit office, to

enhance audit efficiency and effectiveness, while also receiving

regular reports from executive officers responsible for the Risk

Management Committee, Compliance Committee, and other

internal control systems.

In principle, the Audit Committee meets prior to meetings of

the Board of Directors, so that the committee members can pres-

ent their opinions to the meeting of the Board of Directors, if

deemed appropriate.

To further enhance the effectiveness of the Audit Committee, a

separate Audit Committee Office with its own dedicated staff has been

established as a secretariat independent of any operating division.

For details of the Group’s corporate governance, follow the link to the website listed below.

http://www.konicaminolta.com/about/csr/governance/index.html

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 23