Konica Minolta 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

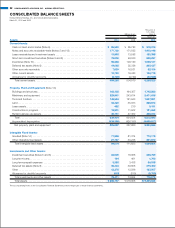

ASSETS

Current assets at March 31, 2010 amounted to ¥489.2 billion,

down ¥15.6 billion from the previous fiscal year-end. Cash on hand

and in banks was virtually unchanged at ¥85.5 billion. Short-term

investment securities rose ¥31.0 billion year on year, to ¥79.0

billion, fueling the increase in cash on hand. Notes and accounts

receivable-trade increased ¥5.8 billion from a year ago to ¥177.7

billion, while inventories declined ¥30.8 billion to ¥98.2 billion for

the same period. The latter mainly reflected the launch of competi-

tive new products and a recovery in sales momentum. Other

accounts receivable, meanwhile, declined ¥8.8 billion, primarily

due to a drop in refunded corporation taxes receivable.

Property, plant and equipment decreased by ¥22.8 billion from

the previous fiscal year-end, to ¥205.0 billion. One factor in this

decline was efforts by the Group to curb capital expenditure. Intan-

gible fixed assets fell ¥12.5 billion year on year, to ¥99.0 billion,

attributed to progress in amortizing goodwill.

In investments and other assets, investment securities rose ¥3.9

billion year on year, to ¥22.0 billion, while deferred tax assets

declined by ¥4.3 billion. Consequently, investments and other assets

amounted to ¥72.4 billion, down ¥1.2 billion from a year earlier.

As a result of these factors, total assets at March 31, 2010

declined ¥52.2 billion year on year, to ¥865.7 billion.

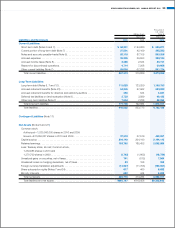

LIABILITIES

Current liabilities at March 31, 2010 amounted to ¥267.3 billion,

down ¥43.5 billion from the previous fiscal year-end. In addition to

a decline of ¥21.4 billion in short-term interest-bearing debt, notes

and accounts payable-trade and accrued expenses were down

¥3.9 billion and ¥3.3 billion, respectively, for the year, due to lower

operating expenses and efforts to rein in capital expenditure. The

reserve for discontinued operations, specifically the Photo Imaging

business, decreased ¥2.5 billion from the previous year to ¥4.7

billion. Long-term liabilities, meanwhile, declined ¥15.1 billion to

¥177.7 billion.

As a result, total liabilities at March 31, 2010 declined ¥58.7

billion year on year, to ¥445.0 billion.

Interest-bearing Debt (Sum of short-term/long-term loans

and corporate bonds)

Due partially to the redemption of corporate bonds that reached

maturity, interest-bearing debt declined ¥33.0 billion to ¥197.3

billion. As a result, the debt-equity (D/E) ratio decreased to 0.47

times, compared to 0.56 times at the previous fiscal year-end.

NET ASSETS

Net assets at the end of the fiscal year under review stood at

¥420.7 billion, up ¥6.4 billion from a year earlier. Although valuation

and translation adjustments declined ¥2.1 billion from the previous

fiscal year-end, net assets rose atop growth in retained earnings,

mainly from ¥16.9 billion in net income posted for the year. Net

assets per share was ¥791.28, while the equity ratio rose 3.4

percentage points year on year, to 48.5%.

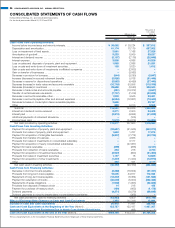

CASH FLOWS

CASH FLOWS FROM OPERATING ACTIVITIES

Net cash provided by operating activities was ¥113.3 billion, com-

pared to ¥107.5 billion a year ago. Cash inflows consisted of

income before income taxes and minority interests of ¥36.0 billion,

depreciation and amortization of ¥61.1 billion, and ¥17.5 billion in

cash from improved efficiency in working capital. This was partially

offset by ¥6.5 billion decrease in accounts payable-other and

accrued expenses, and ¥3.8 billion in interest paid.

2006

67.5

2007

64.0

2008

75.2

2009

61.1

2010

36.9

2006

31.1

38.6

43.0 45.0

48.5

2007 2008 2009 2010

2006

0.81

0.62

0.54 0.56

0.47

2007 2008 2009 2010

CAPITAL EXPENDITURE EQUITY RATIO D/E RATIO

(Billions of yen) (%) (Times)

30 KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010